Decentralized Exchanges Set To Accelerate in 2021

Cryptocurrencies are decentralized forms of electronic money, yet for the most part, the places where you obtain cryptoassets — exchanges — are thoroughly centralized. This centralization has a practical and a political downside, since not only does it introduce single points of failure in which precious funds might be lost, but it’s likely to lead to concentrations of power and influence.

Decentralized exchanges (DEXes) are a solution to this quandary, and while they remain relatively niche compared to centralized exchanges (CEXes) (in terms of volumes), much of the industry seems to be confident that they’ll witness significant growth in 2021. This will be helped by the introduction of new innovations, from layer two scaling solutions, improved automated market maker (AMM) models, and atomic swaps.

This process of improvement and growth might be slower than the market would like to, but even major centralized crypto exchange Binance told Cryptonews.com that it expects DEXes to ultimately overtake their centralized equivalents somewhere down the line.

Niche, but growing

While industry figures are generally in agreement that DEXes will witness growth in 2021, opinion is mixed as to how strong and fast such growth will be.

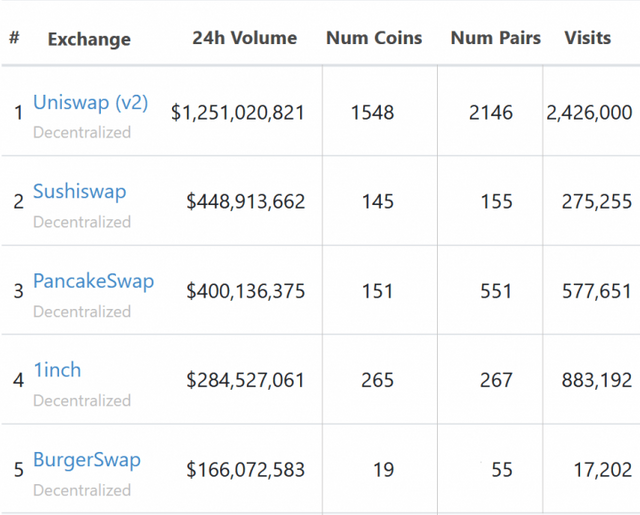

Top 5 DEXes by trading volume:

In fact, at the time of writing, 74 centralized exchanges boast bigger daily volumes than Uniswap, which is the only DEX in the top 75 exchanges by trading volume. However, while trading is undeniably concentrated mostly around CEXes, many figures working within the DEX sector claim that this is changing significantly.

“I certainly think decentralized exchanges will gain significant traction in 2021,” said Kadan Stadelmann, Komodo (KMD) Chief Technology Officer (CTO) and lead developer at Komodo’s decentralized exchange solution, AtomicDEX.