The evolution of Distributed Ledger Technologies - Part 4 of 4

In previous articles, we had a look at the early days of Cryptography, the principles on which Open Source Software operates and the relevant tradeoffs, and looked at case studies of P2P sharing networks with built-in incentive mechanisms, the way they are structured and how the trust factor is taken away from middlemen to be given to the software, as in the case of Decentralized Exchanges. In this article, we will attempt to summarize what Crypto-Economics are and how they are used in the context of distributed consensus protocols.

Crypto-Economics

The term “Crypto- Economics” has been defined in different ways. Common definitions state that Crypto-Economics include the use of cryptography and incentives to create networks, applications and systems. Cryptography helps maintain networks secure, and economic incentives provide participants reasons to participate in the network and maintain a good behavior within it. Relative to traditional economics, Crypto-Economics is all about building systems that have certain desired properties, by using cryptography to prove properties about messages that happened in the past, and at the same time create these systems around incentives to preserve these desired properties in the future.

As in traditional Economics, Crypto-Economics is subject to limitations. The problem lies in the assumptions about human behavior when designing economic incentive designs. The models rely essentially on speculation about the human future mental states, corresponding belief systems and ignore many possible motives beyond proximate incentives.

According to Ethereum developer Vlad Zamfir, Crypto-Economics is “A formal discipline that studies protocols that govern the production, distribution, and consumption of goods and services in a decentralized digital economy. Crypto-Economics is a practical science that focuses on the design and characterization of these protocols.”

Crypto-Economics is a combination of various disciplines and analyses necessary to build decentralized economic incentive designs. Crypto-Economics combine Cryptography, Economics, Finance, Law, Behavioral Economics, Game Theory, Computer Science, Distributed Systems and Network Security, to create these economic designs for distributed systems. Crypto-Economics can be considered closely related to mechanism design, a field related to game theory. Mechanism design is often referred to as reverse game theory because we start with a desired outcome and then work backwards to design a game that, if players pursue their own self interest, will produce the outcome we want.

The innovation and development observed in the field of blockchain-based technologies has provided a sandbox environment to experiment with various economic models, stability mechanisms and other policy tools. These incentive designs in decentralized systems allow us to study economic incentive design on human behavior and token prices, by creating completely new systems, with currencies that have unique monetary characteristics and are governed solely by code.

“Cryptography is inherently backwards facing. Incentives are inherently forwards facing.” - Vlad Zamfir, January 2015.

Macro Vs Micro Crypto-Economics

Macroeconomics in traditional Economics is primarily the study of the overall economy, employment, gross domestic product and inflation while Microeconomics is the study of supply and demand in markets of particular goods and services. Macroeconomics in Crypto-Economics evolve around the context of token metrics in decentralized economic systems. In the same way the Central Banks function as decision makers in fiat centralized economic systems, token designers can act as virtual central bankers for their respective token economy, allowing in some cases, for a democratization of the monetary policy design. In other words, Macroeconomics define the total amount of tokens to be produced, the method, the time and the structure or rules to be followed. Microeconomics in Crypto-Economics evolve around the context of value and incentives for the token holders. Questions like the unique selling proposition, how does the token interact in the system and what are the incentives to hold or use it in the most fair and honest way, arise.

Bitcoin also relies on cryptographic protocols, like the Public-private key that uses encryption to keep individuals safe and maintain exclusive control of their coins. Hash functions act like digital fingerprints and are used to "link" each block in the bitcoin blockchain, proving an order of events and the integrity of past data. Cryptographic protocols like these, provide us the basic tools necessary to design and build reliable, secure systems like Bitcoin. They are foundational pillars to ensure security to the protocol, confidence to the true occurrence of events and value out of incentives to reward an industry of miners. We can say that Crypto-Economics are about solving an information security problem in economic terms, for a given distributed system. Plainly, it is the study of how to get people to participate on the public internet and incentivize them to run nodes that follow distributed protocols.

Satoshi Nakamoto

The first person or group to apply economic incentives in the peer-to-peer systems was the creator of Bitcoin, the unknown inventor, Satoshi Nakamoto, and because of it, he is considered the father of Crypto-Economics. Satoshi solved a major problem of distributed data processing. The problem was, that a reliable computer system should be able to cope with the failure of one or more of its components. A failed component could exhibit a type of behavior that was often overlooked, like sending conflicting information to different parts of the system. The problem of coping with this type of failure is expressed abstractly as the “Byzantine Generals Problem”. By solving this problem, it was possible to achieve consensus among nodes to create a decentralized digital cash system. Satoshi’s implementation of a proof-of-work consensus mechanism, combined with economic incentives to solve the previously unsolvable problem, on a designed system that relies on both, economic incentives and penalties. In this way, economic rewards are provided to miners that contribute their resources in hardware and electricity in order to produce new blocks, with new bitcoins. At the same time, if someone tries to defraud the system by attacking the blockchain to control the majority of the network’s hashing rate, something known as a “51 percent attack”, he would come to realize that in order to do so, he would have to spent a very considerable amount of capital to purchase the specific hardware for this purpose, plus spend enormous amounts of electricity during this attempt, making it practically impossible or irrational to do so.

Consensus Protocols

The basic power of a public blockchain is in its crypto-economic consensus. By carefully aligning incentives and securing them with software & cryptography, we can create networks of computers that reliably come to agreement about the internal state of a system. This is the key insight of Satoshi’s whitepaper, which has now been applied in the design of many different public blockchains including bitcoin and ethereum.

Blockchains are able to reach reliable consensus without having to rely on a central trusted party, and this a product of crypto-economic design. With Bitcoin’s “Proof of Work” consensus protocol, bitcoins are mined using the Hashcash proof-of-work function by individual miners and verified by the decentralized nodes in the P2P bitcoin network. The Proof of Work system’s critics, emphasize on the amount of electricity consumption of the Bitcoin network.

Other systems also incentivize good behavior and speaking the “truth”. For example. the prediction market Augur, uses its native token REP, to create a system of incentives that rewards users for reporting the "truth" to the application, which is then used to settle bets in the prediction market. REP is a cryptocurrency, used by reporters during market dispute phases of Augur. REP holders must perform work, in the form of staking their REP on correct outcomes, to receive a portion of the markets settlement fees. If you do not report correctly, you do not get the fees. If you report incorrectly, you lose your REP. The treatment of REP within the Augur protocol is governed by the protocols smart contracts as described in the Augur white paper and documentation.

Crypto-Economics is also applied to design token sales or ICOs. Gnosis, for instance, used a "Dutch auction" as a model for its token auction, on the theory that this would result in a fairer distribution, although this experiment had mixed results. Antidumping mechanisms via escrow for early investors, token burns and other elements can be applied in these mechanism designs. Building these applications requires an understanding of how incentives shape users' behavior and careful design of economic mechanisms that can reliably produce a certain result. They also require an understanding of the capabilities and limitations of the underlying blockchain on which the application is built. Many blockchain applications are not products of Crypto-Economics; for instance, applications like Mist and Metamask – wallets or platforms that let users interact with the ethereum blockchain. These do not involve any additional crypto-economic mechanisms beyond those that are already part of the underlying blockchain.

Improving proof-of-work systems and designing alternatives to them, is one active field of Crypto-Economics. Ethereum's current proof-of-work consensus mechanism includes many variations and improvements on the original design, enabling faster block times and being more resistant to the mining centralization that can result from ASICs.

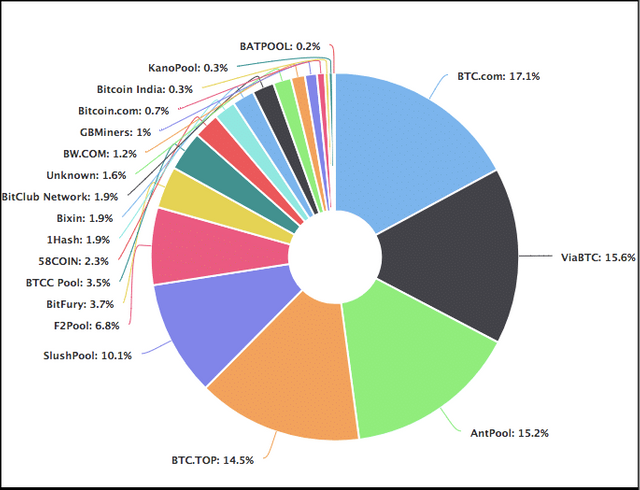

Hashrate Distribution - An estimation of hashrate distribution among the largest mining pools.

Once we have solved the fundamental problem of blockchain consensus, we are able to build applications that sit "on top" of a blockchain like ethereum. The underlying blockchain gives us a unit of value that can be used to create incentives and penalties, as well as a toolbox with which we can define specific rules in the form of "smart contract code." The applications we build with these tools can also be a product of crypto-economic design.

Crypto-Economics also includes the practice of designing much smaller sets of interactions between individuals. For example, state channels. State channels are not an application but a valuable technique that can be used by most blockchain applications to become more efficient. The most commonly discussed scaling challenge is transaction throughput. Currently, ethereum can process roughly 15 transactions per second, while in comparison Visa processes approximately 45,000/tps. State channels approach is one that not every node has to process every operation. An approach in which the network is divided into two sections that operate semi-independently. One section processes one batch of transactions, while another section processes another batch.

Another example is the Lightning Network, which is a "second layer" payment protocol that operates on top of a blockchain, most commonly Bitcoin. It enables fast transactions between participating nodes and has been touted as a solution to the bitcoin scalability problem. It features a peer-to-peer system for making micropayments of digital cryptocurrency through a network of bidirectional payment channels without delegating custody of funds.

The other notable state channels project for ethereum is Raiden, which is currently focused on building a network of payment channels, using a similar paradigm as the lightning network. This means that rather than have to open up a channel with the specific person you want to transact with, you can open up a single channel with an entity connected to a much larger network of channels, enabling you to make payments to anyone else connected to the same network without additional fees.

Imagine A and B want to exchange a large number of small payments of cryptocurrency. The normal way, for them to do this would be to send transactions to the blockchain. This is inefficient as it requires paying transaction fees and waiting for the confirmation of new blocks. Instead, imagine that they can sign transactions that could be submitted to the blockchain, but are not. They only pass these, back and forth between one another, as fast as they want, without fees, because nothing is actually reaching the blockchain yet. With each new transaction, the balance between the parties is updated, and when they have finished exchanging small payments, they can "close out" the channel by submitting the most recent signed transaction to the blockchain, paying only a single transaction fee for an unlimited number of transactions between themselves. They can trust this process because both A and B know that each update passed between them could be sent to the blockchain and any of the parties can “close out” the channel. This technique is not just useful for payments, but for any update to the state of an ethereum program. Instead of sending payments back and forth, we can send updates to a smart contract back and forth.

Like state channels, Plasma is a technique for conducting off-chain transactions while relying on the underlying ethereum blockchain to ground its security. But Plasma takes the idea in a new direction, by allowing for the creation of “child” blockchains attached to the “main” ethereum blockchain. These child-chains can, in turn, spawn their own child-chains, who can spawn their own child-chains, and so on. Plasma and Raiden, are also known as Layer 2 solutions because they are built “on top of” the ethereum main-chain. They do not require changes to the base level protocol, and exist simply as smart contracts on ethereum that interacts with the off-chain software. The principle behind state channels is that we build more efficient blockchain by transacting off-chain, while still retaining a blockchain's characteristic trustworthiness, through the use of crypto-economic design.

Similarly, if we can split a blockchain into many different sections, then we can increase the throughput of a blockchain by many multiples. This is the insight behind “sharding”, a scaling solution being pursued by Vitalik’s Ethereum Research group and others. A blockchain is split into different sections called shards, each of which can independently process transactions. Sharding is often referred to as a Layer 1 or “first layer” scaling solution because it is implemented at the base-level protocol of ethereum itself.

In an ideal scenario, we could have Plasma and Raiden protocols working intraoperatively, by having Plasma handling the smart contracts and triggering the raiden network to execute those payments. Moreover, Sharding would achieve the consensus between the main chain and Plasma chain faster, since the nodes have smaller groups of transactions to verify.

In the future, ethereum plans to migrate to a long-term scaling solution that utilizes a crossbreed “proof of work” and "proof-of-stake" consensus protocol called Casper. Currently, like Bitcoin, Ethereum exclusively depends on the PoW consensus protocol to maintain the network and to confirm, this is an alternative to proof-of-work that does not require "mining" in the usual sense: there is no need for specialized mining hardware or huge expenditures of electricity. Proof of stake will make the entire mining process virtual and replace miners with validators. Validators will have to lock up some of their coins as stake and after that, they can start validating the blocks. When they discover a block which they think can be added to the chain, they will validate it by placing a bet on it. If the block gets appended, then the validators will get a reward proportionate to their bets. With Casper, if a validator acts in a malicious manner, they will immediately be reprimanded, and all of their stake is going to be lost. Just like in proof-of-work, this raises the cost of a 51 percent attack – an attacker would have to commit a very large amount of ether to successfully attack the network, which they would then lose forever.

In the future, most blockchain applications will use state channels in some form. It is almost always a strict improvement to require less on-chain operation, and many things done on-chain today can be moved into state channels while still preserving a sufficiently high guarantee to be useful.

Conclusion

Thinking about the blockchain space through the lens of crypto-economics is helpful. Once you understand the idea, it helps to clarify many of the controversies and debates in our industry. For instance, "permissioned" blockchains that are centrally managed and do not use proof-of-work have been a source of constant controversy since they were first proposed. This area of work is often referred to as "distributed ledger technology" and is focused on financial and enterprise use cases. Many partisans of blockchain technology dislike them, and perhaps for a good reason. It seems like they are rejecting what many people see as the true notion and actual point of blockchain technology. To be able to reach consensus without relying on any central party.

Perhaps a better way is to make a distinction between blockchains that are products of Crypto-Economics and blockchains that are not. Blockchains that are simply distributed ledgers and do not rely on crypto-economic design to produce consensus or align incentives might be useful for some applications. These are distinct from blockchains whose purpose is to use cryptography and economic incentives to produce consensus that could not exist before, like bitcoin and ethereum. These are two different technologies, and the clearest way of distinguishing between them is whether or not they are products of Crypto-Economics.

Furthermore, we should expect that there will be crypto-economic consensus protocols that do not rely on a literal chain of blocks. Obviously, such a technology would have something in common with blockchain technology as we call it today, but labelling them blockchains again would not be accurate. Again, the relevant organizing concept is whether such a protocol is the product of Crypto-Economics, not whether it is a blockchain. The ICO hype has also focused attention on this distinction, though few have articulated it in a clear way. Many people state that one of the strongest indicators over a token's value is whether it forms a integral component of the application to which it is connected. To put this in clearer terms, the question should be: is the token part of a necessary crypto-economic mechanism in the application? Understanding the mechanism design of a project holding an ICO is an essential tool in determining that token's utility and likely value. We need to rethink in terms of Crypto-Economics, just like Satoshi did, and find a unified approach to solving problems.

Bitcoin has changed everything and its importance as an evolution in money and banking cannot be overstated. It has spawned through a global social movement with utopian ambitions. The notion of a new digital currency, maintained by the computers of people around the world has grown into a technology worth billions of dollars, and embraces the potential for a financial system free of banks and governments. It has gone through various booms and busts throughout its genesis, and has provided one of the most interesting tests of the concept of money, and what it might look in the future. It is the best example to date, as to the brilliance of its economic design. It ensures first of all trust between parties that have never met each other without the need for an intermediary. It also distributes these incentives in a way that ensures a single truth, an ever-growing indestructible ledger that is available and transparent to all. And up to date, although it has sustained multiple boom and busts cycles, has been declared dead more than 300 times, it holds more than 55% of the total market share of cryptocurrencies with a market cap of more than $111 billion as of the time of writing.

What is important to remember that it's through technology and collective innovation from a few brilliant minds in the history of the world, that we are able today to address the most important human matters, such as privacy and how we define money. It seems that the future is bright as these technologies become mainstream and provide an alternative financial model for the next generations together with a decentralized alternative to central banking and censorship. As it challenges the most sacred of government monopolies, fiat money, Bitcoin and cryptocurrencies shift the pendulum of sovereignty away from corrupted politicians in favor of the people and providing a strong possibility of a world where money is completely detached from politics and unlimited by any border, and all this, thanks to the understated influence and contribution from a handful of brilliant minds. The future of crypto-economics is still too early to predict but it is almost certain that they will play an even important role on how our society and world functions in the next few years.

Sources:

https://bitcoin.org/bitcoin.pdf

http://www.gwern.net/docs/bitcoin/2008-nakamoto

https://github.com/bitcoin/bitcoin

https://digiconomist.net/bitcoin-energy-consumption

https://bitcoinexchangeguide.com/bitcoin-energy-consumption-index/

https://blockgeeks.com/guides/what-is-cryptoeconomics/

https://thecontrol.co/cryptoeconomics-101-e5c883e9a8ff

https://www.microsoft.com/en-us/research/publication/byzantine-generals-problem/

https://medium.com/@anaminguyen/intro-to-cryptoeconomics-part-1-b2527775bc9c

https://www.coindesk.com/making-sense-cryptoeconomics/

https://hackernoon.com/what-i-learned-by-joining-a-panel-on-institutional-cryptoeconomics-460b157dc38a

https://www.coindesk.com/institutional-cryptoeconomics/

https://www.slideshare.net/dinisguarda/a-financial-tech-tsunami-driven-by-blockchain-ai-crypto-economics-82541146

http://hlwiki.slais.ubc.ca/index.php/Open_source_software

https://www.gnu.org/gnu/thegnuproject.en.html

https://vitalik.ca/files/intro_cryptoeconomics.pdf

https://hackernoon.com/introduction-to-cryptoeconomics-through-bitcoin-818e21d4cbfa

https://blockchainatberkeley.blog/introduction-to-blockchain-through-cryptoeconomics-part-1-bitcoin-369f245067f9

https://medium.com/jump-genesis/jump-genesis-cryptoeconomics-52313f0a60c9

https://medium.com/cryptoweek/an-introduction-to-cryptoeconomics-41973f3ecf67

https://medium.com/blockchannel/cryptoeconomic-theory-game-theory-basics-fb3a49aab1a8

https://en.wikipedia.org/wiki/Mechanism_design

https://medium.com/@viktorwrites/cryptoeconomic-theory-table-of-contents-311fcf30bc2b

https://medium.com/blockchannel/cryptoeconomic-theory-basics-of-social-order-2be4c1be89c1

https://medium.com/blockchannel/cryptoeconomic-theory-markets-vs-planning-85a76bb2c038

https://medium.com/blockchannel/cryptoeconomic-theory-pareto-efficiency-89d34664f9d

https://medium.com/blockchannel/cryptoeconomic-theory-game-theory-basics-fb3a49aab1a8

https://medium.com/blockchannel/cryptoeconomic-theory-basics-of-social-order-2be4c1be89c1

https://ocw.mit.edu/courses/economics/14-12-economic-applications-of-game-theory-fall-2012/lecture-notes/

https://medium.com/jump-genesis/jump-genesis-cryptoeconomics-52313f0a60c9

https://blockchainatberkeley.blog/introduction-to-blockchain-through-cryptoeconomics-part-1-bitcoin-369f245067f9

https://vitalik.ca/files/intro_cryptoeconomics.pdf

https://medium.com/blockchannel/cryptoeconomic-theory-basics-of-social-order-2be4c1be89c1

https://medium.com/blockchannel/cryptoeconomic-theory-pareto-efficiency-89d34664f9d

https://medium.com/blockchannel/cryptoeconomic-theory-game-theory-basics-fb3a49aab1a8

https://medium.com/@viktorwrites/cryptoeconomic-theory-table-of-contents-311fcf30bc2b

https://www.coindesk.com/theres-a-problem-with-crypto-funding-and-vitalik-might-have-a-solution/

https://www.coindesk.com/theres-a-problem-with-crypto-funding-and-vitalik-might-have-a-solution/

https://www.coindesk.com/experimental-voting-effort-aims-break-ethereum-governance-gridlock/

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3243656

https://blog.ethereum.org/2015/09/14/on-slow-and-fast-block-times/

https://ethereum.stackexchange.com/questions/16811/is-ethereum-asic-resistant

https://www.coindesk.com/making-sense-smart-contracts/

https://www.augur.net/

https://blog.gnosis.pm/introducing-the-gnosis-tokens-gno-and-wiz-5295a65c3822

https://github.com/ethereum/mist/releases

https://metamask.io/

https://medium.com/l4-media/making-sense-of-ethereums-layer-2-scaling-solutions-state-channels-plasma-and-truebit-22cb40dcc2f4

https://www.jeffcoleman.ca/state-channels/

https://www.blockchain.com/pools

Coins mentioned in post:

wow, very thorough!

Nice article Brother!

People need to see how important the crypto revolution is in our lifetime and give it the value ti deserves.

Powerful!

Very nice article

Congratulations @universalcrypto! You received a personal award!

Click here to view your Board of Honor

Congratulations @universalcrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!