Build Your Financial Ecosystem with Digital Bank of Africa

Start Building your financial ecosystem by signing up for your no monthly fees personal account with DafriBank - A bank renowned for its first-class functionality and low banking fees in minutes.

Explore an easy and better way to save, make payments, manage your money and your business whenever you want, wherever you are!

#DafriBank #DafriBankDigital #OpenBanking #DigitalBanks #DigitalPayment #OnlinePayment #PaymentSolutions #CrossBorderPayment #DigitalEntrepreneurs #InvesInAfrica #Bitcoin #InstantMoney #InstantPayment #eWallet #Binance #MobileMoney #DigitalMoney #CryptoBank

DafriBank - Digital Bank of Africa Offers Mainly Two Types of Account as

- Personal Account

- Business Account

1. Personal Account

With Personal Account Dafribank offers An account with no monthly fees.

Anyone can Join Dafribank according to requirements. Dafribank offers additional features for every individual according to their needs. To offer, additional features Dafribank introduces four types of accounts within personal Account, to their users globally.

Create Your Dafrbank Account Today!

Types of Personal Account

- DafriBank Silver Account - These Types of accounts are Ideal for clients whose annual income is between zero to $5010.

- DafriBank Gold Cheque Account - These types of accounts are Ideal for clients whose annual income is not less than $5010.90 and not more than $17,896.02.

- DafriBank Premier Account - These types of accounts are Ideal for clients whose annual income is not less than $17,896.08 and not more than $44740.13.

- DafriBank Private Wealth Account - These types of accounts are Ideal for clients with an annual income of $50,000 and assets valued at $1 million.

Features of Dafribank Personal Account

-

No monthly fees

The personal accounts you will hold with DafriBank will be completely cost-free. There will be no charge for EFT, domestic transfers, and ATM withdrawals.

-

Pay on the Go

Enjoy hassle-free payment with hundreds of merchants accepting payment via our online platform. Pay via our QR code integrated wallet.

-

Easy movement of funds for traders

Enable you to make various types of transactions from the online portal and mobile app without physically visiting the bank branch.

-

Use debit card, EFT, and Crypto

Load your flexible DafriBank App wallet with funds from either your debit card, EFT, or Crypto wallet.

-

Exchange currencies

Need to exchange currency for your international transaction? DafriBank allows the exchange of currencies in USD, GBP, EUR, NIG, ZAR, and many more.

-

Liquidate your deposits anywhere

Whether you want to Cash your deposits or deposit funds into your account, DafriBank will process it instantly.via our available and secure options. No delays.

Open an account in minutes.

2. Business Account

Join the effort to alter the way companies obtain banking services. Apply for a free business account with Africa's leading banking service provider right now.

Type of Business Account

- Gold - Gold accounts are for businesses with annual turnover from $0.00 up to $1 million, Gold accounts are favorable to startups and small-scale businesses. DBA provide you with online tools that support your growth.

- Platinum - Platinum accounts are for businesses with an annual turnover from $1 million to $5 million. DBA straightforward banking charges give you clarity, so you can concentrate more on building your business.

- Enterprise - Enterprise accounts are for established businesses with an annual turnover of about $5 million, DBA provide dedicated support. You'll get a personal relationship manager who will assist your business with its banking needs.

Simple and powerful business banking

DafriBank is available to meet the demands of a wide range of companies. DafriBank can meet your demands whether you are a merchant wishing to accept cashless payments from your consumers or a broker looking to move funds with reduced transaction costs.

- Free ATM withdrawals

- Unlimited card swipes

- Access to a business savings account

- Access to internet banking

- Overdraft facility available

Open a business account in minutes.

Features of Dafribank Business Account

-

Integrate with your accounting tools

You can integrate your DafriBank business account with your existing accounting software to ease out the vendor payments and salary deposits.

-

Movement of funds for brokerage

DafriBank provides easy movement of funds, which is built to assist traders in moving funds effortlessly.

-

Digital Receipts

Business needs to keep copies of payments and bills. DafriBank makes maintaining business account receipts easy.

-

Overdraft at a low rate

Dafribank service lets you make use of pre-approved overdrafts. All DafriBank overdrafts are at very competitive interest rates.

-

Accept payments with DafriBank

DafriBank makes it easy for your customers to pay you for your products/services. We'll enable you to accept payment via Cards and E-wallet.

-

Instant transaction notification

Get notified via SMS, email, and your Mobile App the second you send or receive a payment. DBA make sure that their clients never miss a payment due date with help from DafriBank payment alerts.

Private Banking

In Addition, to increasing users requirements and more features, Dafribank offers Private Banking

Discover the advantages of DafriBank's Digital Private Banking.

Your personal banker is your single point of contact for all of your banking and financial requirements. In all of our transactions with you, you can expect secrecy, discretion, and professionalism.

Features of Private Banking

-

Relationship-driven

Your dedicated private banker is your direct point of entry for your banking and financial needs.

-

Customized solutions

A Comprehensive range of financial solutions designed to meet your needs.

-

Specialized advisory services

Network of experienced specialists.

-

Priority services

Convenient service channels.

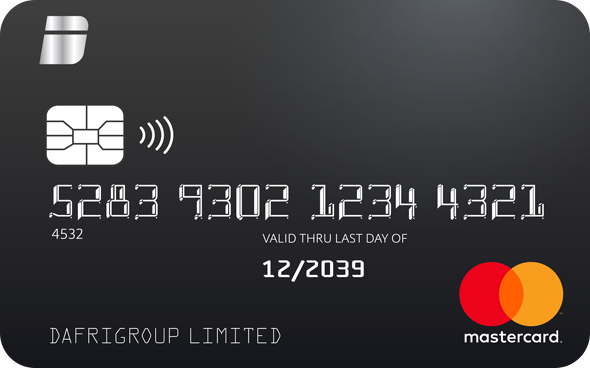

Personal and Business Debit Card

Pay for your goods and services online with DafriCard. DafriCard is available for both business and brokerage traders firms that need to make efficient fee transactions.

Get Your DafriCard

Note

DBA is already listed in Coinmarketcap, Coingecko, and in top exchanges at $15 but they can purchase it today at the launchpad in at $1.8 only.

For More Information

Investor Relation

DafriXchange

DBA Currency

Annual Price Review

Social

Website

Telegram

Author Details

Bitcointalk Username: Digitalbitcoin

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=449709

Proof of Registration: https://bitcointalk.org/index.php?topic=5371346.msg58583068#msg58583068

DBA Wallet: 0xaB33C0559B02A9DCd8115D2230F7141d9c5728d6

If You like this review about Digital Bank of Africa then, don't miss to follow and subscribe @Cryptocoin on Steemit to receive the latest posts

You can integrate your DafriBank business account with your existing accounting software to ease out the vendor payments.

Dafribank is really awesome project for global crypto enthusiasts with many adorable features including fiat.