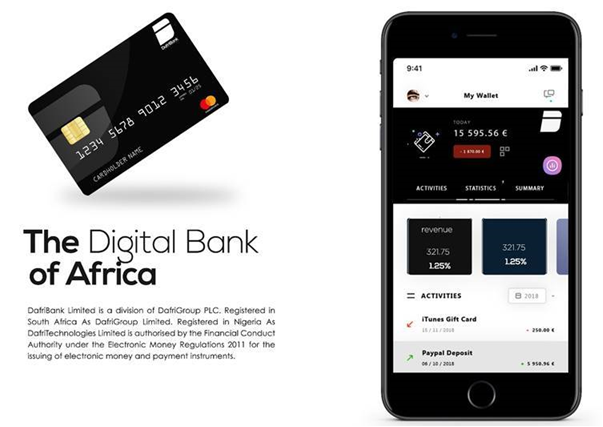

DafriBank - changing the old commercial banking system with a revolutionary Digital Banking model

DafriBank is remodeling the previous industrial banking systems with its revolutionary Digital Banking model. It opens new opportunities for the rising African digital entrepreneurs, Associate in Nursing oft-ignored niche. This digital-only bank is projected to start operation within the third quarter of 2021 and can have physical presence in African nation and South Africa, and envisions increasing to Republic of Kenya, Botswana, and Ghana, amongst additional.

The bank uses advanced technologies that may permit access to a large vary of monetary services while not entry barriers. it'll house the simplest digital banking systems providing payment solutions to Associate in Nursing array of companies and platforms. DafriBank lives up to its promise to open up new opportunities to the African population through future-centric ideals that centres on achieving Associate in Nursing economically liberated continent.

With its troubled technology DafriBank aims to push the boundaries within the African banking community to supply top-class digital banking services that may facilitate several firms uncover the important price of their businesses. DafriBank's primary focus are to serve the unbanked and underbanked United Nations agency are unjustly excluded from the worldwide monetary systems because of many factors.

Poverty and lack of resources ar chief amongst the problems impacting the industry in continent these days culminating within the lack of property banking solutions that meet the people's desires. Some necessary factors that influence bricks and mortar banks are: value and lease, employees salaries, worker coaching, money distribution prices, and therefore the excess of different expenses that has created it close to not possible to supply cost-efficient services to customers United Nations agency are forced to hunt out alternatives.

Alternative native on-line payment solutions have additionally repeatedly unsuccessful its African customers particularly Digital Afripreneurs by ignoring and denying them economical solutions that would facilitate take their businesses to bigger heights and harness their potential. this can be unreasonable considering Africans ar large players within the Digital entrepreneurship niche that's witnessing astronomical growth and ontogeny opportunities across several sectors together with e-commerce, Forex commerce, brokerage business, binary choices, stock exchange, football game sporting, digital exchange, digital promoting, social media promoting, e-magazines, on-line business, blogging, Airbnb, and a excess of additional businesses.

These platforms have overtaken non-digital businesses and ar contributive massively to the economy. It’s surprising to understand that banks and monetary establishments still underserve African players during this multi-billion-dollar trade. This has diode several new-age entrepreneurs to do out different payment solutions like Apple Pay, PayPal, Payoneer, Skrill, and more. Though, these gateways aren't in correct with the African market because of their steep group action fees and a number of other restrictions. Case in point: PayPal denies several African countries full access to its transfer and withdrawal functionalities, deed several African businesses unable to draw in prospects in several regions.

DafriBank, with its distinctive monetary solutions targeted at Africans embrace cuttingedge technology and models as tools to effectively contour banking processes, creating it accessible to everybody and elevating the user expertise. the corporate strives not simply to form solutions for the rich however additionally for the typical African. DafriBank's digital bank represents Associate in Nursing modern monetary dress shop that unites many services starting from ancient banking services together with savings, deposits, payments, and loans to niche services like cross-border remittances; all of which can be offered at competitive rates with speed, ease-of-access, and bank-grade security at the guts of its operations.

The thirstily anticipated digital - entrepreneurial category alternative platform that has been dubbed "the Chime of continent " may be a subsidiary of DafriGroup PLC, a transnational conglomerate headed by a revived South African philanthropist/ man of affairs, Xolane Ndhlovu, United Nations agency is that the former Chief officer of UMEH cluster Ltd. DafriBank is collecting a team of outstanding professionals and thought leaders across many fields. It recently proclaimed its new Chief officer Ramswamy Easwara, a flexible victory banker with over eighteen years of expertise within the banking sector across multiple roles antecedently control in many leading monetary establishments.

DBA is already listed in exchanges, $15 current price;

But you still have the opportunity to purchase DBA tokens today at $1.8 from their launchpad on;

Latoken, ProBit, P2PB2B

#DafriBank #DafriBankDigital #OpenBanking #DigitalBanks #DigitalPayment #OnlinePayment #PaymentSolutions #CrossBorderPayment #DigitalEntrepreneurs #InvesInAfrica #Bitcoin #InstantMoney #InstantPayment #eWallet #Binance #MobileMoney #DigitalMoney #CryptoBank #Forex #Foxcampaigns

for more information:

DafriBank official website:

https://twitter.com/DafriBank?s=09

https://www.facebook.com/DafriBank/

https://www.instagram.com/dafribank/

https://www.linkedin.com/mwlite/company/dafribank-limited

https://www.dafribank.com/investor-relations

Creator:

Bitcointalk Username: Genosida

profile link: https://bitcointalk.org/index.php?action=profile;u=3389617

Bsc Wallet: 0x5Cd94ab4B9e91933Eb60994231A9497e762379B3