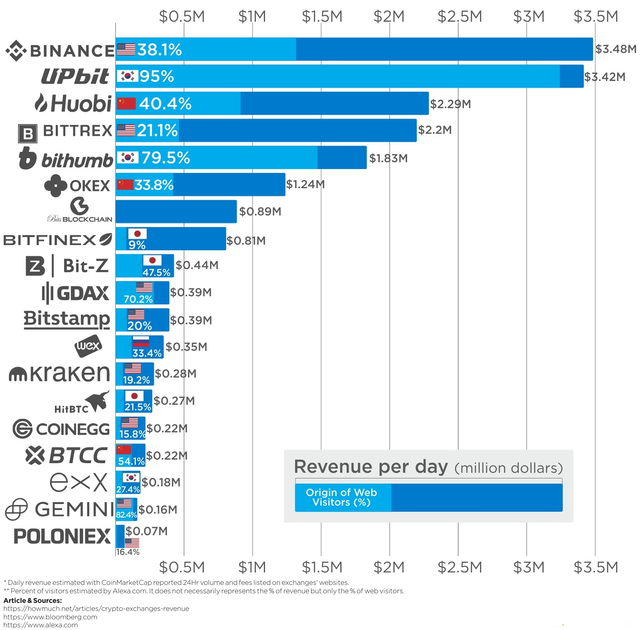

Daily profit distribution amongst cryptocurrency exchanges

If we take into count that the crypto market exists merely 10 years, daily profits that they generate according to Bloomberg are absolutely huge. According to them, the top ten exchanges are making as much as $3 million daily profits.

We don't need a university degree to figure out how they profit, just by simply charging fees for transactions such as buying, selling and withdrawing cryptocurrencies. There are, however, significant profit differences among exchanges and there are some trends that can help us understand why.

Location of exchanges:

Exchange platforms positioned in Asia are ruling the global crypto trading space. Estimation is that over half of daily global crypto trading is done on Asian exchanges. However, recently announced enforcement by the Security and Future Commission in Hong Kong can flag the start of a change in this trend by moving exchanges from countries like China and Japan to other territories if the exchange founders and shareholders become afraid of the less hospitable environment of the exchange headquartered there.

Popularity of cryptocurrencies:

In contrary to popular US-based tech giants such as Google, Facebook, and Amazon, top crypto exchange platform popularity leads to Asia for several reasons.

First and the biggest reason is the low energy cost for crypto mining the nation is using the advantage of to fuel their growth in crypto since the early days.

The second reason is that they have always been on ahead of the curve regarding technological advancement and establishing an electronic payment economy.

Last but not least, the gaming culture of Asian nations helped to get the concept of tokenization since they have been using it as rewards in which hold value, therefore many people viewed cryptocurrency as the next generation of these tokens.

The future of exchanges:

We can notice that over the years there is a formation of more competitors in crypto exchange space which can be seen as a good market trend. Some exchanges, for example, Robinhood wants to offer a zero fee trading between cryptocurrencies which makes other exchanges find new approaches to stay relevant in the market.

Decentralization is one of the ways exchanges want to improve upon their security and shift the authority from their shareholders to users.

Another improvement that they want to focus on is establishing relations with banks and start offering fiat to crypto exchanges. However, relationships with conventional banks require time, therefore, we are yet to see changes within this topic.

Congratulations @exgap! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Congratulations @exgap! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

This post has received a 14.29 % upvote from @boomerang.