Data visualization of the crypto market for 2018

Happy New Year to all steemers, let's start the channel with some optimistic view on the crypto world in general with some of the most interesting and informative data visualization of the recent year.

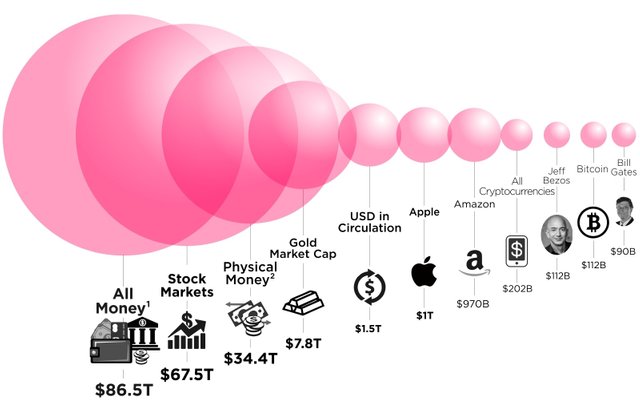

Cryptocurrency market compared to worlds wealth

Visualizing the cryptocurrency market in comparison to the grand scheme of things, we quickly realize that the growth potential is huge. Even though, larger than the entire wealth of the richest people such as Bill Gates and Jeff Bezos, still much smaller than the market cap of several companies etc.

For the full report click here

Here is the breakdown:

- Amazon's market cap is $902Bbigger than BTC ($970B vs. $68B).

- Apple is worth $932B more than BTC ($1T vs. $68B).

- World’s gold market is more than 70x bigger compared to bitcoin ($7.8T vs. $68B).

- Cryptocurrency market is worth 0.59% of the world’s physical money ($34.4T vs. $133B).

- Comparing cryptocurrencies to the world’s stock markets is even bigger. ($67.5T vs. $133B).

- Broadly described, BTC is around 0.23% of value compared to all the money in the world ($86.5T vs. $133B)

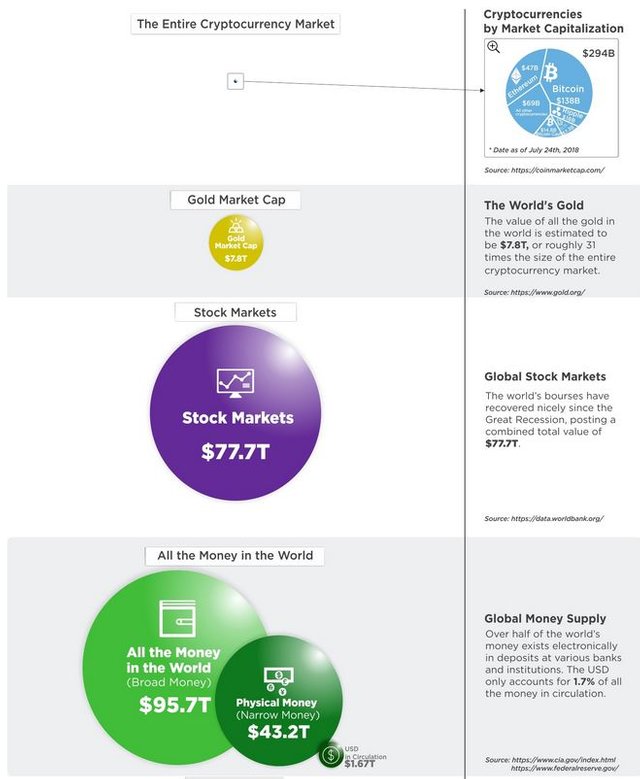

Was the cryptocurrency the biggest bubble?

The media has negatively characterized cryptocurrency investors all year long, and sure, the price of bitcoin and other cryptocurrencies was surely fallen drastically, but smart people expected a drop and plan for the long term. Bitcoin felt 85% from 1 year ago, but it's up 400% from 2 years ago. More importantly, the scope of the crypto market faints in relation to the bubbles growing up in other sectors of the economy.

Many people compare cryptocurrencies market to the 2000 dot-com bubble based on how fast the blockchain industry is growing and how exciting the assets are.

Some say that it’s the greatest bubble of all time. But for all the hype, the whole crypto market is worth only a tiny portion of the gold market, which is itself just worth around 10% of the entire world’s stock markets. This is an existing visualization for all. If the bubble has already popped, there’s potentially plenty of upside in cryptocurrencies. If you are interested in the article, click here

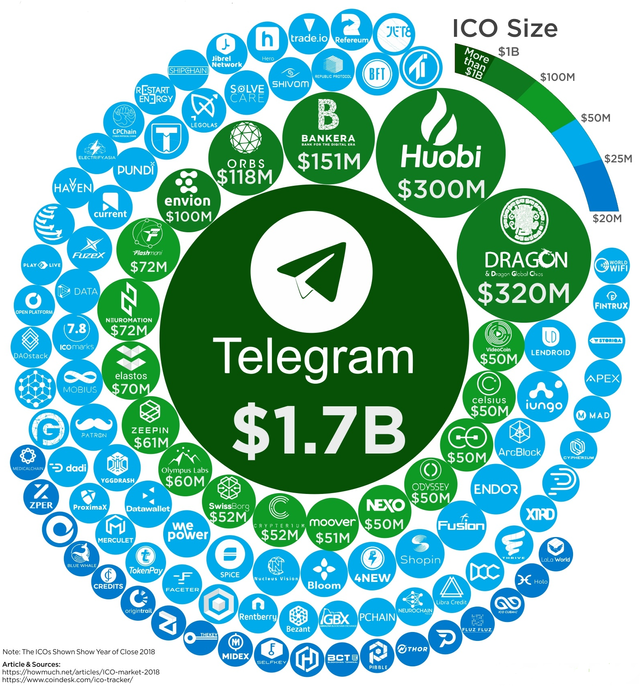

Biggest ICO of 2018

It makes it difficult to identify which cryptocurrencies deserve recognition due to the speed at which this market is changing

The rapidly changing market also means that many ICOs burn out, leaving over 800 dead coins but, after all these to a certain extent, for a brand new market to experiencing growing pains, especially one with low barriers to entry and little regulation.

Low-value ICOs mostly only known inside the crypto community is not included, visualization only includes ICOs worth $20M or more. It is clear that only a couple are big in size putting Telegram’s monster $1.7B ICO into perspective. For the full article click here

Top 10 Biggest ICOs in 2018

- Telegram: $1.7B

- Dragon: $320M

- Huobi: $300M

- Bankera: $150.9M

- Orbs: $118M

- Envion: $100M

- Flashmoni: $72M

- Neuromation: $71.7M

- Elastos : $70M

- Zeepin : $61M

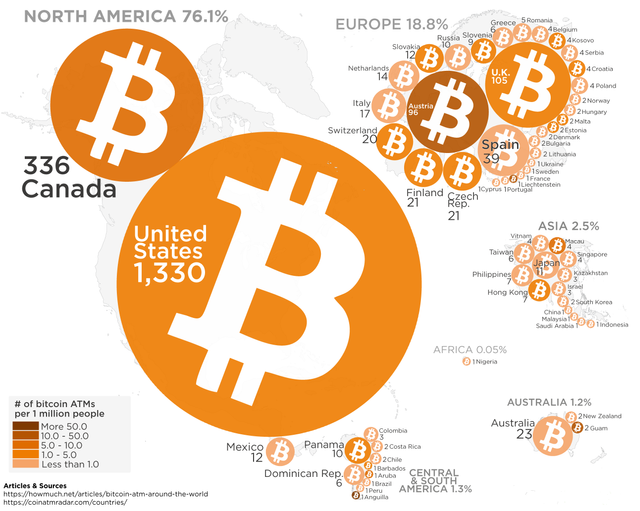

Bitcoin ATM's in the world

The United States is home to the greatest number of Bitcoin ATMs with 1,330 machines. However, Austria has the highest concentration of ATMs per million people, which makes the countries residence have the greatest accessibility to crypto funds in the world.

North America rules the Bitcoin ATM world, which accounts for 76.10% of the world’s cryptocurrency ATMs. Europe is home to the second largest number of ATMs with 18.80% of the total market. Asian governments have remained to crackdown on cryptocurrency forcing bans or strict regulations, and therefore it's the third largest region with 2.50% of the Bitcoin ATM market.

Africa with the lowest share will mostly adopt Bitcoin ATMs as the continent discovers more of the potential benefits that could benefit their economic growth, however, we will likely need some more time before we start seeing an additional increase of Bitcoin ATMs within the continent.

If you are interested in the full report, click here

Breakdown based on each continent’s percentage of the world’s Bitcoin ATM market share:

- North America: 76.10%

- Europe: 18.80%

- Asia 2.50%

- Central & South America 1.30%

- Australia 1.20%

- Africa 0.05%

Crypto transactions speed compared to visa & PayPal

As we can see, Visa has still the fastest transaction speeds above any other competitor, with 24,000 transactions per second. Ripple comes to the second position beating PayPal by the capability of handling 7x more transactions per second. This shows that Ripple may have the capability to be a viable payment solution on a much larger scale. We can viably expect a payment solution by Ripple on a much larger scale in the future.

During the quarter of 2017, PayPal had over 218 million active users and its still among the most common P2P platform out there, however, Ripple's dominance in the transaction speed combined with the safety which is offering can change the future peer-to-peer platforms.

Here is a breakdown of the chart

- Visa: 24,000 transactions

- Ripple: 1,500 transactions

- PayPal: 193 transactions

- Bitcoin Cash: 60 transactions

- Litecoin: 56 transactions

- Dash: 48 transactions

- Ethereum: 20 transactions

- Bitcoin: 7 transactions

Congratulations @exgap! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOP@exgap purchased a 13.58% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com