Debt – The dangerous 4-letter word

All of us opt for various types of loans during different stages of our life. The home loan makes it easier to afford our dream house. Car loan fulfills our dream of having a car. In fact now a day, mobile phones, televisions, washing machines and all other consumer products are available with easy monthly EMI. Loan is neither good nor bad. It all depends on the financial situation of the borrower. Sometimes loan becomes essential while sometimes excessive debt hurt our financials badly. Like us, almost all companies require loan. Sometimes it is for working capital requirement or sometimes for purchasing land and machinery or for other business acquisition. Taking debt is not an issue. Debt is essential for business expansion. Serious concern comes while it goes beyond the capacity. Excessive debt can even lead to bankruptcy. Thus, it may erode the entire shareholder's wealth. So, we need to analyze the type of loan, whether the company is comfortable enough to pay back the entire debt without affecting its profit and day to day business operation. Analyzing the debt repayment capacity of any company is a complex, tedious and time-consuming task because analyzing balance sheet itself is a complex pro My aim is to provide you an easy-to-understand solution

Let's start with financial statement analysis of tun individuals. It is much easier to follow financial individuals than the company. Once you grab the idea with an easy example, then it will become easier to follow complex financials of the company. Follow the example carefully.

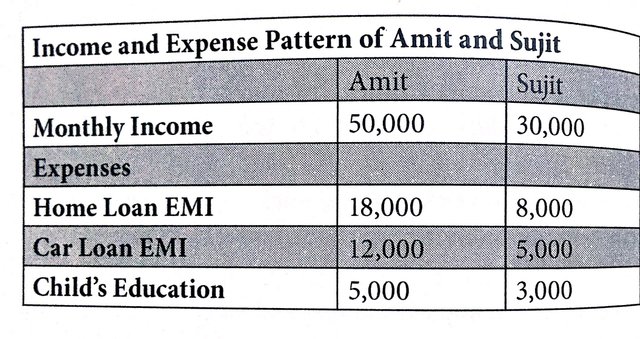

Amit and Sujit - Income and expense analysis

Amit and Sujit both are working in a software company. Amit draws a monthly salary of Rs- 50,000 while Sujit takes Rs- 30,000 per month. A Higher salary is perceived as better financial position, but the same can cause financial disaster! Now let's have a look at the various expenses of the both individuals. Higher salary tends to the luxurious lifestyle, bigger house, and expensive car. Amit has home loan EMI of Rs- 18,000 while the same for Sujit is Rs- 8,000. Amit owns an Audi A4 while Sujit is satisfied with his Maru Suzuki Dzire. Amit shells out Rs-12,000 EMI for his ca loan while Sujit shells out Rs-8,000. Let's have a 100 the following chart for the detailed income and espe pattern

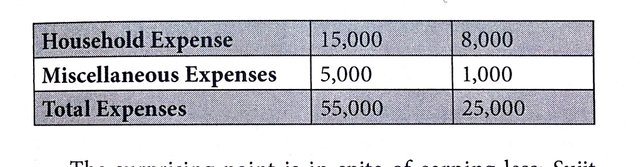

The surprising point is in spite of earning less; Sujit can save Rs-5,000 while Amit is not able to save a single penny. Moreover, there is a deficit of Rs-5,000. Now, you may wonder, how is it possible of having a deficit? Well, with the advent of credit card anyone can spend more than his earning. Amit is no different. His bank offered credit limit of two times of his monthly income. So, he can easily utilize the rolling credit feature to spend more than he earns. Apparently it seems an attractive deal for credit card users. Spend more than earning! While Sujit is saving Rs-5,000 per month and putting it on recurring fixed deposit, Amit is rolling his credit card debt of Rs-5,000 per month.

You may wonder that savings is just 5,000 per month. So, what's a big deal in it? Well, let's illustrate how this small amount can create wonder. Sujit is investing 5,000 per month that translates into 60,000 per year. Now depending upon the investment options return will vary from 8% to 20%. While investment in Post Office deposit or bank deposit will fetch, 8%-9% return at the same time investment in equity oriented product can bring 15%-20% return. Considering only 8%

annual compound return, 60,000 investments per year translates into 20 Lacs (20,00,000) corpus within 15 years. If the annual return stands at 15%, then it will translate around 38 Lacs corpus (38,00,000). You can use any compound return rate calculator (or Excel sheet) to compute the details.

Now, have a look at the financials of Amit. He is rolling his credit card debt of 5,000 per month. Annual interest rate of a credit card is around 24%-30%. Credit card debt is unsecured so bank charge such high-interest rate. For easy calculation, I am considering Amit is paying 20% annual interest on his entire credit dues. Thus, interest expense comes anywhere around 12,000 - 25,000. (Depends on whether it is revolving credit or not). Forget about savings, it makes poorer by 3 - 4 Lacs over the next 15 years.

A friendly advice:

Always try to live below your means. Try to avoid credit card. If a credit card is too necessary, then make sure to clear all your dues within time. Never go for delayed payment. Credit card debt can erode your entire savings. Develop a savings habit. Don't save after your expenses, rather expense after savings. It can create a lot of difference. Whenever, your salary credits into your bank account put a standing instruction that a certain percentage will go for your investment. Unless and until you keep aside a certain portion at the beginning of the month, you won't be able to save at the end of the month.

So, always remember, Income - Savings = Expense

Forget that, Income - Expense-Savings

Now, you may ask why I am putting so much focus on personal finance to describe the stock market. The only reason is that it becomes very easy to co-relate and grab the idea quickly. As like our personal finance debt can also become disastrous for any company.

The easiest way to expand any business is taking a loan. As a business person if you can make a profit of 20 on 100 investments then it is obvious to take another 100 as a bank loan to multiply your profit. Similarly, almost every company take loan to expand their business. The problem comes when they become aggressive to promote growth. Consider a situation, where you are earning 10% profit margin but paying back 12% interest on the loan. In such case higher sales will widen your loss because you are losing 2% on every sale. The irony is higher sales is destroying shareholders wealth. Further high debt means huge interest outgo that eventually drops down profit. This is why sometimes debt becomes disastrous. To analyze debt position of any company, there are numerous ratios like -

- Debt to Equity Ratio 2. Interest coverage ratio 3. Current Ratio 4. Quick Ratio 5. Debt to owners fund

Out of all those ratios, clear understanding of debt to equity ratio will serve your purpose. I am not going to discuss all those because it will become complicated and very difficult for small investors to implement.

Let's start with the definition of debt to equity ratio. Again I want to remind you that you are not going to appear for MBA entrance examination. Your motive is to earn money from investment. MBA in finance degree is not required to become a success is not essential to memorize the definition ratio. Knowing its application is sufficient enough

to fulfill your purpose. definition of Debt to equity ratio is the measure of a company's financial leverage calculated by dividing its total liabilities by stockholders' equity. It indicates what proportion of equity and debt the company is using to finance its assets.

So, debt to equity ratio = Total liabilities/ Equity.

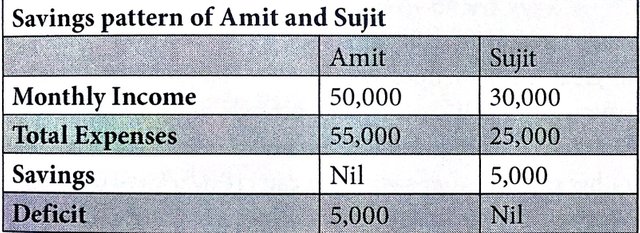

Before investing in any stock, have a look on its debt to equity ratio. No need to calculate on your own. The ratio is readily available on various financial websites (like moneycontrol.com). You need to check the ratio of at least last 3 years. Debt to equity ratio of greater than 1 carries red signal. It emphasizes that the company may face difficulties to serve debt in near future. Don't invest in companies where the ratio is above 1 for the last 3 years. It doesn't matter how many analysts are putting “Buy call or how many times the stock price appreciated. Investing in high debt companies carries inherent risk. Also stay alert if you find any company that is increasing its debt level rapidly. In the following chart let's have a look at the companies having high debt to equity ratio and their stock price performance.

What the table suggests –

The above table displays an interesting result. All those companies had generated negative return during the last 1 year and 3 year period. Most importantly while Sensex is showing 27% and 36% return respectively. So, it doesn't matter whether the market is in bull phase or bear phase, companies having high debt level perform badly across any market situation. There are exceptions if the company can improve its debt level significantly.

If you find a company having debt to equity ratio of more than 1 with increasing debt level then avoid the stock.

Prevention is better than cure. It is always better to st from such stories to minimize the chances of loss.

"Avoid stocks having debt to equity ratio of more

than I”

Moving for the next parameters -

Hopefully now it is clear about the first parameter that you need to follow in any stock. With the advent of Internet and social media, plenty of stock recommendations are there. Don't follow them blindly. After getting any stock idea, just find out its Return on Equity (ROE) and Debt to Equity ratio. Profit and sales growth analysis will come later. If you find the stock is having ROE of less than 12% and debt to equity ratio of more than 1 then discard it.

Also note that to analyze debt situation of any company, it will be better to use the combination of many more ratios like Interest coverage ratio, Current ratio, Quick ratio etc. However I am not discussing those because it becomes very complex analysis for small investors. My aim is to offer an easy-to-implement quick solution for small investors. In 90% cases, debt to equity ratio is sufficient enough to analyze debt burden of any company.

Moving forward, in the next chapter we discuss about easy-to-understand practical ways to evaluate management with different aspects and real life examples.