Debt Relief Programs - Want to Learn More?

If you are of legal age you probably have some debt that you are dealing with.

Credit Cards

Student Loans

Personal Unsecured Loans

Pay Day Loans

Lines of Credit

Medical Debts

Collections Deficiency Items

Auto Loans

Mortgages,

Home Equity Loans

Tax Debts

Liens

There are more items that are not as common but you probably have at least 1 if not more of the above listed debts.

I remember getting my first credit card in college. There was a banker walking around my college campus saying they had great offers for college students at the time. (Reminds me of a drug dealer targeting young kids, now when I think about it) They approved me for some collegiate credit card with a maximum credit line of $3000. I know everyone knows college students are broke and have no money so you can only imagine what that $3000 felt like to me...

Now to be fair I knew that I shouldn’t max out my card so it wasn’t as though I was completely oblivious about credit lines and the interest, but to understand what having that card meant for my credit worthiness is an entirely different thing.

After a couple months passed and I was paying on my cards on time a little over the minimums, they did what at the time I thought was a reward.They increased my credit line. Now I had access to over $5000 on my new credit card that I maybe had for a few months at this point.

That was the end.... lol

I’m sure you all can think of what happened next...More available, more used - not realizing what my high, never had credit card before interest rate was doing to my balances; and to my payments, next thing I knew I had maxed out my credit line...Just like that my credit was shot.

Now knowing what I know now, I would’ve done things better, but even if I still had to go through that to learn the lesson, I wish I would’ve been more open to discuss my options. What I did at 18 and what I see a lot of people do is “I’ll pay it when I have the money, I’ll pay it then...” or “I’ll worry about that later”And the later eventually comes but usually on the on the cusp of a civil suit against you that forces your hand. Versus handling things proactively where you can actually have more control and negotiate.

If you’ve been in this position I’m going to discuss 2 options that you may not be familiar with. These are what they call debt relief programs.In this scenario I would actually qualify for both options. Because both plans deal with credit card debts.

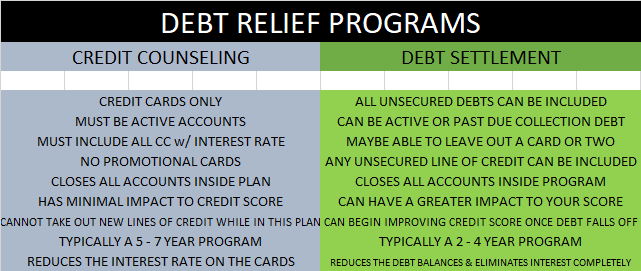

The two are credit counseling and debt resolution. Each one focuses on getting rid of your debt faster. The determining factor for you is how quickly do you wanna get it done and also what can you afford monthly.

Diagram below shows the difference

Now if you have some other debts listed above other than credit cards you can see that your options are more limited. For secured item debts I will post in a separate post. Either way there is a saying - when you know better you will do better and I hope that learning this information will allow you to get rid of anything that maybe holding you back especially those bad debts that aren’t making you any money and are solely just a liability.

Follow to Learn More, will be doing a whole series on debt and managing that correctly....