Ox Protocol- Beginner's guide

Since ages, we have been forced to trust the centralized body to exchange value in form of currencies, stocks and now cryptocurrencies. We trust exchanges to take utmost care of our funds but that does not always turn out to be the case. On many occasions, these exchanges have been found manipulating the price of assets (Bitcoin Price manipulation was observed at Mt Gox exchange in 2013) or hacked leading to loss of assets (Assets worth $60 Mn were stolen from Bitfinex in 2016). These have acted as a deterrent for most for people in and outside the industry.

Good news is that it is going to change with the decentralized exchanges which ensure that funds remain in the user control till they are exchanged. In this article, I am going to cover Ox protocol which is providing a trustless platform for the user to exchange value and don’t risk their funds.

What is Ox protocol?

0x is an open source protocol for exchanging ERC-20 tokens over Ethereum blockchain in a decentralized and cost-effective way. It is developed using a protocol that involves Ethereum smart contracts and intends to enable everyone in the world to use a decentralized exchange. As we make progress towards the world of the blockchain, we can expect many Ethereum tokens launching in future which will need to be exchanged in the efficient and decentralized way. The question arises that why can't we exchange these tokens through Binance or Bittrex (centralized exchange) or through other decentralized exchange (Etherdelta)?

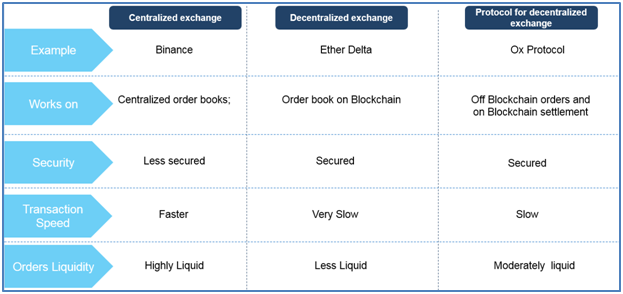

We can use centralized exchanges but they pose a security threat to our funds. Decentralized exchanges such as Ether Delta are slow, expensive and inoperable as everything happens on-chain. Ox Protocol leverages strengths of both centralized and decentralized exchanges by helping in exchanging tokens in a decentralized way without putting the assets at risk. A quick summary of the pros and cons is right below.

Figure: 1- Comparison of Centralized, Decentralized exchanges and Decentralized Protocol

How does OX Protocol Work?

0x leverages Ethereum smart contracts and Relayers to exchange tokens

Below is a step by step explanation of how it works to process the orders

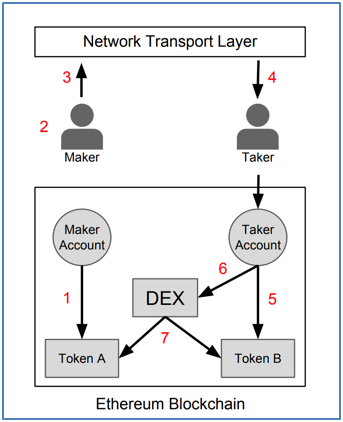

Figure 2: Steps for off-chain order relay & on-chain settlement. Gray rectangles and circles represent Ethereum smart contracts and accounts respectively. Arrows pointing to Ethereum smart-contracts represent function calls; arrows are directed from the caller to the callee. Smart-contracts can call functions within other smart-contracts. Arrows external to the Ethereum blockchain represent information flow

Maker approves the decentralized exchange (DEX) contract to get access to their balance of Token A.

Maker creates an order to exchange Token A for Token B, specifying the desired exchange rate, expiration time (beyond which the order cannot be filled), and signs the order with their private key.

Maker broadcasts the order over any arbitrary communication medium.

Taker intercepts the order and decides that they would like to fill it.

Taker approves the DEX contract to get access to their balance of Token B.

Taker submits the makers signed the order to the DEX contract.

The DEX contract authenticates the maker’s signature, verifies that the order has not expired or filled, and then transfers tokens between the two parties at the specified exchange rate.

Communication or information flow outside the Ethereum blockchain is going through the relayers. They are responsible for broadcasting orders through public or private order books. They bring liquidity to the network by hosting its order books, acting effectively as an exchange. Unlike an exchange, a relayer cannot execute a trade but only facilitate trading by presenting maker orders broadcasted to the network. For a trade to be fully executed, a taker must fulfill the order by submitting the maker’s signature along with its own to the decentralize exchange’s smart contract. In compensation for facilitating this exchange, a relayer is paid a fee in ZRX for each transaction.

Additional features of OX are its ability to execute Broadcast orders, Point orders, maintain the token registry and provide decentralized governance.

• Broadcast Orders: When trades are processed through a relayer, they are known as Broadcast Orders. Broadcast orders allow anyone to submit an order to the network, and in turn, they also allow for anyone to intercept these orders and fill them.

• Point to Point orders: 0x can also accommodate Point-to-Point Orders which are orders transmitted by makers with a specific taker in mind. These orders allow two users to directly transfer funds through a variety of messaging mediums, including email, Facebook messenger, and more. When a maker address sends an order relay this way, only the specified taker address can fulfill it, protecting funds from being hijacked by malicious third parties

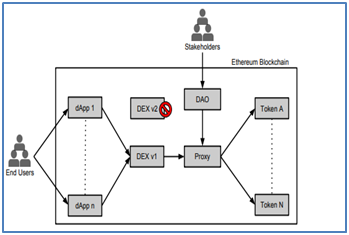

• Decentralized Governance: Protocol tokens can use to drive a decentralized update mechanism that allows for the continuous integration of updates into the protocol while protecting the users and stakeholders. In order to update the protocol, one needs to deploy new smart contract which forks the network and get opt-in from the existing user and process. Once it happens, it will invalidate all the existing orders on the exchange. Protocol tokens will have two uses 1) for market participants to pay transaction fees to Relayers and 2) for decentralized governance over updates to the protocol

Figure:3 Governance through Ox Protocol

Ox protocol is application agnostic, and its smart contracts are open sourced and publically accessible. This allows any development team to build on 0x if they need an exchange function for their token or platform. Its application agnosticism and shared protocol layer also allow for dApp interoperability, creating a “shared infrastructure for a variety of applications

• Token Registry: Lastly, 0x is using Token Registry contract which stores a list of ERC20 tokens with associated metadata for each token: name, symbol, contract address and the number of decimal places needed to represent a token’s smallest unit (needed to determine exchange rates). The registry will serve as an official on-chain reference that may be used by market participants to independently verify token addresses and exchange rates before executing a trade. 0x stakeholders will be responsible for governing this information by adding, changing, and removing data when needed

Who are the people behind Ox Protocol?

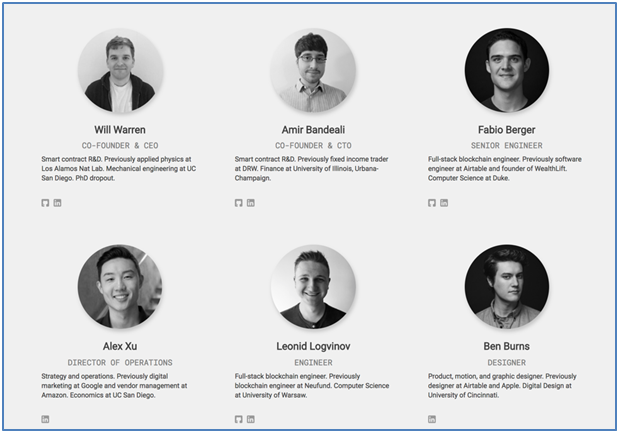

The 0x team comprises of real people with a visionary thought process. It consists of engineering, research, business and design experts who are passionate about decentralized technologies. Some of the representative members of their team are

Figure:4 Team members of Ox Protocol

What is the commercial standpoint?

0x protocol had its ICO last year in August and went live in December 2017. In the ICO, they sold 50% of their fixed coin supply which is 1 billion ZRX tokens at a price of $0.048.They raised $24 million in the ICO successfully.

According to CoinMarketCap, the current circulating supply of ZRX is 537 Million which provides it a market capitalization of $562 million at a current price of $1.05 (at the time of writing this article). It is forecasted to have a $5 billion market cap by end of 2018 which will be 10 times growth in its existing market capitalization. It has already been showing momentum since last few months and is ranked at 23 positions in CoinMarketCap.

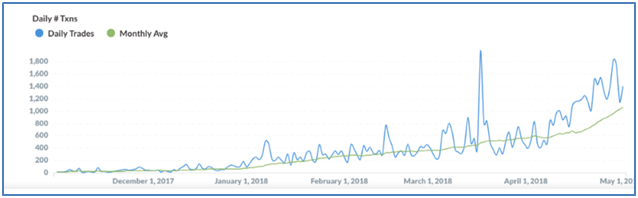

The increasing awareness of decentralized exchanges and sound projects like Augur, Ethfinex using the Ox protocol will be the key drivers for Ox adoption and below chart which was published in one of their blogs confirms it.

Figure:5 Growing trades per day for Ox Protocol

Where can you buy Ox Protocol token (ZRX) and where can you store them?

There are many centralized as well as decentralized exchanges selling ZRX tokens. Here are some of the exchanges where you can buy ZRX tokens:

• Binance: Supported pairs are ZRX/BTC, ZRX/ETH

• Bittrex: Supported pairs are ZRX/BTC, ZRX/ETH

• Livecoin: Supported pairs are ZRX/BTC, ZRX/ETH, ZRX/USD

• Gate.io: Supported pairs are ZRX/BTC, ZRX/ETH

• Ethfinex: Supported pairs ZRX/BTC

• IDEX: Supported pairs are ZRX/ETH

• Cobinhood: Supported pairs are ZRX/BTC, ZRX/ETH

One can store ZRX token in below-mentioned wallets.

• Mobile Wallets: Coinomi (Android), Jaxx (Android, iOS)

• Browser/Web Wallets: Meta Mask browser extension, Jaxx (Chrome Extension)

• Desktop Wallets: Jaxx (Windows, Linux, Mac), MyEtherWallet

• Hardware Wallet: Ledger Nano S, Trezor

What can be expected from Ox Protocol in future?

OX team continuously posts its developmental updates in their blog. As per their recent update, the team has released it Version2 of the protocol with following updates

• Support to ERC-721 tokens along with ERC-20 tokens: The new version allows to trade Ethmoji, Fan Bits, CryptoKitties, LAND, or any other unique, collectible assets using 0x. This new modular architecture will be flexible for the addition of new type of tokens without being needed to modify smart contracts and force developers and users to upgrade

• Supporting new signature types: Ox Protocol team has written a protocol for hashing structured data and make things easy for the user. The new protocol is supporting new signature schemes like EIP-72 and Trezor which allow users to define their own verification functions within smart contracts.

• Atomic order matching and Batch settlement: Orders can be atomically matched and filled together without needing capital other than ETH to cover gas costs. This greatly lowers the barrier to arbitrage trading and order matching

• Forwarding Contract: With the forwarding contract, users can simply send ETH and the orders they want to fill, and the forwarding contract will wrap the ETH and fill the orders in one single transaction, eliminating the need for WETH for takers

The team is constantly working to improve its protocol and its user interface to make things easy for the users. It is also active in being part of conferences, sponsoring conferences, conducting hackathons and workshops which is creating a buzz for the project.

Final thoughts:

0x is trying to capitalize on the strengths of both centralized and decentralized exchanges while leaving their weaknesses behind. The on-chain transaction settlements and off chain order relays helps users to trade in a decentralized way fastly without compromising the security of their funds. Centralized exchanges have been hacked multiple times which acted as a deterrent for new users to enter the crypto space but Ox protocol can bolster the confidence and get new users in the crypto world due to its unique mechanism of action. Moreover, Its adoption has grown and there are many solid projects which are using its protocol which will increase the usage of the ZRX token.

If you liked the content, don't forget to upvote and Resteem it.

Disclaimer: This is only my opinion and should not be construed as an advice or recommendation to either buy or sell anything. It's only meant for use as informative purpose.

Congratulations @deepakcrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!