Blockchain Politics

The elections in Europe over the last few weeks got me thinking – if Bitcoin was a country, what would its democratic system look like?

If Bitcoin was a country then I think the development teams, Bitcoin Core and Bitcoin Unlimited, would be the political parties. Like political parties who are responsible for the maintenance and development of a country, the development teams are responsible for the maintenance and development of the Bitcoin network.

So, who elects these parties? If we are fortunate enough to live in a democratic society then ‘we the people’ elect those who we want to be in charge of our country. However, in Bitcoin it seems the development teams are instead elected by the Bitcoin companies, such as wallet providers or exchanges (https://coin.dance/poli), and mining pools that signal their support (https://coin.dance/blocks). Whilst I’m sure lots of Bitcoin mining pools and companies hope to make a positive change in the world, serving the Bitcoin community for the greater good, the main reason they exist is to make money. Most are backed by venture capitalists that want to see a return on their investment. Their ultimate goal is to make more money – from the Bitcoin users.

If I lived in a country where the political parties were elected only by large companies and wealthy investors would I by happy with that? Probably not! Everyone deserves the right to vote.

While I do believe the Bitcoin development teams have the interests of the users at heart, the users still don’t have a say, and they don’t get to vote for what changes they want to see implemented on the network. I think Bitcoin is amazing, it always will be. And I have no doubt its technology will benefit billions around the world for generations to come. But like other technology it is not without its flaws. Currently governance is one of them.

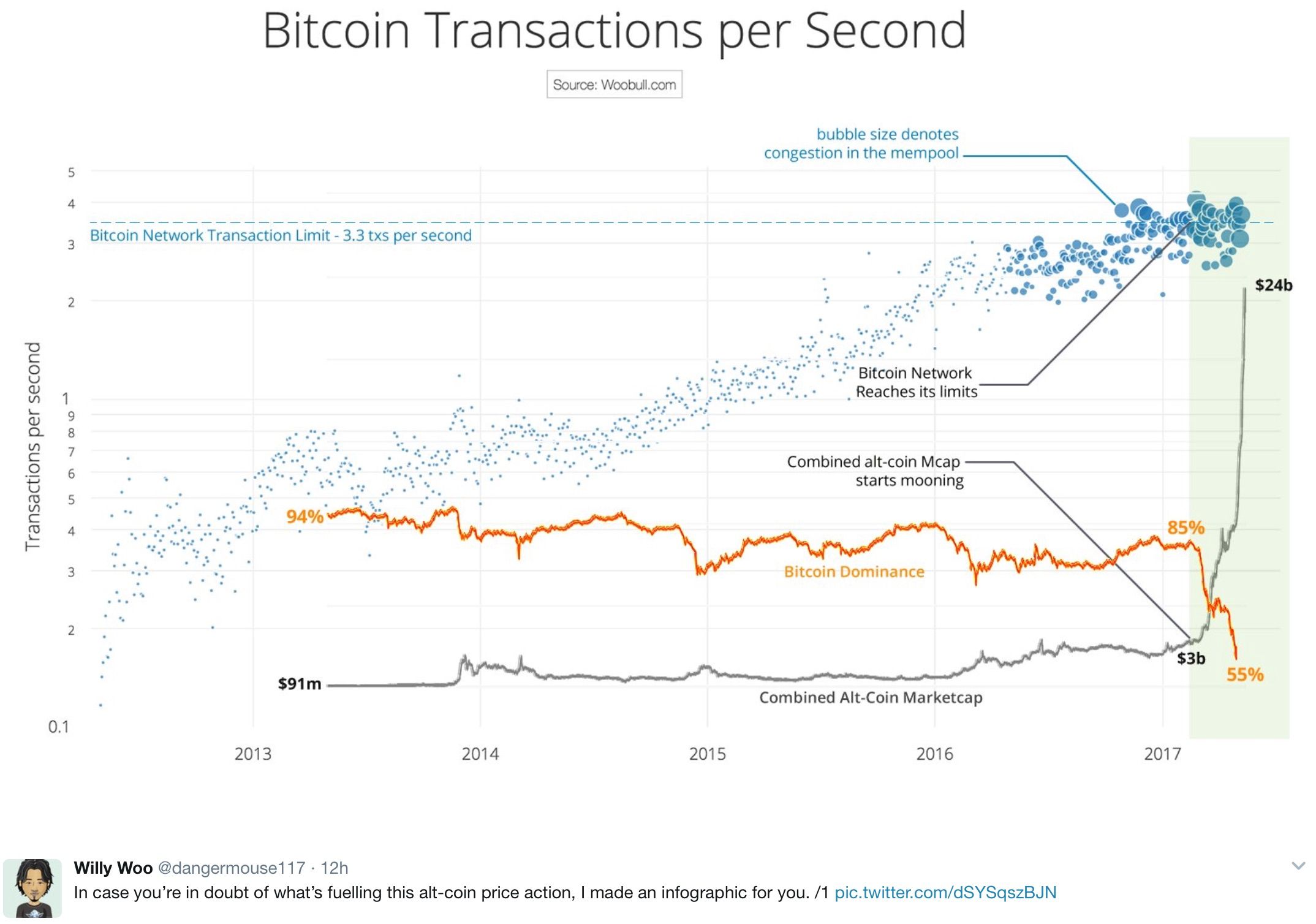

It makes me sad to see the recent fighting between development teams and miners. Because they cannot agree on a way forward to scale Bitcoin, the network is in danger of being outgrown by its user base. An infographic from Willy Woo (@dangermouse117) shows how the Bitcoin network has reached its transaction per second limit, and as a result the number of transactions waiting to be confirmed is steadily increasing. This week the total number of transactions waiting to be confirmed has reached an all time high of 162,790 (https://blockchain.info/charts/mempool-count?timespan=1week). If the number of Bitcoin users and number of transactions continue to grow then I can only see this problem getting worse. Unfortunately I don’t think SegWit is going to happen any time soon (http://segwit.co). A decentralized blockchain needs decentralized governance.

Decred is the first blockchain to implement an on-chain voting system that set out to solve this issue. This is key in giving the Decred holders a voice. Its unique proof-of-work (POW) proof-of-stake (POS) governance structure also makes sure the miners cannot take control of the network.

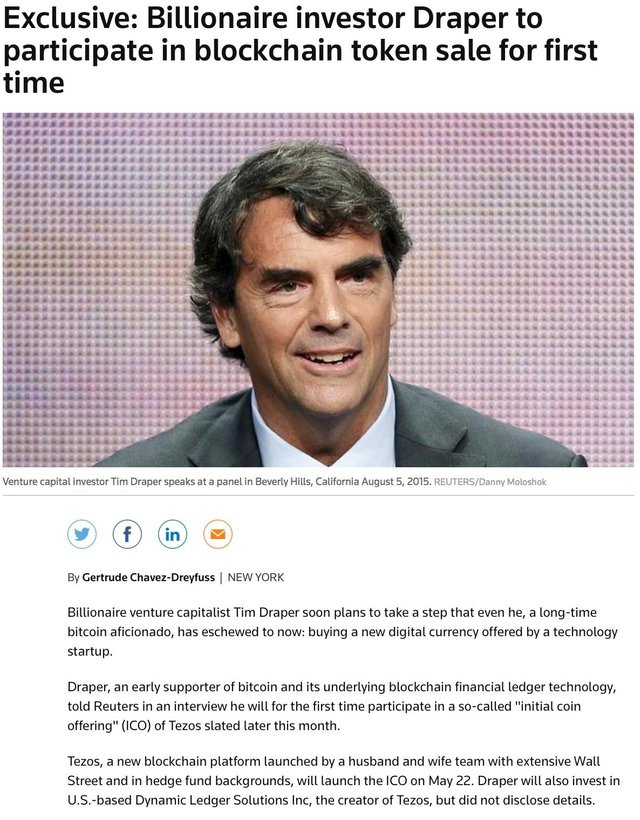

Lately I’ve been hearing a lot of talk about another blockchain, Tezos, that is having an ICO (or TGE – Token Generation Event) on May 22nd. Following Decreds lead, Tezos is also attempting to implement a governance system and an on-chain voting mechanism. However, I was a little concerned after reading the below article about the ICO. It gave me the impression that Tezos is created by the wealthy, backed by the wealthy, and apparently, will be bought by the wealthy.

After reading he above article I thought I would do some more research into Tezos and its ‘governance system’, maybe I had drawn the wrong conclusion from the article. So I started by reading the Tezos overview document – I was surprised.

The document reveals that Digital Ledger Solutions (DLS), the company co-founded by ex bankers Kathleen and Arthur Breitman (the creators of Tezos) “sold tokens at a discount to ten entities from September 2016 through March 2017. Three of these entities were hedge funds with a specific focus on tokens. The other seven purchasers were high net-worth individuals, or federations there of, many of whom were also LPs of the hedge funds. Total proceeds of these sales came to $612,000 at an average discount of 31.48% over the TGE rate for a total of $893,200.77 in outstanding obligations”. Not to worry though, the document also states “No single purchaser represented more than 33% of the total amount”… And, the three hedge funds that have “a specific focus on tokens” only account for 42% of the overall funds raised from backers”…

Yes you read that right. These early backers will be allocated $893,200.77 worth of tokens at a 31.48% discount. In fact, it seems that before we even get to a crowdsale, where Billionaires are ready to swoop in, we already have a collection of high-net worth indivduals and hedge funds that have obtained a significant proportion of the tokens, and therefore voting rights! But don’t take my word for it. Do your own due diligence and read the Tezos overview document for yourself (https://www.tezos.com/static/papers/Tezos_Overview.pdf)

Whilst Tezos recognizes that “challenges around governance and maintenance often lead to stagnation, shortages, and political deadlock” and that “in the case of pioneers like Bitcoin and Ethereum, those challenges have manifested themselves in situations that put too much power in the hands of core development teams or miners”, they apparently do not seem to recognize the voting power they may be placing in the hands of the wealthy few.

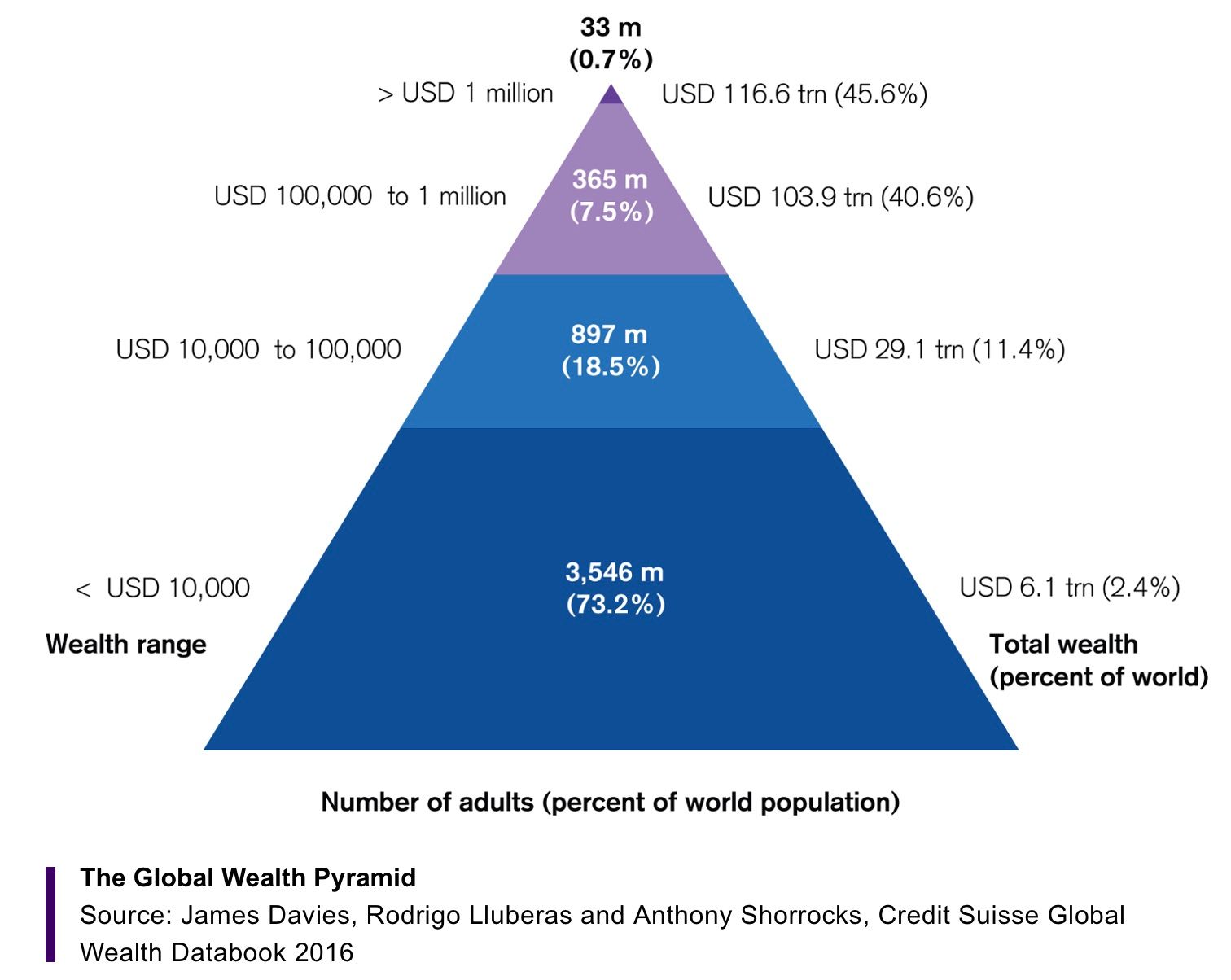

In my opinion, for this reason an ICO is not suitable for launching a blockchain with decentralized governance. With the uneven distribution of wealth across the world an ICO risks immediately handing over control of the network to the wealthy. According to the below chart, approximately 45.6% of global wealth is held by only 0.7% of the population. I’m not sure how a blockchain governance system would work if say, over 45.6% of the tokens were held by a few wealthy individuals? Admittedly this is not the case yet, but with an uncapped ICO and billionaires like Draper chomping at the bit, it is possible.

I continued reading the overview document and my attention was brought to Tezos’ POS consensus algorithm. I was surprised – again.

Tezos has a delegated POS consensus algorithm where stakeholders create new tokens by validating transactions. Whilst every token holder can participate as a delegate regardless of the amount they hold, the overview document states that “the higher the stake delegated to a given validator, the more often they will be called upon to create blocks”. From what I understand, this means that those investing larger amounts in the ICO would be at a distinct advantage over those investing smaller amounts. If larger investors (such as high-net worth individuals or hedge funds) participate as a delegate, then they would therefore be called on more often to validate blocks over a smaller investor. This would give them a higher profitability ratio when staking, and therefore greater return per asset (token) held. If I am reading this right it seems with Tezos the powerful become even more powerful and the wealthy become even wealthier.

In my opinion, if you believe blockchains need a decentralized governance system, and want your vote to count, then you might want to consider investing in Decred instead.

In contrast, Decred offers everyone who buys a ticket the same ratio of reward for staking (currently around 3-4% interest a month), regardless of wealth. Furthermore, the cost of a single ticket can be pooled amongst a group of individuals, with the rewards shared equally. This ensures anyone can stake regardless of the amount of Decred coins they hold. Almost 40% of all Decred coins in existence are currently staked, which I believe is a sign of how much faith the community has in the Decred project. In addition, Decreds free air drop made certain that coins were distributed evenly to everyone who believed in Decred, irrespective of their wealth or position in society.

There is mention in the overview document that Tezos have decided to hold an un-capped ICO, like Ethereum did, to allow as many people as possible the opportunity to invest and “promote a widespread distribution of tokens”. However, while an un-capped ICO might of worked back in the day for Ethereum, when funds raised in ICOs came from mostly smaller ‘innovator phase’ investors, we are now probably in an ‘early adoption phase’ of blockchain technology. As a result much larger investors are purchasing millions of dollars worth of coins, snapping up large proportions of the total coins on offer in crowdsales. What worked in 2014 for Ethereum, a blockchain where decisions are made centrally by The Ethereum Foundation, might not be best for Tezos, who hope to have a blockchain with a decentralized governance system. My guess is that the average investor in the Tezos ICO will end up being a small fish in a very large ocean filled mostly with whales.

While I have no doubt that Decred does not have the perfect governance system in place yet – it did get things right from the start. For a blockchain with on-chain voting as part of its governance system this matters, for obvious reasons. And now the beauty of this means that Decred holders can vote to make its governance system even better!

To put things into some context: Decred launched with a free air drop of coins to a community that believe in the decentralized future of finance. Tezos is launching with a majority backing from hedge funds and seven high-net worth individuals. You decide which has the best decentralized governance system.

Decred is the first cryptocurrency to decentralize and distribute power to its holders and users, and the first that has taken steps to enshrine the values of democracy into its blockchain. In my opinion Decred is still the only real governance blockchain around. Decred is a blockchain with a government “of the people, by the people, for the people”.

M. K.

This blog is based on my opinion only and therefore may not represent the views and opinions of the Decred development team, or the wider Decred community.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://thedecreddigest.com/2017/05/12/blockchain-politics/