Introducing Phantom Dao.

Hi every fella on steam-it. today ‘s topic is phantom DAO. As you see, a lot of new DeFies launches in these days. we gonna find out DeFi 2.0 today

What is DeFi 2.0?

DeFi 1.0 provides liquidity and earns interest. DeFi users can use DeFi farms or pools

DeFi operators entrust tokens (coins) corresponding to the various token lists in. Based on these, they generate revenue through DEX, AMM, etc. However depositors have no choice but to sell native token(here in after NT) because they have to sell them to cash in interest, and as the price of NT inevitably falls, the interest rate promised at the beginning gradually decreases. In the end, most DeFi 1.0 failed to recover the assets entrusted to it. Eventually, the key to the success of DeFi is how to stop the downward pressure on the price of NT, in other words, the selling pressure.

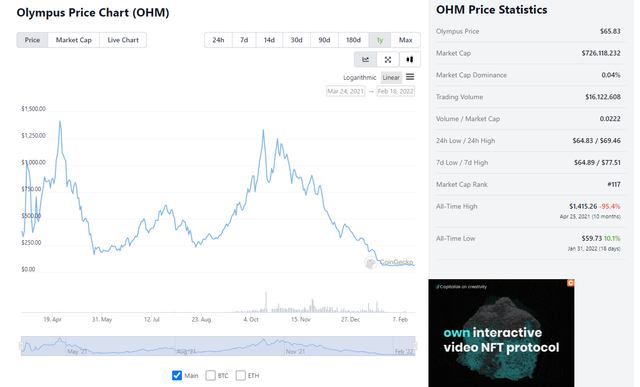

There have been several attempts to stop the pressure to sell NT, and the most successful of them is Olympus Dao, which is said to be the beginning of DeFi 2.0. After Olympus Dao, a number of DeFi, so-called Ohm Fork Coin were emerged, and DeFi 2.0 settled itself as a major wave of DeFi.

To explain DeFi 2.0 more simply, There is a well-organized article about Olympus Dao, the beginning of DeFi 2.0, so if you are interested, please check it out.

https://medium.com/sherpa-library/understanding-olympusdao-in-early-autumn-2021-62fb64fd53fe

If you are new here, it may sounds a bit difficult, but those who ready know even a little bit of DeFi will understand this well enough..

There are two strategies that DeFi 2.0 offers to keep the coin price from falling.

1.Huge interest rates

At the beginning of the launch, even 10 quadrilion % of the cases come out. The interest rate decreases over time naturally, but in case of Olympus Dao, that has been released for almost a year, it exceeds 800% (APY basis), and which cannot be found in a typical DeFi 1.0.

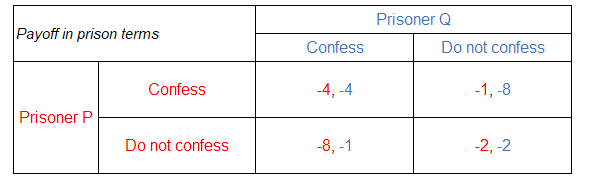

2.3.3 Strategy

Every DeFi 2.0's takes the 3.3 strategy.

https://xplaind.com/472079/prisoners-dilemma

In Prisoner's Dilemma, prisoners must use strategies 3.3 to work together to maximize their profits. At DeFi, the depositors have to do not sell tokens, but stake long-term together, in order to maximize profits together with the effect of compound interest. The question is, what is the incentive for compounding, which is the ridiculously high interest rate mentioned earlier. There are many complications, but DeFi 2.0 generally boasts significantly higher interest rates than DeFi 1.0. And in order to maximize the effect of the interest rate,

Investing in compound interest over a long period of time is key. If so, DeFi 2.0 is unconditionally profitable? The bottom line is that early investors have great returns, but otherwise, most of them have lost money. The reason is that the price of NT price is also falling.

So, the core of DeFi 2.0 is the initial investment, and the core of the initial investment is the whitelist.

Do whitelists really matter?

klaytn's Kronos Dao daily chart (pumping from $80 to $3200 initially)

BSC's Wisteria Swap (pumping from $40 to $1300 )

The initial token pumping provides a margin of safety, so you can invest in DeFi 2.0 in a stable and long-term. In my case, when I invest in DeFi 2.0, I use the strategy of recovering the principal from the initial pumping and staking the rest for the long term to enjoy the compounding effect.

So, what kind of DeFi 2.0 is a viable whitelist opportunity?

There are several projects, but among them, I would like to introduce Phantom Dao today.

Reasons to invest in Phantom Dao

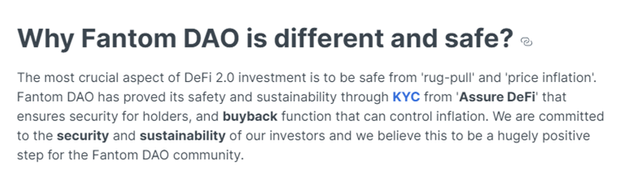

1.Safety from Rug Pull

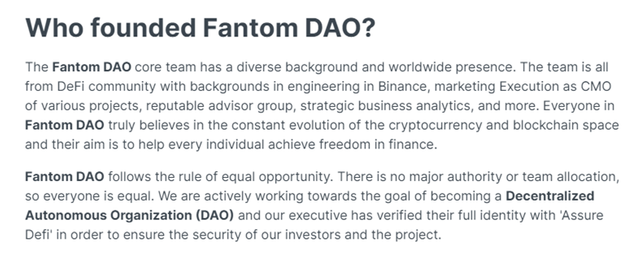

Phantom Dao has received KYC certification from assure DeFi. In general, DeFi

are mostly anonymous operators. Being KYC-verified means that their identity has been verified by a trusted third-party organization.

Revealing their identity is accepted in the crypto world as a sign of a promise not to do rug pulls.

2.Various token price decline defense models

Buyback function

The attached photo is an excerpt from the homepage of Phantom Dao, and among their differences, they say KYC and buyback as the most prominent differences. This is the part where you can read the will to buy back.Combine with NFT

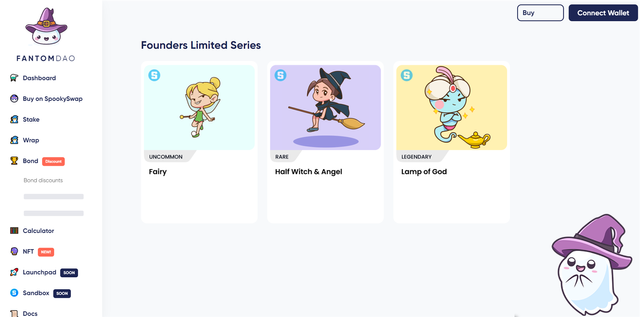

The key of DeFi 2.0 is preventing token price declines . There is a limit to blocking the token price only with a simple buyback. To protect the token price from falling or to increase the token price.

What matters is expectations. People who have the expectation that they will benefit from tokens when they hold tokens The token price does not decrease when they held it. Anticipation arises from expanding the use of tokens, and this use can be created in a variety of ways. But it's not easy.

It is directly related to the skills of the operator. So a lot of DeFi 2.0 fails. Phantom dao token

Create an NFT as a place of use and present it in the form of P2E in the sandbox, the world's largest platform for metaverse. As this is a factor that can instill anticipation in token holders, it is positive for token price defense.

It is stable

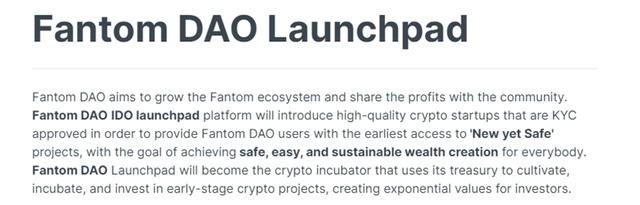

- Launchpad

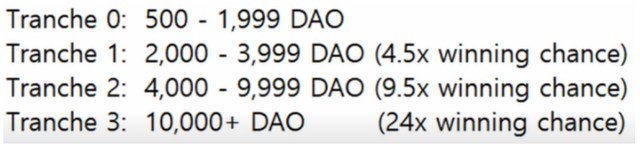

DAO MAKER’s token distribution table listed on Bithumb recently (If you own 10,000 or more, there is a 24x chance Meaning that you can get new coin / Meaning that the more Dao you have, the better)

- Reliable management team

Of course, it is a premise that all of the above plans are being carried out, but the management team will implement all of the above plans. Being humble isn't easy. These are things that one would not dare to think of without a clear passion and skill to grow the project. In the coin world, there are many projects that are just words. The Phantom Dao could also be just a word. But if

it were just a word, the management wouldn't have to accept KYC.

In a coin world full of scams and lies, entering the world of DeFi armed with new attempts and plans, Just by revealing the identities of the operator and casting their votes, you can feel the passion and sincerity of these executives.

3.Phantom Dao White List

Whitelist events - 300 addresses

- Discord, Telegram activity: 50 addresse

- Social media promotions: 200 addresses

- Giveaway (through Gleam.io.): 30 addresses

- Meme Contest: 10 addresses

schedule

Until February 20: Participation period for whitelist selection February 21: IDO Whitelist Selection

February 22 - 23: Whitelisted IDOs February 23: Public IDO

February 24: Claims of $MAGIC Tokens

The above schedule is based on UTC

In addition, you can receive Founder OG rolls and NFTs through Discord activities, etc.

4.Will participating in the whitelist really make money?

Initial Circulation Supply: 60,500 $MAGIC

Whitelist IDO: 22,500 $MAGIC Public IDO: 22,000 $MAGIC

Initial Liquidity: 16,000 $MAGIC

One of the most important things to predict token price is market cap. Whitelist sale price of magic tokens is $20 and the public sale price is $25, it is correct to predict the initial market capitalization of (22,50020)+(22,00025)+(16,000*20). If you do the math, $1.32 million is the initial market cap.

The initial market cap is about $1.32 million. Wouldn't it make sense to pump? If the initial market cap is small, even a small buying trend will cause pumping.

Looking at other DeFi 2.0 coins for comparison

OHM's market cap is $772.6 million. That's about 920 billion won. Of course, OHM is a very old coin and a recognized coin.

Although it is a very old coin and a recognized coin.

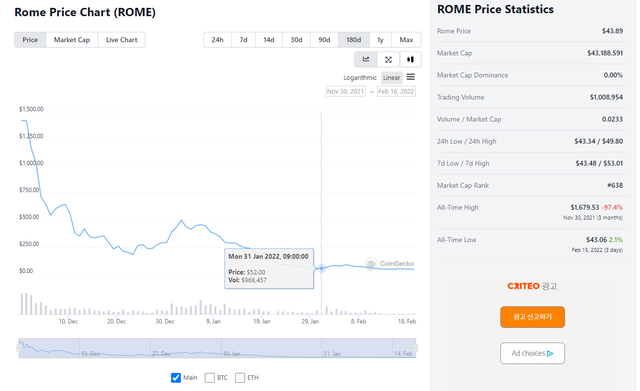

The market cap of ROME tokens, which was launched two months ago, is $42.84 million. 514 billion. How

about you? Are you feeling it? The initial market cap of $1.32 million is a very small amount. That said, it is very easy to pump. Previously, in order to make a successful investment in DeFi 2.0.

I mentioned that an approaching through the whitelist is very important.

If you look at Phantom Dao's Discord, the number of participants is approaching 13,000. Even if only a few of these are invested, the price of the MAGIC token will rise tremendously.

Phantom Dao is just the beginning. Wishing you all DYOR and successful investment.