African Holding Company VP Urges Central Bank to Buy Bitcoin and Ditch Dollar

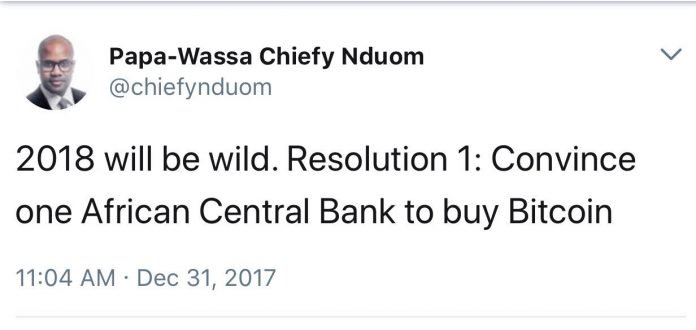

Concerned about the US dollar’s predicted drop in value, and many African countries relying on USD cash reserves, vice president of Groupe Nduom, a leading financial holding company, Papa-Wassa Chiefy Nduom, has taken to Linkedin and Twitter to make the case for less reliance on greenbacks and more investment in bitcoin.

Unnecessarily Prolonging Gut-Wrenching Human Suffering on the African Continent

“What if this continent could finally build consensus around a new digital reserve asset – and figure out ways to fund infrastructure development by leveraging it,” Mr. Nduom asks via his Linkedin account. He’s “concerned about the US Dollar. The experts say it’s going down” this year especially, he fears. It’s of particular worry for Africa due to the reliance many nations have on US currency, and a crash of the predicted double-digit magnitude could lead to “unnecessarily prolonging gut-wrenching human suffering on the African Continent” if action isn’t taken, and soon.

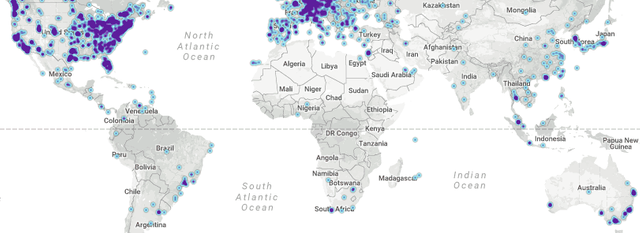

The alternative Mr. Nduom advocates is for more investment in bitcoin. Placing himself in context, he notes “I am a lawyer / member of a family business group / small time investor. My only interest in this particular bombastic argument is a kind of black globalist fomo (fear of missing out),” he writes. Referring to a map (see inset) “Bitcoin nodes are all over the world but Africa is a very conspicuous dark spot. Africa keeps getting left behind,” he urges.

Much more than a mere speculative instrument, Mr. Nduom views bitcoin as a chance for Africa to almost be borderless like the currency, building a less arbitrary group of political units, something Ghana’s independence leader referred to as “United States of Africa.” Bitcoin might also be a hedge against endemic government corruption, the sort he claims could easily steal fiat reserves. “That’s not so easy with reserves on a public blockchain that has never gone down and has the data being broadcast for free on a network of satellites,” he writes.

“Citizens can put alerts on the address,” he argues, “and definitively off limits to political sticky fingers. And eventually you can borrow against them to build things these countries desperately need.”

Tired of Begging

In a recent interview with Modern Ghana he’s said to have asked Ghana’s central bank to risk one percent of its reserves on bitcoin. “On the investment case, for a central bank, especially for a country that needs to come up with solutions, we need more funding for investments and my view is, by making that investment and by signalling that it’s an enabling environment for investments,” he stressed. “For example, if the exchange is domiciled in Ghana trades in the digital currency will not be subject to tax or capital gains but will tax the profit that the exchange is made. That could result in massive inflows of foreign currencies to Ghana.”

He limited his research to 13 African nations, English speaking mostly, and found rebalancing away from over-dependence on the dollar and more in cryptocurrencies could be very much worth the gamble. If response is any indication, his Tweets to this effect have gone viral with over 70K likes thus far.

“I will be looking for the first African Central Banker who says – I’m tired of putting my hat in my hand and begging – let’s take some risk and dig into this new global, permission-less, robust and extensible financial ecosystem. Everything we need to learn is for free on the internet,” he wrote.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/african-holding-company-vp-urges-central-bank-to-buy-bitcoin-and-ditch-dollar/