Storm on Bitcoin: Does Goldman Sachs really abandon it?

The announcement of the suspension of the future Bitcoin trading office of Goldman Sachs led to a sharp drop in prices. The US merchant bank nevertheless retains many interests in the sector.

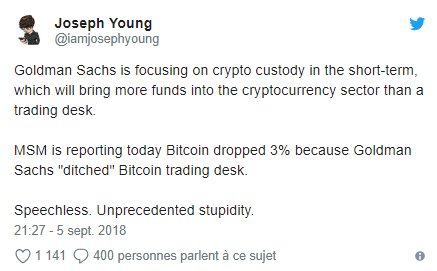

An ad ... and patterns! On Wednesday, September 5, Business Insider reported that Goldman Sachs was abandoning "the short-term" launch of its bitcoin trading office. According to the US website, it is because of the lack of regulation that the merchant bank suspends its project. This new department was announced in the press in December 2017, at the height of the excitement around Bitcoin. Last May, the New York Times had questioned the officials of this cell that should have started this summer ... but they will gnaw still little. As a result, Bitcoin prices fell by more than 12%, sometimes reaching highs on other cryptocurrencies (-20% on Ethereum). On some specialized media, one can read "Goldman Sachs would no longer believe in cryptocurrency".

Although the investment bank's announcement is not favorable news for the sector, Goldman Sachs continues to advance its marbles in activities fewer media than trading. In particular, she recalled Wednesday that she continued to offer Bitcoin futures, which allow speculating on the future of the courses. Bloomberg also announced in early August that the Wall Street giant was studying a solution to keep bitcoins safe for its customers, one of the most complex tasks to perform. This point is fundamental: most experts consider that it is only once institutional investors no longer fear the flights that they choose to invest heavily. According to computer security company Carbon Black, more than a billion dollars in cryptocurrencies were stolen in the first half.

Goldman Sachs has also been a shareholder of Circle since 2015, one of the industry's most popular start-ups. It offers a solution to simplify the purchase of cryptocurrencies for the general public and last May acquired Poloniex, one of the largest US cryptocurrency trading platforms, for $ 400 million.

At the end of June, the new boss of the bank David Solomon (he will take office on 1 October) told Bloomberg : "We propose futures Bitcoin, mention the possibility of opening other activities in this sector, but we We are going very carefully. We listen to our customers and try to help them when they want to explore cryptocurrencies. "

Discover ZEYO , our cryptocurrency portal. Follow the courses of the main values and find all the news about bitcoin produced by Capital. You can also join our specialized Facebook discussion group by clicking on the banner below.

Also discover 21 MILLIONS , our monthly podcast that tells the story of Bitcoin and digital decentralization.