New Theory Behind Stalled Economy: Retirees Are Hoarding Too Much Cash

For years we've written about the fact that Americans, young to old, are lousy savers (see "Retirement Crisis Looms As Average U.S. Household Has Saved $2,500 For Retirement"). Of course, they have to be because how else can a mature economy continue to grow unless every single person levers every asset they own to the maximum extent possible and then spends all of that money? Anything less would mean that all of Janet Yellen's efforts have been a colossal waste. Meanwhile, this inherent inability to save is awful news for a nation that faces a massive wave of baby boomer retirements over the next 20 years.

All that said, we were somewhat shocked to come across a report from money manager United Income which effectively argues that American retirees are saving too much money rather than too little. To summarize the thesis, United Income argues that retirees become more conservative as they grow older which causes them to save more and allocate less to equities...which is, of course, a somewhat self-serving conclusion but nevermind that.

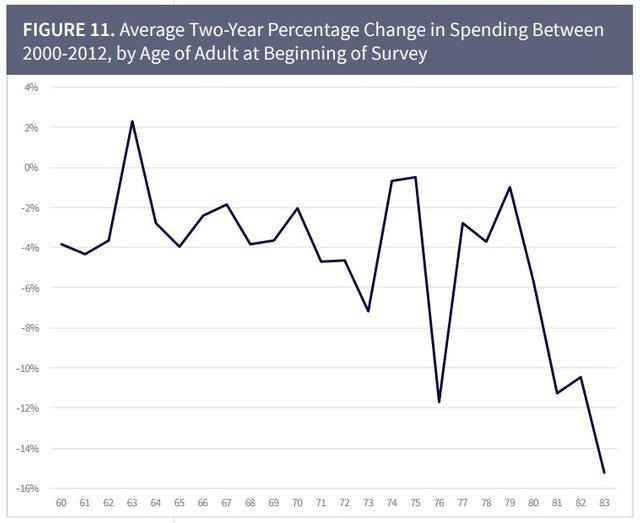

Innovations in medicine and technology have extended human life by over 30 years since 1900. This has helped to double the amount of time the average adult now spends in retirement compared to several decades ago. But, the benefits of longer lives and retirement may be limited if older households curb their consumption or investment in preventive health measures because they are overly pessimistic about their future financial health. Overly negative viewpoints toward the future may also create self-fulfilling economic problems if it leads to an overly aggressive fixed-income portfolio. To assess these possibilities, we analyze consumer sentiment and spending data from the University of Michigan that was commissioned by the Social Security Administration and U.S. Commerce Department, among other federal agencies.

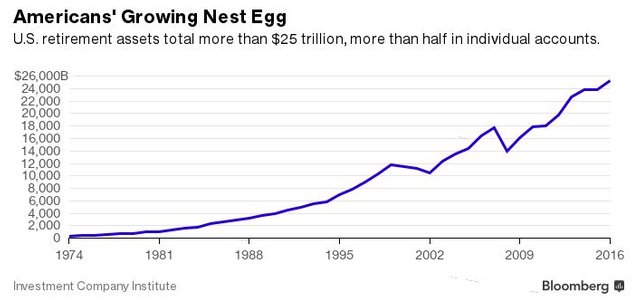

problem with the theory is that, intentional or otherwise, it's based on a complete misinterpretation of data. Per the chart below, United Income referenced the growth in "Mean Net Wealth" as evidence that retirees are hoarding too much cash.

Unfortunately, when combined with the fact that "Median Net Wealth" is actually shrinking, it's easy to deduce that while the majority of American retirees are actually spending their retirement income (and then some), there is a group of super wealthy old folks who simply can't spend enough money to offset annual investment income growth....which speaks more to the growing wealth gap than to some economic fear that is causing retirees to hoard cash

In this context, it's not too difficult to understand why aggregate YoY spending trends collapse as old folks get older. The most wealthy retirees can only find so many ways to burn their massive nest eggs which means that, at least for these folks, YoY spending doesn't grow but retirement balances do...

...while the overwhelming majority of people simply run out of cash and have to cut every corner possible to survive...

But we're sure the report from United Income, as misleading as it may be, will undoubtedly convince more retirees to allocate more money to equities...all of which will inflate this ETF-induced equity bubble even more, all while adding to United's fee income...It's one of those 'win-win' deals.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://austrian.economicblogs.org/zerohedge/2017/durden-theory-stalled-economy-retirees-hoarding/

Congratulations @jimmyelric! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!