Waiting for the IDX Composite to Bullish in the Political Year | Menunggu IHSG Melambung di Tahun Politik |

The political elites in Indonesia said that 2019 would be the hottest year because there were moments of general elections which were first held simultaneously for presidential and legislative elections. Previously, the legislative election was held before the presidential election.

Every time they face an election event, both local regional head elections and national legislative and presidential elections are always mentioned as crucial years. As if the election is a frightening and bloody political event. In fact, history has proven, elections with a new system in Indonesia which began in 2004, always take place in an orderly and safe manner so as to become an example for other countries. Many countries have conducted comparative studies with the Indonesian General Election Commission (KPU) to learn to hold elections safely and peacefully.

Riots did occur in several regions, the burning of the KPU office in the area occurred. However, the percentage is very small because it only occurs in one or two districts or cities which number reaches 400 in 34 provinces. The chaos did not seep and the police could handle it immediately. Although small, this includes homework that must be completed together.

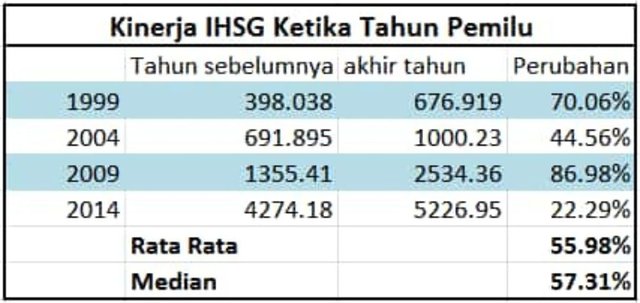

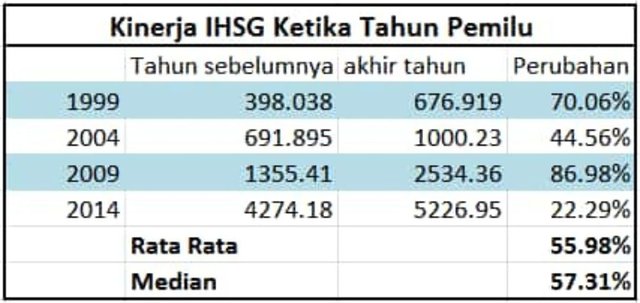

Many political and economic analysts mistakenly analyze. In the election year, since 1999, the economy has actually grown and stretched. The Composite Stock Price Index (IDX) has always risen in the election year.

From the table above shows, the increase in the IDX Composite has been seen since the 1999 election, which was 70.06 percent. The highest increase occurred in the 2009 elections reaching 86.98 percent. The total increase since 1999 to the 2014 election was 55.98 percent. So, domestic and foreign investors need not worry about the upcoming 2019 election season.

Indonesian society has grown up in democracy. The elections in Indonesia, in contrast to elections in the South Asian country which are loaded with violence. The success of the election in a peaceful and safe manner has so far strengthened Indonesia as the third largest democratic country in the world.

From a number of reports that are the reference to stock investors in Indonesia, in 2019 the IDX Composite is expected to rise. Inarno Djayadi, Managing Director of the Indonesia Stock Exchange (IDX) said that the democratic party next year was not the first experience for Indonesia. Because, the election of democracy in 2004, 2009 and 2014 was carried out.

Since the 2009 democratic party, capital market trading activities have not decreased. According to Inarno, the decline in the IDX Composite was due to global sentiment. "There are no decreases in the 2004, 2009 and 2014 elections. God willing, three elections that have been passed have no problems," he said in Jakarta.

Muhammad Nafan Aji, an analyst at Binaartha Sekuritas, said that as long as the government is able to maintain domestic political and security stability, a smooth national development process can be created. "So that this can drive national economic growth," says Nafan to Kontan.co.id, Sunday (09/23/2018). According to Nafan, the IDX Composite can survive at 6,117 levels. If it succeeds in quickly touching the level then the next level is 6.330.

According to Nafan, with the democratic party, the purchasing power of consumers will increase so that consumption sector stocks such as GGRM, ICBP, INDF are interesting to collect. Construction sector stocks such as WIKA, WSKT, WTON and WSBP can also be observed in light of the government's promises in infrastructure development. The telecommunications sector such as TLKM will be attractive because the legislative and executive elections will encourage increased internet traffic because social media will be used massively for political campaigns.

Nafan also said, BBCA, BMRI, BBNI, BBRI, BBTN banking shares were also interesting to observe. Similarly, shares in the mining and agricultural sectors deserve to be glanced along with the rising trend in world commodity prices, such as oil prices, CPO prices, nickel prices. Interesting stocks in this sector include AALI, BWPT, ANTM, INCO, ADRO, ITMG, DOID.

Recapital Sekuritas analyst Kiswoyo Adi Joe said that this momentum will be the movement of the IDX Composite over the next year. One of them who will enjoy because there are a lot of extraordinary activities, it costs a lot, starting from printing posters, banners, banners, uniforms, and not to mention food and other activities. Because of that money will rotate a lot in the community below. The positive effect on the Indonesian stock market. There are shares in the consumer sector and the media that will be positively affected directly," says Kiswoyo.

So, this is a good opportunity for investors to save shares in Indonesia to get profit in the first half of 2019.[]

Menunggu IHSG Melambung di Tahun Politik

Banyak elit politik di Indonesia menyebutkan 2019 mendatang adalah tahun paling panas karena ada momen pemilihan umum yang pertama kali dilaksanakan secara serentak untuk pemilu presiden dan pemilu legislatif. Sebelumnya, pemilu legislatif dilaksanakan terlebih dahulu baru disusul pemilu presiden.

Setiap menghadapi even pemilu, baik pemilihan kepala daerah yang bersifat lokal maupun pemilu legislatif dan presiden yang bersifat nasional, selalu disebutkan tahun krusial. Seolah pemilu meerupakan even politik yang menakutkan dan berdarah-darah. Padahal, sejarah sudah membuktikan, pemilu dengan sistem baru di Indonesia yang dimulai sejak 2004, selalu belangsung dengan tertib dan aman sehingga menjadi contoh bagi negara lain. banyak negara yang melakukan studi banding ke Komisi Pemilihan Umum (KPU) Indonesia untuk belajar menyelenggarakan pemilu dengan aman dan damai.

Kericuhan memang terjadi di beberapa daerah, aksi bakar kantor KPU di daerah terjadi. Namun, persentasenya sangat kecil karena hanya terjadi di satu atau dua kabupaten atau kota yang jumlahnya mencapai 400-an di 34 provinsi. Kericuhan itu pun tidak merembes dan bisa ditangani kepolisian dengan segera. Meski kecil, ini pun termasuk pekerjaan rumah yang harus diselesaikan bersama.

Banyak analis politik dan ekonomi keliru dalam menganalisa. Di tahun pemilu, sejak 1999, ekonomi justru tumbuh dan menggeliat. Indeks Harga Saham Gabungan (IHSG) selalu naik pada tahun pemilu.

Dari tabel di atas terlihat, kenaikan IHSG sudah terlihat sejak pemilu 1999 yakni sebessar 70,06 persen. Kenaikan tertinggi terjadi pada pemilu 2009 mencapai 86,98 persen. Total kenaikan sejak 1999 sampai pemilu 2014 sebesar 55,98 persen. Jadi, para investor dalam dan luar negeri tidak perlu cemas dengan musim pemilu pada 2019 mendatang.

Masyarakat Indonesia sudah dewasa dalam berdemokrasi. Pemilu di Indonesia, berbeda dengan pemilu di negara Asian Selatan yang sarat dengan kekerasan. Keberhasilan pemilu secara damai dan aman sejauh ini kian menguatkan Indonesia sebagai negara demokratis terbesar ketiga di dunia.

Dari sejumlah pemberitaan yang menjadi referensi investor saham di Indonesia, pada 2019 IHSG diperkirakan akan naik. Inarno Djayadi, Direktur Utama Bursa Efek Indonesia (BEI) mengatakan, pesta demokrasi tahun depan bukan menjadi pengalaman pertama bagi Indonesia. Sebab, pemilihan demokrasi pada 2004, 2009 dan 2014 telah dilakukan.

Sejak pesta demokrasi 2009, aktivitas perdagangan pasar modal tidak mengalami penurunan. Menurut Inarno, penurunan indeks harga saham gabungan (IHSG) karena ada sentimen global. "Pemilu 2004, 2009 dan 2014 enggak ada penurunan. Insya Allah tiga pemilu yang sudah dilewati enggak ada masalah," ungkapnya di Jakarta.

Muhammad Nafan Aji, analis Binaartha Sekuritas mengatakan, selama pemerintah mampu menjaga stabilitas politik dan keamanan dalam negeri, maka kelancaran proses pembangunan nasional dapat tercipta.

"Sehingga hal ini mampu mendorong pertumbuhan ekonomi nasional." Kata Nafan kepada Kontan.co.id, Minggu (23/9/2018). Menurut Nafan, Indeks Harga Saham Gabungan (IHSG) bisa mampu bertahan di level 6.117. Jika berhasil cepat menyentuh level tersebut maka level berikutnya adalah 6.330.

Menurut Nafan, pesta demokrasi 2019 membuat daya beli konsumen akan meningkat sehingga saham-saham sektor konsumsi seperti GGRM, ICBP, INDF menarik untuk dikoleksi. Saham sektor konstruksi seperti WIKA, WSKT, ,WTON dan WSBP juga bisa dicermati mengingat realisasi janji pemerintah dalam pembangunan infrastruktur. Sektor telekomunikasi seperti TLKM akan menarik lantaran pemilu legislatif dan eksekutif akan mendorong kenaikan trafik internet karena media sosial akan digunakan secara masif untuk kampanye politik.

Nafan juga bilang, saham sektor perbankan BBCA, BMRI, BBNI, BBRI, BBTN pun menarik untuk dicermati. Begitu pula saham sektor pertambangan serta agrikultur layak dilirik seiring tren kenaikan harga komoditas dunia, seperti harga minyak, harga CPO, harga nikel. Saham-saham sektor ini yang menarik dicermati antara lain AALI, BWPT, ANTM, INCO, ADRO, ITMG, DOID.

Analis Recapital Sekuritas Kiswoyo Adi Joe menilai momentum ini akan menjadi pergerak Indeks Harga Saham Gabungan (IHSG) sepanjang tahun depan. Salah satunya yang akan menikmati karena ada banyak kegiatan yang luar biasa, besar biayanya, mulai dari pencetakan poster, spanduk, umbul-umbul, kos seragam, dan belum lagi bagi sembako dan kegiatan lainnya. Karena itu uang akan banyak berputar di masyarakat bawah. Efek positifnya pada bursa saham Indonesia. Ada saham sektor konsumsi dan media yang akan terkena dampak positif secara langsung," kata Kiswoyo.

Jadi, ini menjadi kesempatan bagus bagi para investor untuk menabung saham di Indonesia untuk mendapatkan profit pada semester pertama 2019 mendatang.[]

Congratulations @ayijufridar,

Your post "Waiting for the IDX Composite to Soar in the Political Year | Menunggu IHSG Melambung di Tahun Politik |" hast just been Resteemed !!! 🙂🙂🙂

You have achived this service by following me.

😄😻😄 Be ENGASED to continue with this FREE Restreem service @tow-heed😄😻😄