Living Just In Time

Hey JessIndividuals

If you've followed my blog for some time now or scroll down my feed, you'll find several posts ranting about how inefficiency tour finances and economy is but it was all papered over by continued debt financing from the future and money printing. It "worked" according to those in power and who benefited from it working this way so why fix it?

Now that a significant wrench has been thrown into the gears of this fragile system, we see the wheels fall apart. The trade war between the US and China had already started to have far-reaching effects, and now with the pandemic of Covid-19 supply chains are drying up. For the US's consumer-based economy this is a real problem, this was the fuel propping up the farse, it was the sugar rush keeping the economy from crashing.

Now as the slow down begins the Russians and Saudis are seeing the chink in the US armour and going after their oil production markets in a bid to price them out, driving further harm to the worlds largest economy.

The problem with this to me is if you make a beggar out of your neighbour, soon you'll only be living around beggars, but that's a story for another post.

Living for the moment - It's just business

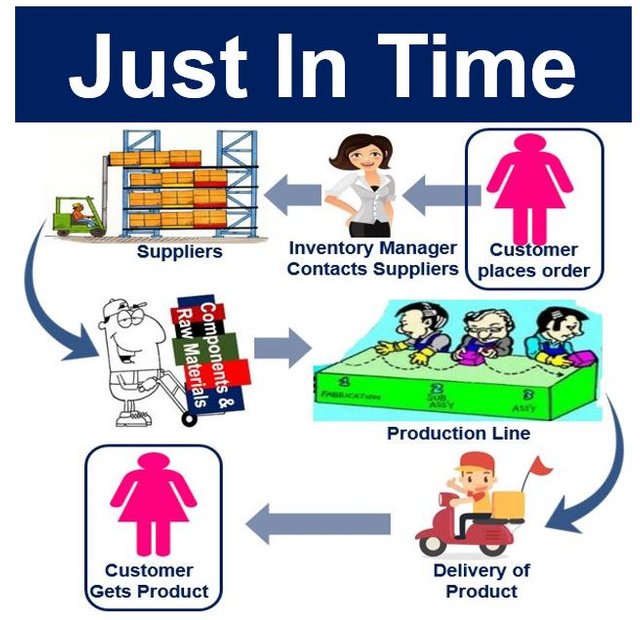

There are so many reasons why the global economy is so fragile and inefficient, but one of those reasons is due to an over-reliance on the just in time system. Businesses don't hold their means of production any longer many are only an administrative front, a shell company if you will that takes a fee and passes on to the next person in the supply chain until the consumer gets their goods.

Because things have been pretty stable, these companies got increasingly good at knowing how much to keep on hand and how much to order to supply their demand and maintain a level of profitability. This was never about efficiency or price discovery only about sustaining margins, it was a short term view of business, and this is where it's all going to go to hell with this disruption in service.

Businesses without cash on hand to hold themselves over until demand returns will see operating costs eat into what was once their moving capital and start to eat themselves to death. There will be a purge of SMEs, luxury brands, airlines, travel agents, gig economy businesses, tech startups and more. I'm keen to see who the first few victims of their mismanagement will be; I think airlines will be the first to belly up.

Note: I could be wrong as this does depend on policymakers and banks not continuing to recklessly lend at zero to negative interest rates in the US and Europe to keep these zombie businesses open.

Image source: - marketbusinessnews.com

Living for the moment - It's just how we live

Then we come to the consumer; there are millions of people around the world living paycheque to paycheque and rely on work to make ends meet. They also live on a Just In time system whereas money comes in its then distributed to the store for groceries, to the bank or landlord for mortgage or rent and for the various services and goods they need with minimal left to store away for later.

This disruption in work, as well as businesses going under, will see these vulnerable people being forced out of their homes, forced into bankruptcy and deeper into poverty where they will most likely remain, and this is if they didn't get sick and stayed healthy. There is minimal upside for this part of the population, which is more significant than you think.

We often think of this as a poor person problem, but we don't know how overleveraged many of the middle class and even the rich are and once the bills pile up and the income dries up the deficit increases, and you can quickly find yourself in poverty.

This will be a purge of those who did not live within their means.

But what about insurance

Yes, you could be paying health insurance, life insurance, car insurance, credit card insurance and all that shit that's meant to protect you, if anything were to happen. Still, we must remember these are for-profit companies and have been built on a particular risk model. If this pandemic continues it will be way out of their risk model, and they will first opt to deny payout on various legal bullshit and then declare themselves insolvent because let's face it, insurance is a piece of shit and its an idiot tax for the most part.

Helicopter money

The only way I now see the US and affected European countries from going into complete depression and staying there for the next few years is through something I doubt would ever happen, are a nationwide debt jubilee and helicopter money. Given the fact that these are extraordinary circumstances, it may require exceptional solutions. So instead of bailing out the banks and businesses who were acting irresponsibly, we allow them all to go bust.

The funds that would otherwise be used to fail them out is then used to forgive individual citizens debt; this could be credit card debt, mortgage loans and student loans, this will give the consumer some breathing room and lift the boot off their neck.

Additionally, a divident could be given to consumers to start spending while a premium can be provided for those willing to start businesses or require funding for their small businesses. Rebuilding economies based on what is needed in that particular area instead of filling the cophers of the S&P 500, wall street and the silicon valley.

Do I think this will work? I don't know, but theoretically, it seems like a better option than what we've been trying since 2008 and only increased the wealth gap in the US, while Europe has been in a zombie state of low-interest rates and low growth after peaking out years ago.

Do I think this is an option policymakers will consider? No, they'll instead opt for civil unrest than give the people a fresh start like they do their friends and family in privileged positions.

Have your say

What do you good people of steem think? Will we see a depression rather than a recession?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler

| Buy & sell STEEM | Donate LikeCoin For Free | Earn Interest On Crypto |

|---|---|---|

|

Thanks for sharing your thoughts and I agree 100% with you... Unfortunately, that makes us only two...

...and this will never happen... and it is so needed... as we are speaking, they are already pumping money for those entities... :( They will do the SAME as they have done in the last crisis, until the next cycle... and the cycle will get shorter after every next crisis...

Made in Canva

@thisisawesome Moderator

This is Awesome Content, and it will be manually curated with an upvote of 65% from @thisisawesome (will be done today), and it will also be included in our Awesome Daily report in category Awesome CTP Curation for more visibility.

The goal of this project is to "highlight Awesome Content, and growing the Steem ecosystem by rewarding it".

Source

I have zero doubt that what you're saying will be the reality, regardless of the diminishing returns they will produce with that new money they will keep the status quo and yes the cycles will be shortened but what I hope is that it gives us enough time to keep improving crypto and gathering momentum organically and building something we can share with the world

of course... I will not stay on-side and watch... and I certainly don't want to be INSIDE that cycle... Pushing the crypto and blockchain until we reach the breaking point... and it will come...

It's inevitable, sure we're early so it doesn't seem like it but we're not wrong, this cat is out of the bag and its only going to continue growing. If we look at all the QE going fiat is speeding up its death

So what about those that were disciplined, paid off their debts, borrowed responsibly, and lived within their means and never a burden on others?

Posted via Steemleo

Those people need to hope their won’t be a bail in and their savings are taken from them to keep banks open! Otherwise these people will be the ones that provide the liquidity and collateral to kickstart the economy

"No Good deeds goes unpunished." or is it, "So long and thanks for the fish(Cash)."

Posted via Steemleo

Lol I think its the second one, no one is allowed to escape the clutches, the beatings have to continue, its a one-trick pony

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 17 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 2 SBD worth and should receive 105 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePigHi @chekohler!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.216 which ranks you at #2079 across all Steem accounts.

Your rank has dropped 41 places in the last three days (old rank 2038).

In our last Algorithmic Curation Round, consisting of 78 contributions, your post is ranked at #64.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server