Decade of Negative Real Interest Rates and a Shrinking Middle Class

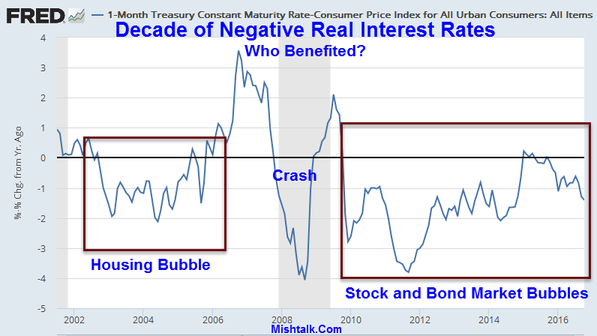

In "Decade of Negative Real Interest Rates: Who Benefited?" Mike "Mish" Shedlock tackles one of the biggest economic questions in the last decade: Who really benefited from all the Federal Reserve interventions that bailed out large segments of the financial system and drove real interest rates negative?

Winners and Losers

The first obvious answer is that banks and those financial firms directly and indirectly subsidized benefited. Shareholders, managers, employees, and some set of customers all make the list of beneficiaries.

A more subtle answer is that various stakeholders in government--politicians and government workers--certainly benefited by expanded powers, election gains, growth in public sector jobs, and more resources in their hands.

What about the rest of us? Here's a fairly damning chart from Mish:

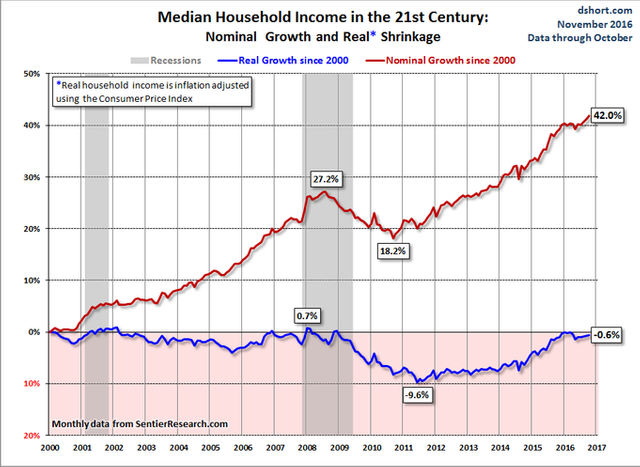

The median American household earns 0.6% less than at the start of the century, despite a 46% nominal gain over the period. What an insane divergence!

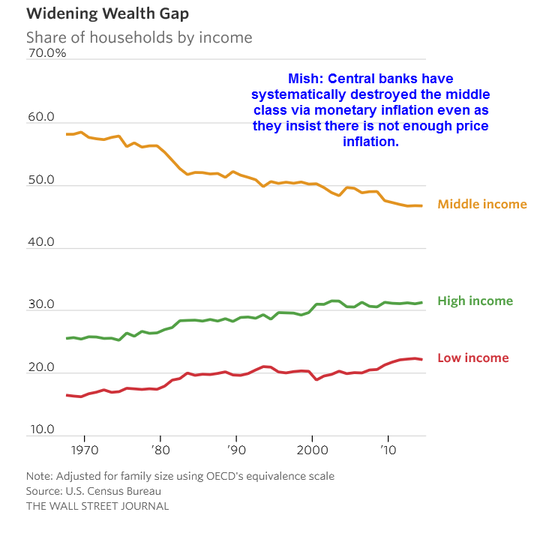

The share of "Middle Income" households has consistently fallen, while "High Income" and "Low Income" groups have both grown as a share of total households:

The good news is that more households are now in the "High Income" group. The bad news is that there are also more households in the "Low Income" group. This ambiguity makes it tough to pass judgment on whether the decline in "Middle Income" households was good or bad; of course, for those that made it into the former group it was good, and those that dropped into the latter group, not-so-good.

The Federal Reserve: Culprit, Hero, or Neither?

Mish and a lot of others blame the Fed. Easy monetary policy--all the QE, the bailouts, the implicit subsidies, and the outright money printing that ZIRP (zero interest rate policy), or near-ZIRP, induces--can be reasoned to benefit some segments of society more than others.

Clearly, shareholders of bank stocks benefit from bailing out banks and the Fed handing them essentially free money and profits amidst all the bailouts. And equally clearly, retirees living on interest income lost big time with interest rates collapsing.

Two questions arise:

- Is this the Fed's fault?

- Would things have been worse without such policies?

Both points are difficult to prove either way. Barring a glimpse into an alternative universe without the Fed ever existing, we'll never know what would have been. It's entirely plausible that the financial system would be more stable without top down control by a monetary authority, or other political influence. It's also possible the Fed provides stability, particularly in panics and other downturns.

Academic literature is mixed, but "Did Saving Wall Street Really Save Main Street? The Real Effects of TARP on Local Economic Conditions" forthcoming in the Journal of Financial and Quantitative Analysis, finds that:

Our difference-in-difference analysis suggests that TARP statistically and economically significantly increased net job creation and net hiring establishments and decreased business and personal bankruptcies. The results are robust, including accounting for endogeneity. The main mechanisms driving the results appear to be increases in commercial real estate lending and off-balance sheet real estate guarantees. These results suggest that saving Wall Street via TARP may have helped save Main Street, complementing the TARP literature and contributing to the cost-benefit debate.

Studies like this can show that, at least on average, there were some beneficial results of the bank bailouts. Still, we don't know what a Fed-less world would look like, nor do we know what would have happened in the long run had the interventions never occurred. It's tough to say one way or another and opinions most likely align with prior beliefs. It's also possible that the financial system experienced such a negative shock because of prior interventions.

The world is really a repeated game and bailouts are guaranteed to induce moral hazard. Institutions, managers, and investors are fairly smart, in aggregate, and every bailout increases expectations of future bailouts. This, in turn, certainly drives more capital than otherwise would into these industries, which contributes to systemic risk. The question we'll never have answered is whether the supposed benefits outweigh these truly long horizon costs?

Conclusion

My sentiment errs on the side of Mish, but I say that cautiously acknowledging that economics is rarely clear cut. Negative interest rates and bank bailouts do not benefit all of society, and those harmed are unfortunately some of the most vulnerable. The interventionist policies of monopolistic central banks playing with our currency likely induce some serious long-run risks that cause their own problems.

I'm not a fan of policies that cause winners and losers; it's clearly unfair to the losers and utility doesn't sum across individuals. There's no way to objectively claim that harming some people is worthwhile because others benefit.

We've just experienced our own "lost decade" in the U.S. in terms of real median household incomes, and that's a problem. Whether it was caused in whole, or in part, by the Fed is TBD, but we should nonetheless be skeptics and contrarians to both the mainstream and the contrarians.

What are your thoughts?

If you like this post, please upvote, resteem, or share below! Please check out my other articles and follow @finpunk to keep in touch with future content.

Rob Viglione is a PhD Candidate in Finance @UofSC with research interests in cryptofinance, asset pricing, and innovation. He is a former physicist, mercenary mathematician, and military officer with experience in satellite radar, space launch vehicles, and combat support intelligence. Currently a Principal at Key Force Consulting, LLC, a start-up consulting group in North Carolina, and Head of U.S. & Canada Ambassadors @BlockPay, Rob holds an MBA in Finance & Marketing and the PMP certification. He is a passionate libertarian who advocates peace, freedom, and respect for individual life.

On the net, the financial policies since the crisis have definitely been detrimental. Savings is being destroyed in order to "boost" the economy (i.e. Keynesianism), and all it did was inflate several bubbles.

While the Fed isn't clean in this story, the federal government is more to blame. After all, it controls the Fed like the other Departments: it nominates its heads and dictates its general direction. In the present situation, it was to "stimulate" the economy by quadrupling the monetary supply. It was a miserable failure...

I tend to support that hypothesis, as well...just trying to be balanced despite my own priors :)

I also agree that the savings destroying "boost" nonsense is likely destructive.

To hell with balancing! The simple fact that you talk about it shows that you have biases. I was a reporter for 2 years in a small weekly, and the simple fact that I would report on this rather than that showed a bias.

ha, great point! Still, I'm trying to present both sides since it is complex, then just weighing in with my own qualified opinion...

that's for the economic complexities; as for the moral arguments, i'm always unambiguously pro-freedom.

Good article. I just wish one day we can actually define middle class( income,net worth). As for winners and loser based on policies. I think with no policies the results will be the same. Will always be a winner and loser, policy does not dictate this out come. It is the individual education, desire and drive to succeed that will determine his status or success or coporation management and insight.

For sure there'll always be winners and losers, but if left to natural processes i'd refer to them as "successful" vs. "unsuccessful" in earning income. even earning income doesn't necessarily define success. Policies are different bc they force the outcomes. There's just something that doesn't sit right about using power to force outcomes; those who lose in that process do so unfairly, e.g. all those retirees whose fixed incomes collapsed with interest rates.