Business Confidence Heats Up Despite Stock Market Volatility

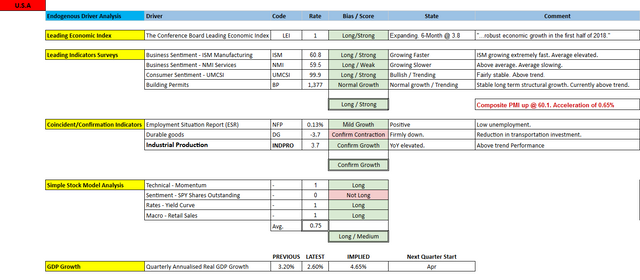

Leading economic indicators reported as of 14th March 2018 show strong growth potential in the United States economy for the short/medium term. All major leading indicators currently show growth supported by a positive reading of the Conference Board leading index. Most coincident/confirmation indicators confirm growth. 'Simple Stock Model' analysis currently confirms growth. Implied GDP growth currently sits at a robust 4.65%. Official Q4 GDP at 2.6%.

The beginning of March has started off with a powerful return to business confidence despite the current market volatility with the composite ISM reading a blistering 60.1, the fastest reading since October last year before the S&P500 (SPY) went on to post a 13% gain.

While this reading was supported by an incredibly 'hot' consumer sentiment reading of 99.9 and a leading index score of 1.0, the conference board was quick to point out that these levels of activity were for the previous month and the lasting impact of the current market volatility is unlikely to be fully reflected in these figures until at least next month.

Despite what may come a softer expansion in April the current probability of the FED increasing the FED Funds Rate in response to inflation fears currently sits at above 80%, with the current probability of it reaching at least 2.25% by the end of the year sitting at almost 40%.

In other news, China's Communist Party have pushed the removal of term limits for the positions of president and vice-president. The change will raise concerns that China will step back on promises to liberalize markets and allow limited forms of democracy. As the United States largest trading partner, this has the potential to bring uncertainty and instability to the markets as a strengthening of government control may mask potential economic issues.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: I/we have stock positions open within the indexes mentioned.

If anyone has any questions or would like to chat please don't be afraid to comment! I'm happy to answer any questions!