Sears Crashes After Second Largest Shareholder Resigns From Board

With Toys 'R' Us having already filed Chapter 11 bankruptcy, in a move that came as a shock to most of its bondholders, suddenly the race between Bon-Ton Stores and Sears Holdings who will file next, is entering its last lap.

For those who may have missed it, late last week, in a scenario right out of the last days of Toys "R" Us, some of Bon-Ton Stores’s suppliers reportedly scaled back shipments and asked to be paid sooner in order to protect themselves from potential losses in case the department-store chain unexpectedly filed for bankruptcy, Bloomberg reported on Friday.

The suppliers have insisted on getting paid with letters of credit or cash on delivery, which can be a drain on the company’s resources, said the people, who asked not to be named because the matter is private. The demands come just as the chain enters the key holiday-shopping season in the U.S. “We maintain constructive relationships with our vendors,” Christine Hojnacki, a spokeswoman for the York, Pennsylvania-based company, said in a statement. “Our team has been working closely with all of our vendors, large and small, as we build inventory ahead of the holiday season.”

Unlike Toys, however, Bon-Ton's inevitable default has already been largely priced in, and the news of the supplier strike had a modest impact on Bon-Ton’s $350 million of 8% second-lien bonds due 2021 which dropped "ony" 2.5 cents to trade at 32.6 cents on the dollar Friday.

Bon-Ton, which operates 260 stores across 24 states, had hired PJT Partners and AlixPartners over the summer to explore options for dealing with its more than $1 billion debt load. In September, it announced an $18.9 million sale-and-leaseback transaction for a store in Roseville, Minnesota, that will boost liquidity in the short-term and buy breathing room.

And while Bon-Ton's fate now appears sealed, the question is whether or not that other perrenial bankruptcy candidate, Sears Holdings, will get to bankruptcy court first.

The reason, and why Sears stock crashed 12%, on track for its close in 8 months is that on Monday the struggling department store chain said that Bruce Berkowitz, CIO of of Fairholme Capital Management LLC and the company's second largest shareholder after Eddie Lampert, was stepping down from its board of directors at the end of the month. Fairholme Capital controlled 28.9 million Sears shares as of June 30, making it second-largest shareholder with just shy of 27% of the shares outstanding.

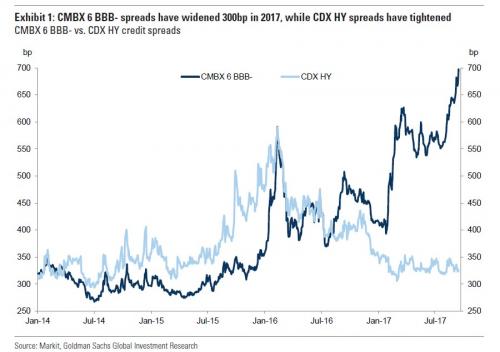

With today's collapse, the stock has erased all gains it made since it announced a $1 billion restructuring in early February, and has plunged 26% over the past three months. A Sears bankruptcy would be catastrophic for the US mall sector, and as such we expect the "big short" trade, the CMBX 6 BBB- tranche to blow out sharply on the news of Berkowitz' resignation.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloombergquint.com/business/2017/10/13/bon-ton-vendors-are-said-to-pull-back-on-retailer-s-shipments