What is M2 Money Supply and who's responsible for your economy?

What is M2 Money Supply?

According to Investopedia:

- M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money.

- M2 is a broader measure of the money supply than M1, which just includes cash and checking deposits.

- M2 is closely watched as an indicator of money supply and future inflation, and as a target of central bank monetary policy.

What happens when M2 increases?

As a result, M2 offers a more comprehensive overview of inflation levels because if the M2 monetary supply is increased, inflation could rise. Equally, if M2 supply is restricted by central banks, inflation could fall.

News articles have stated, "35% of All U.S. Dollars in Existence Have Been Printed in the Last 10 Months". fn1

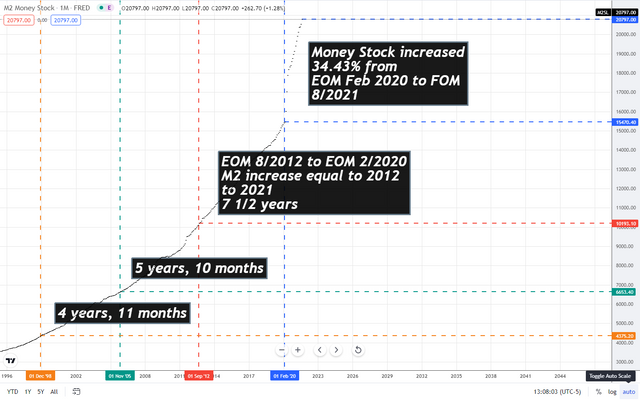

Look at this chart from Tradingview

In 18 months, from March 1 2020 to August 31 2021, M2 increased 34.43%. Go back in time and one can see that this same increase in M2 took much longer. This is a harbinger of inflation.

So who's fault is it that all this money was put in the economy?

Is it this guy?

.png)

Answer: No

Is this guy responsible?

.png)

Answer: NO

Who's at fault for your interest rates? for your economy?

These guys are

.png)

The Federal Reserve System is composed of 12 regional Federal Reserve Banks that are each responsible for a specific geographic area of the U.S. The Fed's main duties include conducting national monetary policy, supervising and regulating banks, maintaining financial stability, and providing banking services.

Also, these guys are just as culpable