Generation Y: How Millennials Are Changing The System

Generation Y - people who were born between the 1980s and 2000s at the crossroads of epochs, has a unique mentality. We are deeply involved in digital technologies and at the same time we remember the world as it was before.

These features are forcing financial institutions and the governments to change their development strategies and models. After all, today, 1.5 billion of millennials are the driving force behind the global economy.

On the one hand, many of us are lucky, our parents and especially their parents caught the "Golden age" of unrestrained capitalism. They created the so-called middle class, giving their children a good start and prospects. But since the 50s, the world economy has undergone a series of falls, which ultimately created a less productive environment for opportunities of financial growth of our generation.

Through the development of technology, today we have the opportunity to make money literally out of thin air (youtube, social networking, streaming…). Products of intellectual and creative labor are paid higher than ever. At the same time, automation of many processes reduces the number of available high-paid vacancies. Where before to perform the work required to hire 10 employees with higher education, today we need only 1-2 technical specialists.

Let’s consider the current financial situation of the Generation Y on the example of the United States, as one of the leading economic and technological countries. Before the global crisis of 2008, there were practically no full-scale studies on this subject, there were suspicions that the situation as a whole does not look very good.

In 2013 it became known that the total capital of millennials almost 50% less of the total capital of their parents.

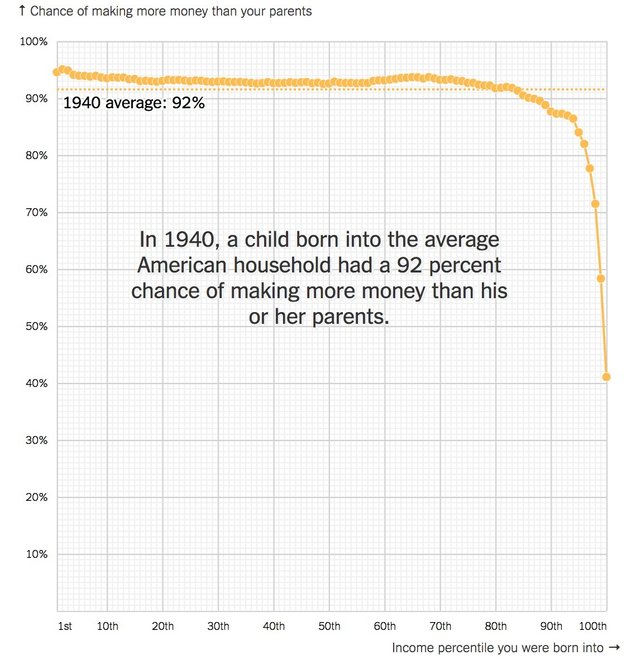

In 2016, Professor Raj Chetty has published a full study on the financial status of millennials. These studies (based on the data of the tax declarations of the age group of 30 years and above, since 1940) indicate that the generation to which today guided all global brands, mired in student debt and has not very bright prospects of increasing income.

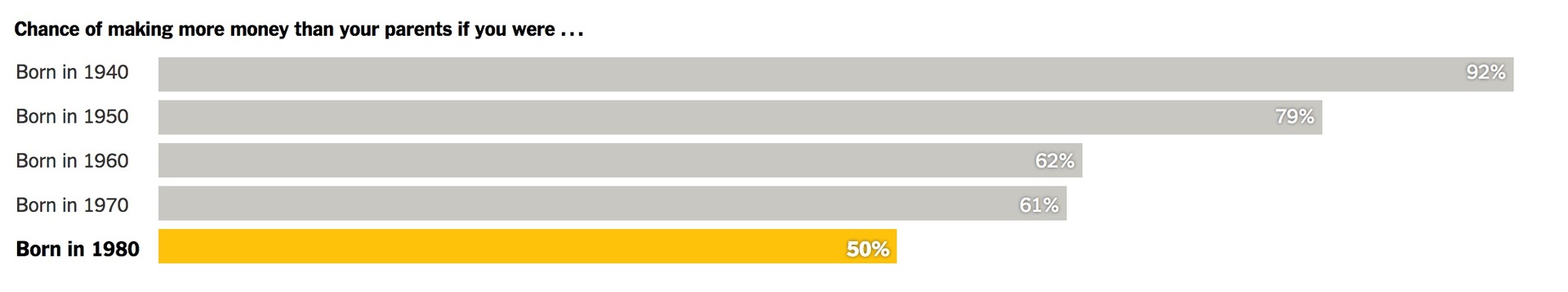

Only 50% of people born in 1980 will be able to earn more than their parents. For those born in 1940, this figure was 92%, due to the explosive growth of the economy after the great depression. But since the 1950s this figure is rapidly falling.

Obvious that children from the families of millionaires will feel good, even if they will not fall into 50% of the lucky ones. Capital of parents supports their purchasing power at the appropriate level, and provide them with an income above average due to education and connections. However, 70% of the population is middle class and lower strata, whose income does not exceed $100,000 per year - they are the heart of the market.

The probability for children, whose parents earned less than $100,000 a year, is rapidly decreasing. 44% of millennials will be able to cross the bar in $100,000, and only 29% will be able to overtake their parents if they earned less than $50,000 per year per family.

Who is guilty: The system or people?

The crisis of 2008 actually killed the career dreams of most millennials, who just reached working age and have received higher education. The young people agreed to more low-paying jobs, just to stay busy at all. At the same time, more than half of the graduates stayed with academic loans, which they expected to pay off with the help of a high salary. But as a result, people with higher education were forced to get a job as a cleaner to pay at least interest. Even by 2013, the employment market has not reached the balance between the relevant candidates and vacancies.

For the 2012-2013 academic year, about 60% of graduates of government universities have an average debt for its education loan on average of $ 27,300 each.

Only 30% of people with higher education find jobs in their own or related fields.

In 2014, 50% of recent College graduates employed in jobs not requiring higher education. For example: 100.000 of cleaners and 317.000 waiters have College diplomas.

Thus, more than half of the educated population by the age of 25-30, don't have not only their own capital, but have a negative balance.

Generation Y is often called a Peter Pan generation, due to the fact that it tends to delay the transition to “adulthood” at a later date, compared to previous generations. This is due to economic and psychological factors: the increase in the cost of rental housing, cars, family-friendly content, failed marriages of parents, dissatisfaction of parents with their work...

Millennials are not buying cars and houses, they try to minimize the use of credit cards and change jobs frequently. Some more statistics:

Only 36% of people under 35 years old own real estate (in 2005, this indicator was 43%). Overall only 65% of the population have their own housing (mainly mortgage).

The profile of the average buyer of real estate in 2005: Married couple, 29 years old, buying a family property. Today: unmarried, age 33 years, buy housing economy for 1 person.

Only 26% of millennials have credit to buy a car, a smaller percentage immediately make a purchase without credit. According to some estimates, after 15 years only 20% of US citizens will own a personal car.

37% of people under 30 years have a credit card, with the average size of the balance $ 5800. Only 8% of young people have more than one credit card. For example: in the age group older than 35 years 65% use credit cards.

All these data are related to the fact that our generation has a completely opposite mentality, in contrast to previous generations. These differences are primarily due to technological and social progress. From the point of view of the system, this entails a number of serious problems for the economy, at least for the current model.

All participants of the payments market (retail, сommerce, credit) will suffer from reduced purchasing power of the population.

In the 1970s, lenders have predicted a twofold increase in the profits of mortgage payments by 2010. On the basis of such forecasts, the construction market was growing enormously. Today it is obvious that these predictions are wrong, thousands of buildings are empty.

The lack of property (or of marriage and the family) means the absence of associated costs: repair and home improvement, insurance, cost of children, raising the status through the purchase of unnecessary things.

Banks are not able to predict the credit policy, as more and more people adhere to the principles of a "one-time payment" and Geekonomics. It is impossible to predict the future income of a citizen.

The level of pensions and the standard of living of millennials in 30-40 years will be significantly below the current figures for their parents. The economy must show more than six percent annual growth (8 consecutive years) to compensate for current trends- it is unreal.

From the viewpoint of millennials it looks not so bad, because their system of values and goals is significantly different from the parents.

No need to buy a car, when Uber and carsharing are cheaper. Why buy a house on credit, if you have the opportunity to rent housing anywhere in the world. No need to sit on one job all life, when every day appear new and interesting specialty and projects. Many technologies do not require specialized education for earning, and profile education does not keep pace with progress and does not guarantee subsequent employment.

Traditional media are not relevant, millennials prefer direct communication with each other, thus blurring the boundaries between States and different social groups. In corporate culture, generation Y follows a strategy of "there are no losers, the winner is friendship.". However, we highly employable, want the impact on our work and take greater participation in decision-making. We do not see the point of blindly doing our work for the sake of work, or for a car that would be better than the neighbor's.

Obviously, all major institutions can’t function today as successfully, as it was in the past. That is why in recent years we hear more and more criticism and see the growth of distrust to all areas: banks, medicine, education… And at the same time we observe the growth of trust and interest in new models of interaction between people (striking example is a blockchain).

The system as a whole, at the state level, does not keep pace with such rapid changes in the values of people. All forecasts made 30, 20 or even 10 years ago do not work, the situation is out of control.

That is why in many countries we are seeing a tightening of policy in relation to citizens and their rights. While the more visionary States put first the interests of the citizens and carry out appropriate reforms. The world is changing as fast as never before in history… And this time, ordinary people are changing it.

Great article. All that we know before is changing so fast. We need to learn everything fast because every day new things come to the market. We will be outdated if we don't ride on this new technology. Good thing we have now the Steemit Community which adds values and information to one another. LIke this article of your's very informative. Thanks for sharing @natord

Thank you for reading. Steemit is certainly a part of the movement forward, albeit very small but it is growing.

One of the challenges faced by millenniums is the increasing cost of living. In Kuching where I come from, the price of houses have increased is way beyond the reach of the this young generation.

The same story in my country. My parents were able to buy a house when they were 25 (with the support of their parents). I think I will be able to buy a house only 35-40 years -without taking credit.

This was a really nice overview of how the mentality of new generation has changed (for bad or worse). Enjoyed reading this.

Thank you for reading, i'm glad that you found some interesting information for you!

Congratulations @natord! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Congratulations @natord! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Very insightful as always @natord !

Maybe you like what I have written on a similar topic today :)

https://steemit.com/blockchain/@tosch/blockchain-generations

Thanks! upped on your post ;)