Want a Mall For $100 (and Ghost Cities in America)??

I'm not sure how many people's radar this came across, but there was a mall in Philadelphia recently that was sold for $100. Yes, you read that correctly. Not $100 million, but 100 smackaroos. Due to low occupancy rates (by businesses/retailers/vendors) and foot traffic (by customers/consumers) the value of the mall has dropped considerably, along with the revenue it used to derive.

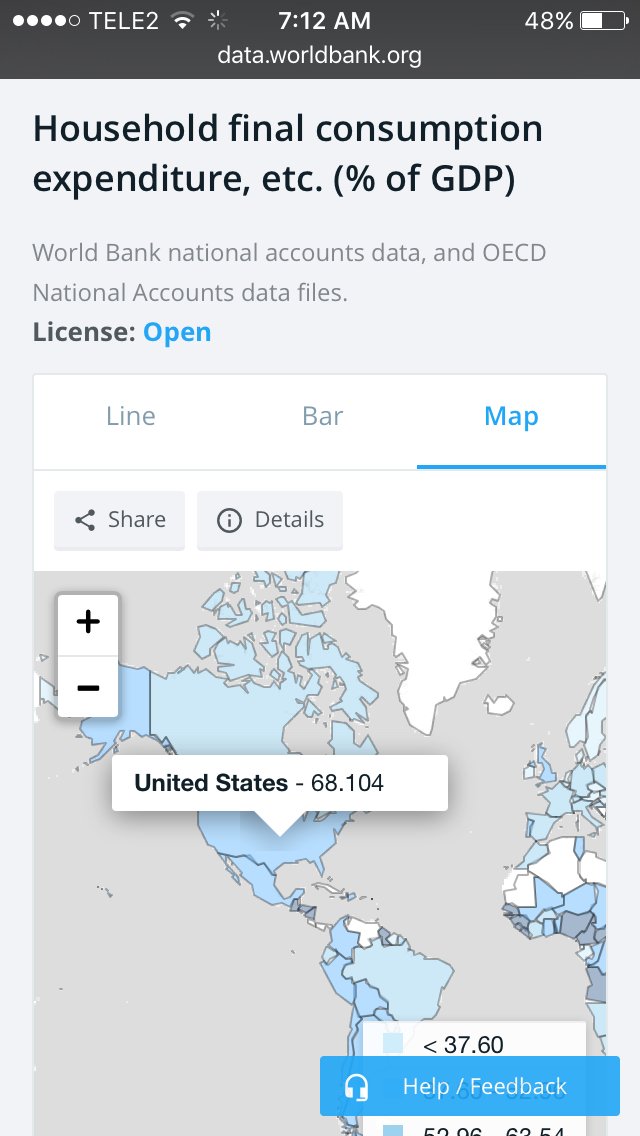

But this is actually a larger symptom of something that has been happening for quite a while. Ever since the on-set of the Great Financial Crisis (GFC) of 2008 and the subsequent 'Greater Depression', American consumers just haven't been themselves in terms of spending and consumption. About 70% of American GDP is calculated from/based on consumption.

http://data.worldbank.org/indicator/NE.CON.PETC.ZS?view=map

This means, simply, that if Americans aren't spending, then the economy isn't doing so good. This is also part of the reason why Americans are encouraged to 'spend, spend, spend' at holiday times and others. It is also why Americans have some of the highest debts in the world (consumption before production) and lowest savings rates.

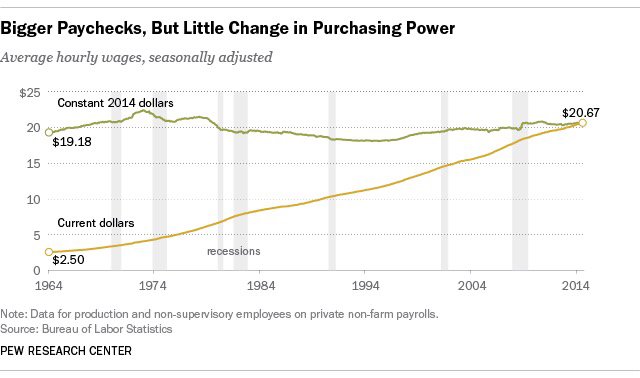

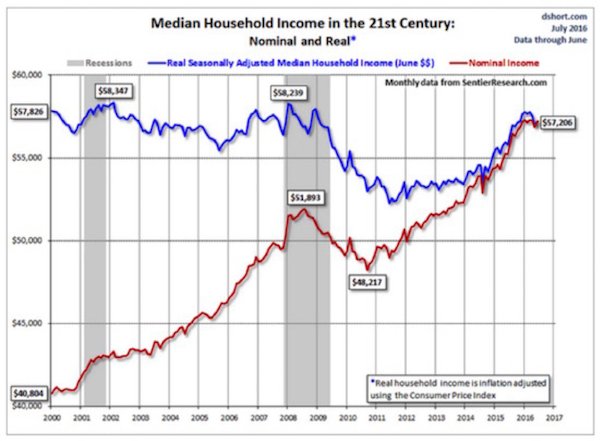

But even this is probably due to the stagnation of real wages (that is, accounting for inflation) that has been occurring over the past 30+ years or so. While the cost of everything from medicine and medical care, housing, food, education, and other essentials have been rising, the money used to pay for these necessities has not.

Nominal wages have increased, but real wages have not. This is one of the main reasons why American consumption has been depressed, and why you can buy a mall for $100.

This trend will surely continue, so if you missed your chance to get this one, don't worry. Your opportunity will be coming soon.

So to take a step back and look at the larger real estate sector, what other trap-doors/opportunities await those with a discerning eye and cash on hand? We spoke about the commercial real estate sector above, but what about the residential?

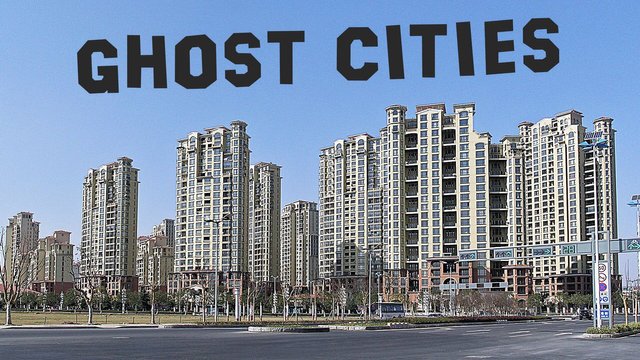

We've all probably heard about, seem, or even made fun of the so-called 'Ghost Cities of China'

But have we taken time to consider what may soon be known as the 'Ghost Cities of America'? We can already highlight examples such as those coming out of Detroit and other depressed places where failed economic activity have depressed prices to levels such that some investors (read: Chinese) are buying up entire blocks, site unseen.

http://www.nbcnews.com/news/china/chinese-investors-snap-property-bankrupt-detroit-n253186

http://www.forbes.com/sites/gordonchang/2013/12/08/chinas-newest-city-we-call-it-detroit/

There are signs that the American economy may be headed for more such turmoil in the future. Outside of the bustling coastal areas of New York and California, could it be that we will be looking at similar 'Detroits' in other cities around the country?

The 'blood in the streets' hasn't begun to run just yet, but it's something to be on the look out for. Coming to a town near you? I hope not, but we can't overlook the obvious economic fragility (read: Over-indebtedness with an inability to pay) that relegated the Galleria mall in Philadelphia to its' current status and potential for other such spill-overs to take place in cities across the nation.

Nice post, and a good summary of the situation. We are likely to see continual falls in economic activity unless we find ways to spread wealth more evenly. It is only with some security of income that a populace becomes more economically active.

.

ColdMonkey mines Gridcoin through generating voluntary BOINC computations for science...

I'm confident that a technology like Blockchain, accurately described as 'the Internet of Value', will afford communities the ability to create, manage, and exchange the value of their own creations and, thus, invigorate them with what they need most..money. There is an over-supply of 'money' in places that don't need it (i.e. 'Rich folks'), and an under-supply in places that do. This, I quantify, by the 'velocity of money' (M2) that has been falling ever since the first 'bailout' (of the hedge-fund Long-Term Capital Management) in the late 90's.

Less money circulating means less people who get access to what is actually out there. There is a similar phenomenon in communities where money circulates many times before it leaves that community (like Asian communities ~ [28 days] and Jewish communities ~ [19 days]), and the others (like the African-American community ~ [6 hours]). The exactitude of the numbers themselves can be argued, but the principle cannot.

There is a community in Pittsboro, North Carolina that is leveraging this idea by creating and using/circulation their own local currency called the 'Plenty'.

http://m.technicianonline.com/news/article_ab41cdbe-7cad-11e2-8fcf-0019bb30f31a.html?mode=jqm

http://m.democracynow.org/stories/10098

They were featured on a recent episode of Max Keiser's 'Keiser Report'.

One of the gentlemen in charge succinctly made the point when asked "Why use the Plenty? [paraphrase]". His response, "Because they don't accept it in China."

Exactly.

Velocity and momentum of money will not matter as much once we stop mistaking the means for the goal. Money is a means.

Well-said. 👍