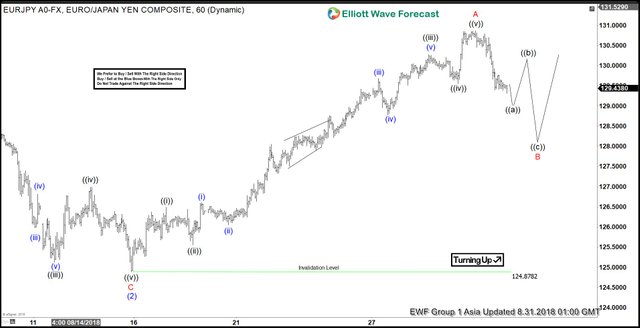

EURJPY Elliott Wave View: Ended 5 Waves Advance

EURJPY short-term Elliott wave view suggests that the decline to 124.87 low ended intermediate wave (2) pullback of a leading diagonal structure from 5/29/2018 cycle. Above from there, the rally higher is taking place as Elliott wave zigzag structure within intermediate wave (3) of a diagonal. In a zigzag ABC structure, lesser degree cycles should show sub-division of 5-3-5 structure i.e Minor wave A unfolds in 5 waves either impulse or a leading diagonal, Minor wave B unfolds in 3 swings corrective structure. Whereas Minor wave C unfolds in another 5 waves structure either impulse or Ending diagonal structure.

In EURJPY’s case, the rally higher from 124.87 low unfolded as 5 waves impulse structure in Minor wave A. Up from 124.87 the rally higher to 126.49 high ended Minute wave ((i)) in 5 waves structure. Down from there the pullback to 125.55 low ended Minute wave ((ii)) pullback. A rally higher from there to 130.275 high ended Minute wave ((iii)) with another lesser degree 5 waves structure. Below from there, a pullback to 129.55 low ended Minute wave ((iv)). Finally, a rally to 130.86 high ended Minute wave ((v)) & also completed Minor wave A. Currently Minor wave B pullback remains in progress in 3, 7 or 11 swings to correct the cycle from 124.87 low before the rally resumes, provided the pivot at 124.87 low stays intact. We don’t like selling it.

EURJPY 1 Hour Elliott Wave Chart

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://elliottwave.whotrades.com/blog/43883967914