Review Metavault Trade

Are you familiar with Bitcoin? Since Bitcoin appeared more than ten years ago, a series of alternative coins (altcoins) have sprung up to fill the void in the cryptocurrency ecosystem. Metavault Trade, a new project, has attracted the interest of crypto fans and financial advocates looking to diversify their crypto portfolios. With so many cryptocurrencies in interest, people are looking for an alternative to Bitcoin and other expensive altcoins. However, why should Metavault Trade be the cryptocurrency of choice for currency sponsors, despite many setup considerations to be made? First and foremost, do we have a basic understanding of cryptocurrencies?

Everything you need to know about cryptocurrencies

Cryptocurrency is a form of digital currency, encrypted and decentralized. Unlike the US Dollar or the Euro, the cryptocurrency has no central authority to manage and maintain its value; instead, these responsibilities are spread among cryptocurrency users on the Internet. Furthermore, unlike centralized cryptocurrencies and well-known financial institutions, cryptocurrencies are usually managed by a decentralized network. It is a networked type of digital data that is distributed across multiple machines. They can exist beyond the control of governments and central governments due to their decentralized nature. For example, cryptocurrencies are online payment systems that use virtual "tokens" to represent system ledger entries.

Why are there so many cryptocurrencies on the Blockchain?

For new decentralized companies, there are many opportunities. Smart Contracts and Blockchain, for starters, rely on expensive third parties. Second, no matter how clever they appear, traditional methods still have outdated mentality and mindset, which is why cryptocurrencies are gaining popularity. As a result, advanced technology is increasingly being applied in many applications. However, not all of them are worth it. As a result, Metavault Trade stepped in to help. Let's take a quick look at it.

What is Decentralized Finance (DeFi)?

Decentralized finance (DeFi) is an emerging financial technology based on secure distributed ledgers, similar to that of cryptocurrencies. The system removes the control that banks and institutions have over money, financial products and financial services.

Some of the key benefits of DeFi for many consumers include:

It eliminates the fees charged by banks and other financial companies for using their services.

You keep your money in a secure digital wallet instead of keeping it in a bank.

Anyone with an internet connection can use it without permission.

You can transfer money in seconds and minutes.

KEY LEARNINGS

Decentralized finance, or DeFi, uses emerging technology to remove third parties from financial transactions.

The components of DeFi are stablecoins, software and hardware that enable the development of applications.

The infrastructure for DeFi and its regulation is still under development and under discussion.

Metavault.Trade is a new kind of decentralized exchange designed to provide a large number of trading features and very deep liquidity on many large capitalization crypto assets.

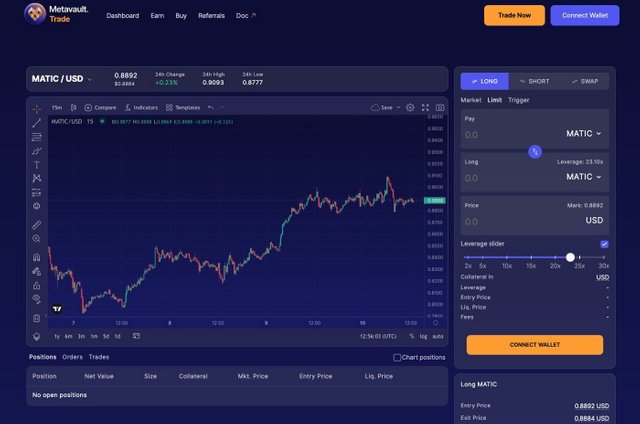

Metavault Trade Is A Decentralised Spot And Perpetual Exchange With Low Swap Fees And Zero Price Impact Trades. Trading Is Backed By A Multi-Asset Pool Which Is In Turn Supported By Liquidity Providers.

Trading Is Backed By A Multi-Asset Pool Which Is In Turn Supported By Liquidity Providers. Liquidity Providers Receive Rewards From Swap Fees, Market Making, Rebalancing And Leverage Trading. MVX Uses Chainlink Oracles And TWAP Pricing From Large-Volume Decentralized Exchanges For Dynamic Pricing.

this project metavault has come to a successful journey, i wish You all the best to Your all the future events as well. me and my crypto audience always support good projects like this.

- Traders can use it in two ways:

Spot trading, with swaps and limit orders.

Perpetual futures trading with up to 30x leverage on short and long positions.

Metavault.Trade aims to become the solution for traders who want to be in control of their money at all times without sharing their personal information. Its innovative design gives it many advantages over other existing DEXs.

- Very low transaction costs.

No price impact, even for large order sizes.

Protection against liquidation events: The sudden price changes that can often occur in one exchange (“scam-wicks”) are smoothed out by the design of the price mechanism.

All-in-one platform: spot and leverage trading.

A multi-asset pool -

the solution for trading without price impact

The main innovation at the heart of Metavault.Trade is the multi-asset pool. This feature allows the platform to have shared liquidity across all the assets it supports. This is how it works.

For every x amount of assets deposited into the pool, an equivalent amount of index tokens called MLVP are minted. A liquidity provider can withdraw at any time by burning MVLP in exchange for assets in the pool. Therefore, Metavault.Trade can be used to trade large volumes with no price impact.

For example, imagine a situation where the pool consists of five assets (BTC, ETH, MATIC, USDC and DAI) in equal proportions in terms of dollar value: 20% of each. If a trader wants to buy 50% of the BTC supply with USDC, he can do so immediately, at the exact price displayed on the platform, without any price impact. The only thing that changes after the order is processed is the status of the pool that becomes BTC: 10%, USDC: 30% and the rest remains unchanged. The price of BTC offered on the platform is the same before and after the swap, even though half of the available supply has been bought up!

With each swap, the pool becomes more or less out of balance compared to its original state. To rebalance the pool, liquidity providers will be incentivized to deposit requested assets and discouraged from depositing assets of which there is a surplus.

For most traders, it will seem like the platform has infinite liquidity at a fixed price, making an order book completely unnecessary.

Blockchain Technology and Oracle Pricing

Metavault.Trade will be launched first on Polygon and soon after on Cronos.

The assets supported at launch on Polygon are six large caps and three stablecoins:

BTC, ETH, MATIC, LINK, UNI, AAVE

USDC, DAI, USDT

Choosing Polygon over other chains has many advantages:

- Polygon transactions are fast and cheap.

- It’s easy to get users on board thanks to exchange entrances and exits.

- Chainlink offers a large number of price feeds on Polygon. These are crucial to the platform’s pricing mechanism and the listing of new assets also depends on them.

- To set the price of each asset, the platform collects Chainlink and Time-Weighted Average Price (TWAP) prices from the major DEXs and CEXs.

- This pricing mechanism benefits leveraged traders in a huge way as it reduces the risk of liquidation due to the temporary fuses you find on some exchanges. These scammers often come from whales who manipulate the order books to liquidate other traders.

MVLP — Liquidity That Provides Incentives

As of the first quarter of 2022, trillions of dollars will be traded on crypto markets every month. DEXes that offer perpetual trading account for about $100 billion of this total — and this number is growing regularly. Metavault.Trade is well positioned to capture a slice of this market, in which its direct competitors earn anywhere from $5 million to $60 million in fees each month.

In order to run smoothly, Metavault.Trade needs a multi-asset pool with a lot of liquidity. To ensure that this is the case, the platform has a very generous incentive program: 70% of the platform fees are redistributed to the liquidity providers who minted MVLP by bundling their crypto assets.

One can think of MVLP as a “crypto majors index”, further stabilized by stablecoins. The incentive program makes it worthwhile for liquidity providers to move from traditional peer pools (such as the aTriCrypto Curve pool) to MVLP.

In addition, MVLP acts as a counterbalance to the leveraged traders on the platform, with their losses flowing back to MVLP. Data shows that, on average, traders lose more money now and then than win: as the saying goes, “the house always wins”. In this case, that’s MVLP.

Tokenomics and Community

Metavault.Trade was built by the team behind Metavault DAO, which powers an entire ecosystem of blockchain and technology projects.

The code is a friendly fork of GMX, which has already been audited by ABDK Consulting [Find the audit here under the name “Gambit”, the original name of the GMX project].

As safety is paramount, an independent audit will be conducted in the near future.

After carefully considering GMX’s tokenomics, the Metavault DAO team chose to completely redesign them for Metavault.Trade. The main differences are the following:

Compared to GMX, Metavault.Trade allocates a higher proportion of tokens to reward farming. That makes the incentive program much more extensive.

The MVX token was launched in a fair manner, with no private or seed rounds.

Metavault DAO intends to be a liquidity provider in Metavault.Trade, making it robust and independent.

There is already a strong community that supports Metavault.Trade, such as those who follow it through Telegram and Discord channels. Sharing 100% of the platform fees between MVX and MVLP holders/players — in addition to a carefully designed incentive structure — means the project will attract and retain supporters in the long run.

End

So what are your thoughts? Is it worth reading? Finally, the Metavault trade allows crypto farmers to improve their Polygon compounding technique using their profit-seeking tendencies. Metavault trade includes solutions to meet the needs of a wide range of crypto farmers, from those looking for huge income to cautious investors who are averse to risk. I like the idea of the project and believe it will bring a lot of money to investors. So at least, check out this platform and let us know what you think.

Website: https://metavault.trade

Telegram: https://t.me/MetavaultTrade

Twitter: https://twitter.com/MetavaultTRADE

Medium: https://medium.com/@metavault

Discord: https://discord.gg/metavault

Docs/Code

Github: https://github.com/metavaultorg

Docs: https://docs.metavault.trade

#ProofOfAuthentication

Bitcointalk username: Vietnamtuhao