The Energy Complex Remains For The Battle Hardened

Summary

Energy investors need staying power as energy stocks continue to diverge from oil.

This too shall pass.

Are you still in or have you given up on this sector like many others?

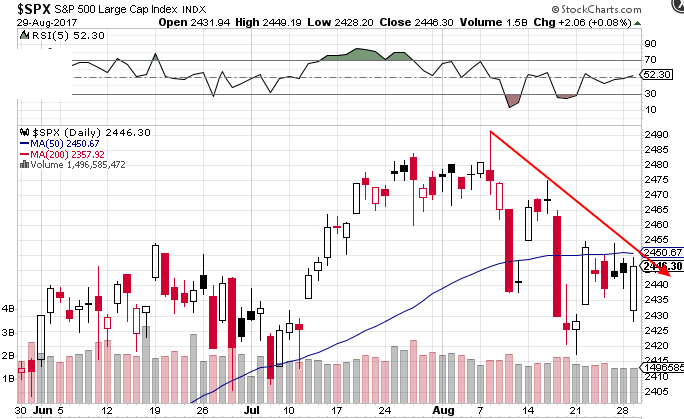

It came as no surprise to me that the market at one point was down 20 handles yesterday (Aug. 29), yet finished up for the day. Traders and investors alike need to heed the fact that if a North Korean provocation can't even wipe 1% off the S&P 500, then what really can? This is like free money in the stock market at present. Every potential correction gets corrected. All eyes are now on the $2,455 level, which is the down trend line. Pre-market prices were at the $2,450 level, so the second estimate of the GDP numbers could easily rally the S&P beyond that technical level and get up to at least $2,500 in this particular cycle.

I read a good article recently on how a person could potentially quit their job in a relatively short period of time. The article centered around aggressive saving and then obviously putting those funds to work in some form of investments. I firmly believe that the first step to wealth is aggressive saving. In fact, I actually know a couple with modest incomes who have their apartment paid off by aggressively targeting their mortgage with their savings. The mortgage only lasted 10 years and the figure that was drawn down initially was something like $170,000. The couple basically lived off only one salary and threw the entirety of the second salary into the mortgage. Now they have a paid off asset worth at least the price they initially paid for it.

While this strategy could potentially kill one's spirit, there is a lot to be learned from it. First, by paying down debt you are a guaranteeing a return on your money. Every extra $1 that goes toward your debt reduces the amount of interest you will eventually pay on the loan. Second, this couple now has their home paid for and are still in their early forties. The husband, Jason, is actually unemployed presently, as he has just been laid off. He is pretty nervous about his situation since he's aware that his welfare will one day run out. He wants to get back to work as quickly as possible and get back to saving aggressively. They buy everything in cash, from cars to shopping to you name it. They are not in the business of making money for the banks. Debt or credit cards, for that matter, are totally off their radar.

hello bro

follow me

lets help each other:)

I followed you

There is no principle worth the name if it is not wholly good.

- Mahatma Gandhi