LendLedger. Unlocks data for informal borrowers and small businesses. Using Blockchain

- No credit history.

- No ability to pay.

- Age.

Without a credit history, the bank doubts and mostly denies the loan simply because the bank does not trust the owner to repay the loan.

On the other hand, the bank as a business requires the increase of its income by expanding its loan portfolio, but in the same way the bank limits itself by not looking for a solution with the bureaucracy of that requirement as is the credit history.

We know that lending money to someone who does not ensure your return is a great risk, that is why you have to activate other ways to help the customer move forward, a way that is under study and has great advantages is the collection of information on the use that the customer makes both for the same and its business.

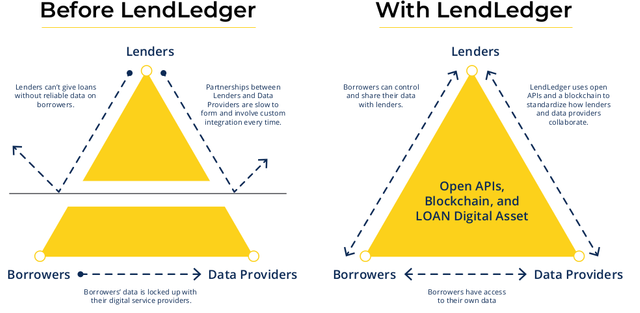

It is not necessary to have a bank reference on a loan, since we can observe that with the use of technology and digital payment systems that are used daily, invoices, sales points (POS), among others, all these data over time become transactional history that could show the solvency of both the customer and the business, Unfortunately this digital information is owned by digital service providers who are not shared with financial institutions, perhaps the business presents a profitable growth but even though all its digital movements are reliable the bank does not have access to such data, so the business owner turns to their relatives or lenders who may not be able to help them in full.

That's why you need a platform that integrates lenders with digital data to help meet your lending needs, so LendLedger will combine borrowers, data providers and lenders into a secure, open, global, blockchain-based ecosystem.

The need to be under the blockchain platform guarantees security and transparency in transactions so that banks and other institutions can trust blindly in this platform.

Solution

For this to happen, centralization has to be eliminated and replaced by decentralization, as these centralized systems are currently inefficient and require the trust of all parties to function. This is currently a major disadvantage, as centralization limits their potential and growth rate.

This centralized scheme in summary brings delays, high costs and as a consequence avoids growth.

How LendLedger works

Thanks to this decentralized system called LendLedger, you can control your data, share it with as many lenders as you want, choose the loan you offer and trust the open standards that manage information security.

LendLedger replaces the centralised intermediary with an open and decentralised network system. The LendLedger protocol makes it possible for anyone to join the network and allows reliable data to be exchanged directly between the parties. All members maintain their own data and build a reputation on the network. This is possible through LendLedgers' open APIs and a unique digital asset (LOAN) that interrelates with an intelligent blockchain contract. In addition, LendLedger will begin production as users can easily access the ecosystem.

An ecosystem of trust

Why a blockchain? Real-time recording of LendLedger loan disbursements and repayments makes the reputation of borrowers, lenders and data providers transparent and irrefutable.

This decentralized, standards-based approach lowers loan origination costs and greatly expands them, even for small loans.

A transparent payment channel

A stellar digital asset, LOAN is used by all network participants to pay commissions, including issuing and servicing loans. As the stable accounting currency in the LendLedger network, which ensures the complete and accurate recording of operations in the blocking chain, the creation of a transparent system.

Prospects for the future

In due course, LendLedger may include the following features:

- The open source feature of the LendLedger protocol allows all developers to create their own software to allow users to participate in the LendLedger open network.

- LendLedger could unlock the global market for cross border P2P loans. A person in one country could use LOAN to make a loan to someone in another country.

- The loans recorded in LendLedger could become negotiable. Digital asset that will back up real assets, such as loans. Instead of the already existing packaging process with lots of documentation

- If you want to sell your loan obligations to investors, you could simply sell the rights to a sequence of receivables of digital assets.

Team

- Greg DeForest - Product Manager

- Gautam Ivatury - Co-founder and CEO

- Manish Khera - Co-founder

- Srinivas Valluri - Technical Director

- Alberto Jiménez - Advisor

- Nick Hughes - Advisor

- Ignacio Mas - Advisor

If you need more information I leave you below the links where you can review it in much more detail, any questions or doubts I invite you to comment.

| Platform | Links |

|---|---|

| Web Site | https://www.lendledger.io/ |

| Whitepaper | http://lendledger.io/images/LendLedger-Overview-Optimized.pdf |

| https://twitter.com/LendLedger | |

| Medium | https://medium.com/lendledger |

| Telegram | https://t.me/lendledger |

| Ann | https://bitcointalk.org/index.php?topic=4424652.0 |

By Bitcointalk user: jpirulo

Profile: https://bitcointalk.org/index.php?action=profile;u=1192567

Stellar : GDKXRDCSB7AABH3ETB2QMPUUTJFVEKGL5DSLQXPKAO6E4TMNLGGMTON7