Economic model of Dapps - How to value the potential of EOS token

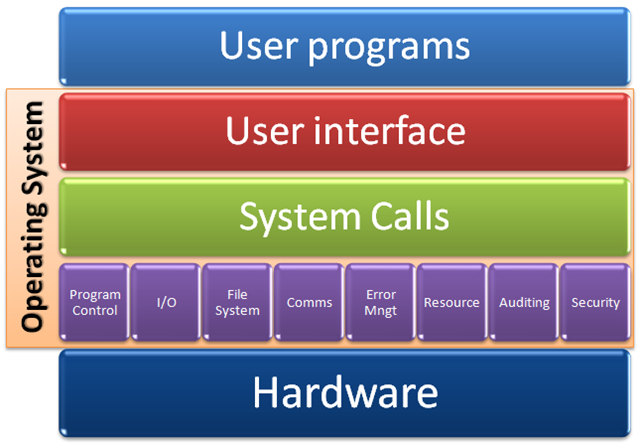

EOS as the blockchain Operating System, User Programs as dApps

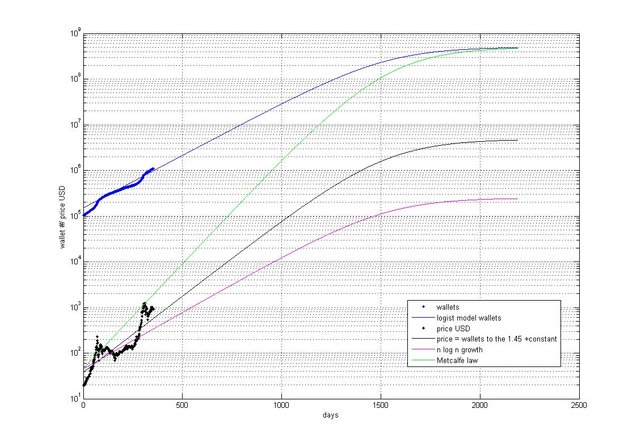

A comparison between Metcalfe’s, Zipf’s and Bitcoin’s law.

“In fact there is a strong correlation (R2 = 0.82) between number of users and price. All these things are not understood by too many people, unfortunately. Also the price doesn’t grow linearly with the number of users but instead with the power of 1.45 of the number of users. That is nice because for the price to increase 1000 times you need only 140 times the number of users of today. We have about 2 million BTC users.”

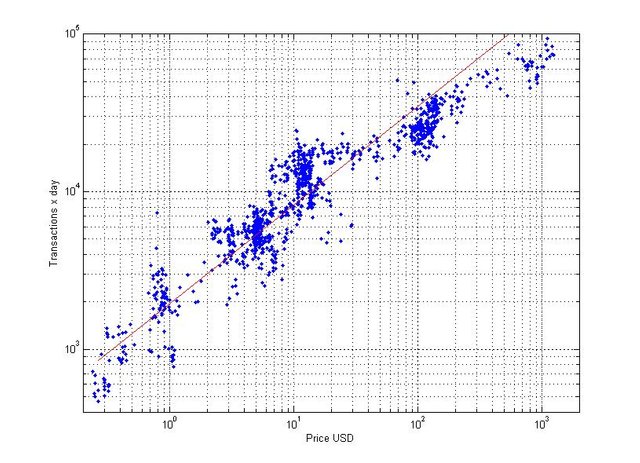

Here is an improved graph of the bitcoin price history versus the Metcalfe value. I am now using the price history from bitcoinaverage.com (giving me post-Gox prices as well), and I am using both the number of transactions per day (excluding popular addresses) and the number of unique bitcoin addresses used per day as the N in Metcalfe's Law : V ~ N2 . I would like to do a proper regression to get a numerical model, but the blockchain.info charts currently have holes in the data (the large spikes visible on the curves) that render such a processes useless. For the time being then, I've just eyeballed the fits as you see below. The current price of bitcoin is slightly higher than its Metcalfe value. However, should the network continue to grow at its historical rate of 3.2X per year, the Metcalfe value should exceed the current bitcoin price later this spring.

What is interesting with regard to EOS is that while the average consumer does not have a strong motivation to use Bitcoin (limited acceptance, hard to buy, scary to store) the average consumer and average business are going to have a lot of motivation to use EOS DAPPs. Bitcoin price is pure speculation, EOS may well be the first crypto to be priced based on utility. And if that's case all those pie in the sky predictions about $100, $500, $1000 EOS may not be unrealistic.

JP Morgan's revenue from contracts alone are more than 96 billions

10 years from now EOS (DAO) maybe able to add narrow AI features who knows? e.g bug hunting

1 trillion marketcap is not impossible if the execution is right

interesting analysis. thanks for the info

your welcome