How can I safeguard legal rights?

Everyone watches him grow on the commercial battlefield and lost at last.

This is for Fcoin.

In the afternoon of 17th February 2020, Zhang Jian, the co-founder of crypto currency exchange FCoin, published an announcement after 7 days’ disappearance of the publication of destroy all platform access schemes to uncover the truth of ‘FCoin business termination’

In the announcement, Zhang Jian straightforward pointed out that ’the route to hell is paved with goodwill‘, but for users, the door of hell has been opened, will the path to rights be full of goodwill?

Behind the scenes of doubt and conspiracy, everything in crypto was exposed.

Event review

On 10th February, FCoin announced that they have destroyed all FT they owned, and then published one announcement for shutdown and maintenance, and said the maintenance will end in following 4 hours.

Supplementary

FT is platform token of FCoin: 51% of the token is used to reward the ‘ Trading is Mining’ users; 49% is held by funds, teams, partners and private investors through pre-release.

FCoin once published that the only goal of FCoin is to become an autonomous, community-based and transparent trading platform. As one platform token, if all FT are rewarded to ‘Trading is Mining’ uers, it will be a good benefit for the whole industry.

The destruction of all FT by FCoin was seen by most netizens as FCoin giving up FT.

On 11th Februay, FCoin published an announcement to extend their termination of service and claimed that the estimated time of recovery of their website is around 1-2 days.

On 12th February, FCoin published the third announcement to present the latest progress of system maintenance and the availability of withdrawal application.

And the announcement denied that FCoin had been hacked, claimed that due to the loss of core personnel and serious damage to some systems and data, the withdrawal application only accepted by email.

So far, FCoin is said to be on the run.

Between 13th-14th February, the operation of transferring money to the new address has appeared in all the hot wallets of the former FCoin in the mainstream currencies.

Take EOS as example

Address transferring can be regarded as bill transfer and also can be interpreted as the transfer of control power. There was a lot of speculation that there might be a fight within the company, namely, someone with backend privileges broke the system.

On 17th February, Zhang Jian, the co-founder of FCoin, published an open letter to positively respond to ‘runaway boss’ and said: data errors and decision-making errors lead to non-payment events, coupled with a series of operational problems, and finally accumulated over time, the capital hole is getting bigger and bigger.

Finally, the cash reserve is insufficient to meet users' demand for withdrawal, and the scale of overdraft is expected to be between 7000 and 13000BTC

Official Announcement

Subsequently, FCoin issued an announcement again to change the email withdrawal process: users receiving verification codes do not mean that they can successfully withdraw cash, they must go through the verification of mailbox + assets.

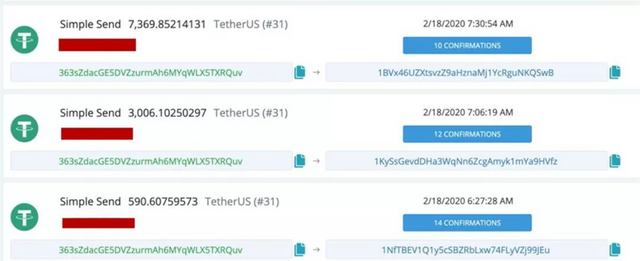

On February 18, some netizens raised doubts: FCoin's email withdrawal efficiency is bad, basically clear a dozen or even only a few in a day. We have enough reasons to believe that this is FCoin's self-directed and acted scene to deceive users.

Some trading History

On February 19th, according to the current public information, FCoin hot wallet has about 8578,800 us dollars of assets (661.1btc, 6232.73eth, 22,100 USDT). But there is a huge capital hole compared with the scale of overdraft of 7000-13000 BTC.

Once brilliant, hide today's fiasco

In 2018, when it comes to the phenomenal exchange, Fcoin, which was born out of nowhere, definitely took the top spot.

The "Trading is Mining" mode caught the eyes of countless players, and Fcoin suddenly became the most popular exchange. Daily trading volume not only beat Huobi, Okex, Binance and other exchanges, but also exceeded the sum of the latter.

At its craziest, Fcoin's one-day trading mining dividend reached 6000 BTC. The platform token FT grew 120-fold in just 20 days.

Behind the countless glories, the crisis began to flow.

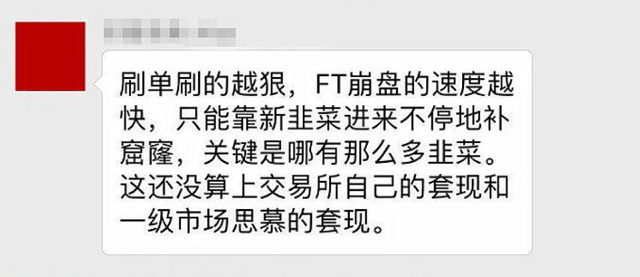

Screenshot of community views

On the one hand, there's been a lot of skepticism from industry competitors, with Binance co-founder openly questioning FCoin:

If an exchange does not have service fee income and the profit model is based on the rise of platform token, how will it survive if it does not pull? Are you sure you can beat a marketmaker? Are you sure you can beat an exchange marketmaker?

Notice: 49% of FT is held by funds, teams, partners and private investors through pre-release.

On the other hand, we found by looking at the change curve of the total amount of bitcoin in Fcoin cold wallet.

On July 22, 2018, the total number of bitcoins in FCoin reached 11,509. Since then, the overall number has been declining.

In the first quarter of 2019, the stock of bitcoins at the address was just over 2,000.

In October 2019, the bitcoin stock at the address was almost empty, leaving only a few dozen.

The change curve of the total amount of bitcoin in Fcoin cold wallet

Most importantly, Fcoin has lost a lot of users.

Most of the early users of FCoin came from Binance, Huobi, Okex, etc. During the collapse of FT prices, a large number of users chose to transfer COINS back to the previous exchanges.

To sum up, whether it is "run-away" or poor management, FCoin's abnormality has been seen since the second half of 2018.

Angry activists and fierce competitors

Although Zhang Jian's 3, 000-word announcement was emotional, it was clear that he was moved by himself.

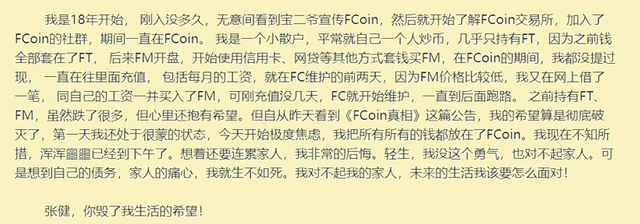

On the one hand, with the release of the announcement, FCoin users, regardless of whether in the community or social platform, without exception, all burst into flames.

A large number of rights protection posts appear online

FCoin telegram groups, FTFan community, WeChat community, etc., are all crowded with activist retail investors, many of whom wrote angrily:

Boss Zhang ran away with my hard-earned money!

On the other hand, He Yi, the founder of Binance, who regards FCoin as a competitor and is also known as "the queen of crypto", has also reopened her Weibo account and is suspected of expressing her views on the incident.

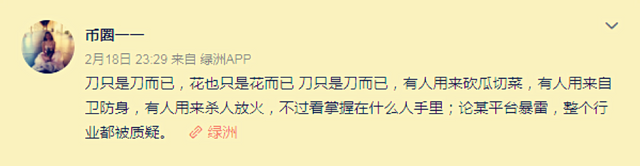

Screenshot of the content in Weibo

Looking back at history, how to clean up the mess

This is not the first time that exchanges have had a crisis of confidence, nor is it the first time that users have defended their rights.

For users, I suggest you use digital currency wallet + cold wallet double protection, to protect your assets while achieving steady asset growth.

View of Starteos:

As the must-have crypto wallet, Starteos wallet App is committed to creating a complete, innovative, fresh, comfortable, considerate and energetic full ecological experience station, which supports functions such as multi-chain, professional financial platform Acorn, eCloud, Free Resource package and Fiat money purchasing.

Click to view the video introduction about ‘Starteos’ Wallet App

Worked with the world's first one-click access cold wallet- Memory Box developed by Starteos, it has a 3-second high-speed link, dual storage units to ensure double security, and can store 500+ wallets. No one can pose any threat to your assets, unless you lost your password.

Click to learn more about Memory Box:

We invite you to join the beta group immediately for more hidden features and "little thoughts" in the Android beta version of Starteos Wallet App.

For FCoin, how to get out of danger in this hostile environment?

History does not repeat itself, but in reviewing history we sometimes find answers to problems.

Reviewing the crisis management methods of major exchanges, it may be of reference significance for FCoin and activist users:

Binance

In May 2019, Binance lost 7,000 bitcoins and then chose SAFU fund to compensate users.

Bitfinex:

In August 2016, Bitfinex lost 120,000 bitcoins.

Bitfinex elected to record losses on all accounts and to credit customer accounts at a ratio of 1 BTX to 1 USD, which the holder may convert into US dollars or Bitfinex parent stock.

This is a good way for investors to add value to their Bitfinex shares.

Mt.Gox:

In 2014, Mt.Gox started bankruptcy proceedings after losing 750,000 bitcoins. But the process never ended because the value of the 200,000 bitcoins remaining in Mt.Gox had already exceeded the legal losses of the users at the time, as the value of the COINS rose.

Now that the original owners of Mt.Gox have waived all claims to the liquidation of their assets, Mt.Gox's creditors have the option of accepting Fiat money payments or continuing to wait for bitcoin to be returned.

To sum up, it is very unlikely for FCoin to choose the first two methods when the core team is out of touch.

On the other hand, FCoin's platform token FT and its derivative "community governance" system bring more variables to FCoin's liquidation.

According to the latest news, the FCoin's third "Community Governance Committee" has contacted its controller Zhang Jian to try to restart FCoin.

How will FCoin deal with the crisis? The whole industry is waiting for Zhang Jian's next move.

Interestingly, at the end of Zhang Jian's "Announcement of the truth," there was this sentence:

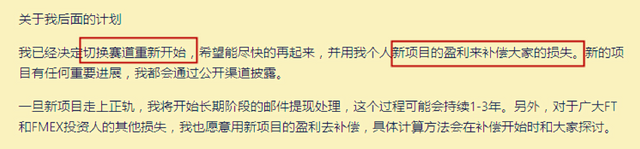

About my future plan:

I have decided to switch tracks and start again, hoping to get back on my feet as soon as possible and make up for the loss with the profits from my personal project. Any significant developments in the new project will be disclosed through public channels.

Once the new project is on track, I will start a long-term email withdrawal process that may last 1-3 years. In addition, for other losses of FMEX investors of the majority of FT, I would also like to use the profits of the new project to compensate. Specific calculation methods will be discussed with you at the beginning of compensation.

Screenshot of the content

It seems that Zhang Jian gave us a new choice to make up for Fcoin's loss by choosing a new project to stage a comeback.

Fantasy of the overnight rich people are everywhere, the road to sudden wealth is ten thousand people across a single-plank bridge.

But after this, who else would easily believe Zhang Jian's new project.

I believe everyone in this industry has a different answer to this question.