Using SPXU to Short Equities

Introduction

As everyone who reads this blog knows, I'm an equity bear.

Pardon me if I think buying at the all-time high is a stupid idea and pardon me if I observe history closely when I say that all-time-highs almost always precede routs.

There is absolutely no reason for equities to be as expensive as they are given all the fear and doubt hanging over the world economies. Especially with regard to the European situation and the somewhat mixed messages emanating from the Federal Reserve and the ongoing slowdown in China (which almost everyone is ignoring). Not to mention the mess in the UK and Europe.

The world is a less secure place and uncertainty has risen markedly since 2015 so why should the risky-side of mainstream investments (I.e. equities) be at all-time highs? I feel this question deserves an answer from devout equity bulls.

In this article I'm going to present a deconstruction of the current state of the primary United States stock market ETF (the S&P500) and explore and examine a method for attacking it which I consider to have meric.

My goal is to present a blueprint for shorting equities which may prove safer than borrowing shares or indeed my own traditional method of using CFD's set up in "short configurations".

The Buyback Bubble(s)

One of the reasons western equity markets are so expensive is that corporate buybacks have of course helped support the price of equities since around 2010.

Buybacks recently passed the $1trillion mark and have been responsible for a huge chunk of the gains in the prices of stocks such as AAPL (who are the biggest buyback firm by weight) and undoubtedly are one of the reasons we arrived at the present situation in corporate equity markets.

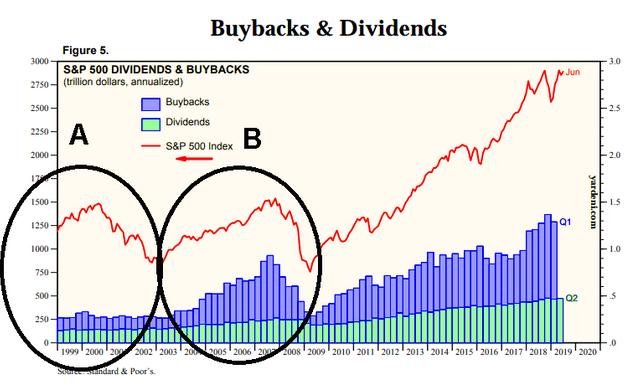

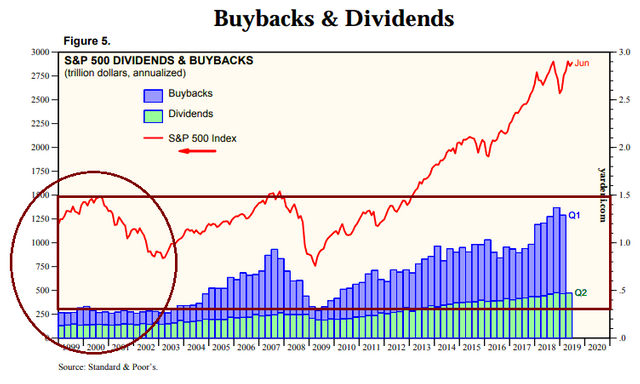

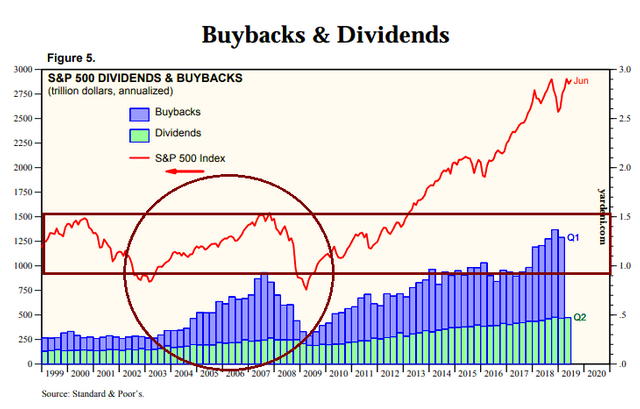

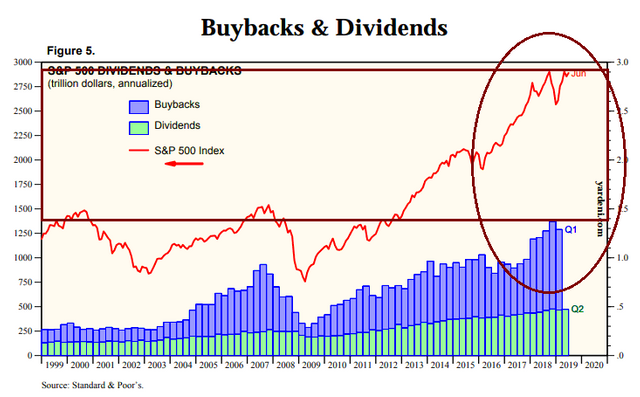

If we look at buybacks for the wider S&P500 there are some interesting observations we can make.

Firstly, the present buyback bubble (yes it's a bubble, I'll qualify that assertion within this article) is actually nothing new. We’ve actually been here before.

If w look at buybacks & dividends for the S&P500 and cross-compare it with the raw price performance of the index then we can see that the 2008 collapse was also a buyback bubble.

Interestingly, if you compare the range between buyback volume and price performance on the housing bubble (in 2008) to the range between buyback volume and price performance on the tech bubble ( which burst in 2001) then you will notice something very interesting.

Comparing Fig. A to Fig. B we see a very similar price performance however... we also see a markedly different performance in total buybacks.

Thus we have a much greater range between the buyback volume and the price performance on the tech bubble.

To compare, the tech bubble displayed a volume vs. price range of about 1.2 (referencing the right axis of this graph).

During the housing bubble the gap between price and buyback volume closed dramatically and displayed a range of only 0.65.

This suggests actually, that grassroots buyer and ETF activity was actually lower in the housing bubble than it was during the dotcom era and thus, that the housing bubble was "more artificial" as it had a greater ratio of buybacks per $ of gains.

Interestingly, during the modern buyback bubble, we display a range of about 1.52.

This is by far the largest range in terms of volume to price even with more overall buybacks in the marketplace..

So, the question is, where is the price coming from? It cannot be driven by buybacks alone. There is another vector of buyers pouring capital into the equity markets somewhere.

Equity Trade Volume

Individual stock volumes on the whole are pretty pathetic by historical standards and the soaring price coupled with this factor is evidence of buybacks being the primary driver of prices.

Think about this for a moment. What a buyback does is reduce the total amount of outstanding shares by buying them back into the company. This means the total amount of shares on the open market become is reduce and scarcity related price dynamics kick in. As such, shares command higher prices in order to acquire.

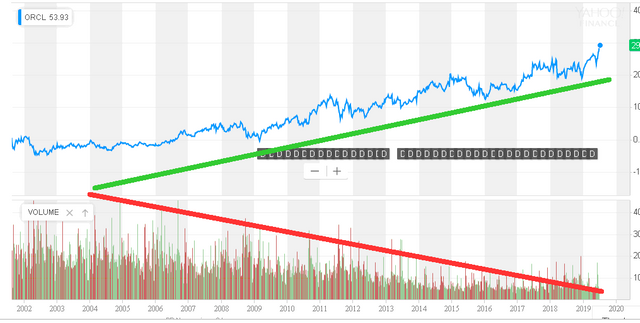

For example here is a chart of ORCL (Oracle - one of the biggest buyback cowboy firms) showing diverging price and volume - the opposite of what you would normally expect in a market and as such is evidence of other factors driving the price.

This is clear evidence of the buyback bubble in all it's glory.

When we look at the S&P500 ETF itself however, then we can also see that this shows a very different pattern on volume vs. price.

Though demonstrating a similar inverse-correlation versus price and declining for the first 7 years or so after the housing bubble burst, volume is actually very stable and as such it can be demonstrated this is where the majority of grassroots investors, traders and retail buyers are focusing.

This is where I believe the volume which has been driving the price-performance of the S&P500 ETF above and beyond levels which it's buyback-stocks could do by themselves has been coming from.

FOMO kicked in and is driving the bubble to new heights.

To summarise, what we have here is ETF's which have been pumped-up by the buyback bubble and are now in the process of forming their own more-traditional speculative-buyer bubble comprised of people who have been seduced by the apparently quick and easy gains.

We have a bubble-within-a-bubble.

- Stocks pump up their values using buybacks

- Their values pump up their ETF's

- Thus driving a speculative buyer bubble in ETF's and index funds.

This means that ETF's and indices are likely where the retail investor crash will actually occur because this is where the "dumb money" is focusing itself and this is where the "missing volume" is gathering in the markets.

Needless to say, this will not end well.

Attacking US Equities

The profit-potential of an attack on US equities should be fairly obvious. We seem to be at the top of the market and the S&P500 has often shed as much as 70% unleveraged during full-blown market crashes. However, missing parts of the puzzle tend to revolve about the “when and how” of the matter.

The US stock market, and by extension, US ETF's are notoriously expensive to perform trades on. To clarify, a long position on the S&P500 will set you back $3,000 per share. A lot of money for just one ETF share. Similarly, due to the raw expense of these ETF shares, they're pretty difficult to borrow for the sake of shorting and liquidity is pretty low because you're practically asking to borrow $3000 worth of relatively illiquid capital assets for the sake of a fairly risky bet against the markets. Borrowing costs for this can therefore be pretty high and therefore borrowing them in substantial numbers is a generally rubbish idea.

Thus, a cheaper and less-risky way of doing this is to use derivatives wherein you will simply pay a deposit for the contract.

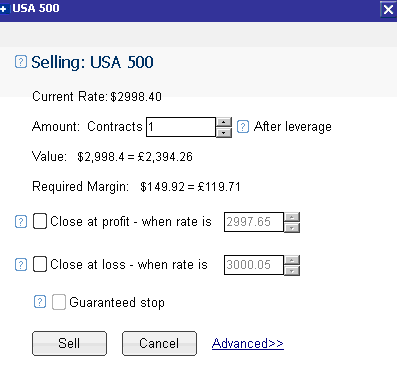

Lets look at an example using simple Contract-For-Difference (CFD) derivatives.

As you can see, the above position requires only $135 to get started (however, I would argue against doing this and would plough more funds into the account to cover the relatively big moves on the S&P500 due to it's sheer cost which I'll explain more below).

One of the disadvantages to this approach is volatility on the S&P500 can be extreme in raw dollar value due to it's hefty price tag of around $3000 per ETF share. As such this is a significant disadvantage of trying to perform low-capital derivative trades against the S&P500 as upside risk is still substantial even now.

Even something as small as a 1% move on the S&P500 in percentage terms can translate to a $300 move in dollar-terms ultimately because at top of the market (where short positions would be more profitable), the raw $dollar values are bigger per percentage of gains/losses..

Another way of performing this sort of speculative attack on the markets which I've been examining of late which appears to be safer is to use a short etf which, simply put, is an ETF comprised of instruments which rise as the USA500 falls (and vice versa).

We're going to look at one such ETF here. Specifically, the Proshares Ultrashort Pro S&P500.

Inverse Trading

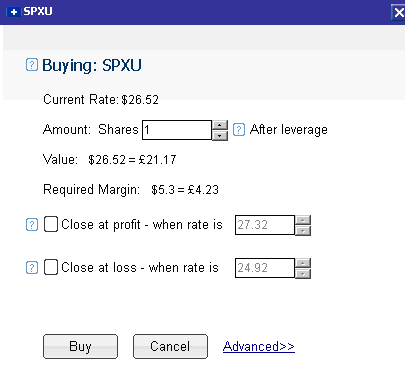

The Proshares Ultrashort Pro S&P500 ETF is based on swaps against the S&P500 and has a starting price of just $26..

The fund description states:

"The investment seeks daily investment results before fees and expenses that correspond to three times the inverse (-3x) of the daily performance of the S&P 500® Index. The fund invests in financial instruments that ProShare Advisors believes, in combination, should produce daily returns consistent with the fund's investment objective. The index is a measure of large-cap U.S. stock market performance. The fund is non-diversified."

So in theory, this means that you can get a 3x leveraged position against the horrifically overpriced United States stock market for just $26.

The main advantage here of course is that you do not need to shell out lots of capital or borrow shares or anything like that to actually perform an attack on the markets.

The primary disadvantage here, is that the way the fund has been set up by Proshares disincentivizes long-term positions and could be incredibly difficult to take profits on later* if you did particularly well out of your position due to some relatively simple dynamics of the market.

Let me explain.

Imagine you hold SPXU ETF shares and get a good entry into the market shortly before a serious downturn.

Well done. You bought ETF shares for $26 which are now appreciating rapidly.

After a few years holding your SPXU shares have gone up in value from $26 to over $3000 at the point of maximum profit potential (as they would have done if you bought them around the 2007 era and held them until about 2009).

Okay, great. You made a good call. Equities are at the bottom of the market and your SPXU shares are now at the top. You hold a pile of potential capital just waiting to be released. Yummy.

However... there is a catch (predictable eh?). In this situation S&P500 ETF shares would be at the bottom of the market after a pretty hefty crash. Very little demonstrable downside left and considerable upside potential to the de facto S&P500 ETF.

Your SPXU shares are worth around $3,000 a piece however they can only realistically decline in value from thereon out as the S&P500 is most likely to start appreciating and of course the SPXU, which is inverse-indexed against the S&P500, will begin move in relation to it's inverse - downwards.

As such, you are stuck with a very valuable asset which nobody will want to buy and as such is practically worthless in market-value terms.

sadface.jpeg

You can surely see the problem. The issue per se is not with what to buy or how much or how to enter the market, but actually taking profits once actualised. A winning position here could quickly become a completely unrealisable one due to a quirk of the instrument we're working with.

So, to override this disadvantage and get around the problem we are going to ignore the de facto ETF shares and instead use derivatives indexed against its price performance.

The Solution: Derivative Trading on SPXU

Combining the two approaches offers the best possible advantage.

Looking at derivative brokers, then those that include SPXU among their instruments are offering positions on it for around $5 of margin per share (so basically 20%).

The advantage here is due to the fact that a derivative really boils down to a bet between yourself and the broker and that taking-profits is made easy simply by closing the position. There is nothing to buy or sell. The broker is entering into a contract by brokering the derivative to you and cannot easily prevent you from cashing out and taking profits even though the broker loses a considerable amount of money in the process.

So unlike taking profit on de facto SPXU shares, you do not have to worry about selling the contracts. You can just close the positions and take profits.

The Maths Of Derivative Trading On SPXU

Now remember what we are setting up a trade on here.

The derivative I outline in this piece is a mathematical instrument traded on-margin and is indexed against an ETF designed to return a 3x leveraged bet against the S&P500 and moves inversely to it in an exponential fashion.

Sounds horrible right?

Well, yes actually.

I would consider this a considerably risky trade but the profit potential is enormous and as such we need to calculate the position out in-depth in advance to be conservative enough in writing our contracts to defend our capital while taking enough risk onboard to deliver decent amounts of profits.

Understanding the instruments in question is the key to a successful trade.

Thusly we need to think about the maths in play here and calculate out the downside risk in such a way that limits our risk of potentially damaging margin calls or worse.

So lets look at the numbers of what we're actually going to be trading.

1. Firstly, the obvious. The SPXU is stated as being triple-leveraged to return 3x the inverse of the S&P500's daily performance.

This means that (in theory) the SPXU will return 3% for every 1% on the S&P500 and is adjusted daily to correlate as closely as possible to the inverse of the S&P500's daily performance.

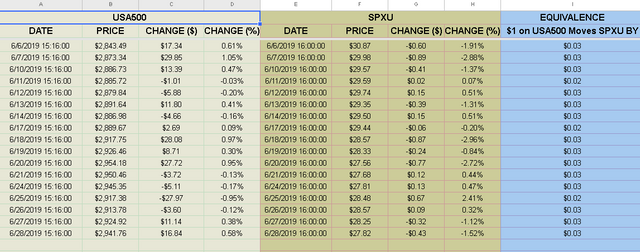

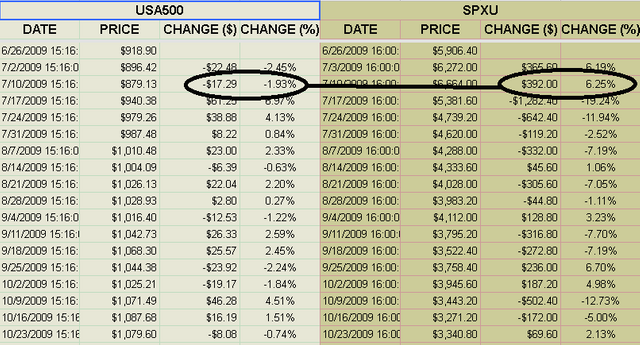

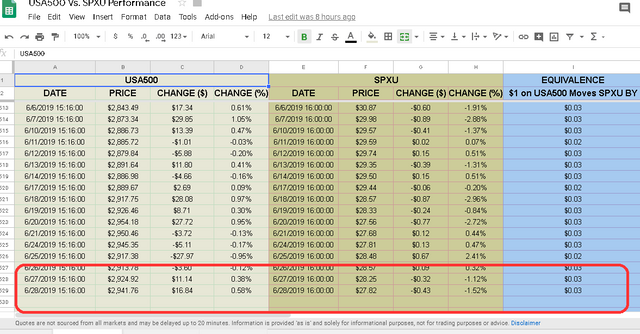

One of the first things I did (Credit to a Mr. Cresswell for assisting me with the horribly complex maths within this article) was to reference the USA500 out against the SPXU over their history since 2009 to determine exactly how $1 on the US500 equated to on the SPXU.

The accompanying spreadsheet can be viewed here https://docs.google.com/spreadsheets/d/1tnwsiBPaVaa5c25qFOgU7-Lbb4W5JDeUcg4cKgBKELM/edit?usp=sharing

I enclose a screenshot here for convenience and to demonstrate the concepts.

There is about 45 minutes worth of lag in the cross-referencing as I am sure you will see but by carefully comparing the values we can see that we can work out what $1 on the USA500 would be worth on the SPXU for each point in the market cycle (E.g. at every point between all-time-highs and all-time-lows).

The raw percentile equivalence at the present time is simple enough. In short (no pun intended) for every 1% the S%P500 gains/loses then the SPXU will gain/lose about 3%.

2. Actual $ Value for $1 on the S&P500 Vs. The SPXU Varies Over A Very Wide Price Range

Remember that because we are referencing percentile values across 2 instruments moving inversely to each other (one of which is leveraged) then the maths quickly becomes wildly complex when we look at actual $dollar values of each unit (as opposed to percentages).

To clarify, as USA500 depreciates (And SPXU appreciates), then the bigger the dollar values returned by SPXU become.

Similarly, as the USA500 appreciates (And SPXU depreciates), then the raw dollar values returned by SPXU movements shrink.

This is because SPXU is actually moving exponentially relative to a linear USA500.

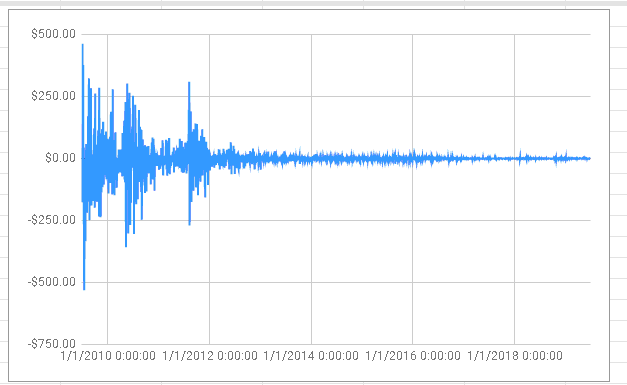

Here is a simple 10 year chart to illustrate this.

This shot of the spreadsheet referencing the 2009 era also demonstrates how returns per $1 increase as SPXU appreciates relative to USA500.

To sum up, if there is a serious crash on the USA500 (presuming it sheds around 60%), the SPXU will be moving by about $25 for every $1 on the USA500 by the time it gets to rock bottom.

This seems extreme. In cash-basis, it is effectively equivalent to leveraging each $1 of your position by 25 on a margin trade.

However the truth of the matter in practice would be that by the time we got to these sort of movements, then as long as our entry points are made early-on enough, we would be deep into profit by which time such movements would be largely ineffectual versus the total capitalisation of our position and trading accounts. It must also be pointed out that this would be at the effective end of the lifespan of our position near the final penultimate take-profit points.

The good news is that SPXU will return far smaller values nearer to our entry point as this snapshot of the spreadsheet referencing the 2019 era shows.

As you can see, movements on the S&P500 closer to it's all-time-high return very very small dollar values on the SPXU with $1 on the USA500 worth about 3 cents on the SPXU.

As such this trade can be thought of as a leverage gradient which will begin at around 25:1 (meaning every 25 dollars on the S&P500 is worth 1 dollar on SPXU) while the S&P500 is at all time high and gradually move on to 1:25 ratio at the bottom of the market (wherein every $1 on the S&P500 will be worth around $25 on SPXU).

Summary Of The Maths

If the above seems bewilderingly complex, then let me attempt to summarise the numbers for you.

SPXU will return smaller numbers relative to the top of the market on USA500, and bigger numbers nearer the bottom of the market on the USA500 per $1 of investment capital in a position.

This is because SPXU moves exponentially while USA500 moves in a linear fashion.

This means that although the stated leverage is 3:1, that in practice your position will start off with a dollar-to-dollar leverage value of 1:25 and taper onto an effective leverage of around 25:1 as the numbers get bigger on the SPXU relative to each base movement of $1 on the S&P500.

An advantage here is that the SPXU will return smaller numbers for each $1 on the S&P500 nearer the S&P500's all-time-high. This makes entering into the market and establishing the position safer.

The Obvious Issues With All This Stuff

The obvious issue here, is that every $1 move on USA500 will return more raw dollars on SPXU if a crash hit deep enough.

This could cause problems with, for example. trailing stop losses and of course trades executed via CFD’s on-margin..

So, lets look at possible big moves and try to forecast in advance what we might be dealing with.

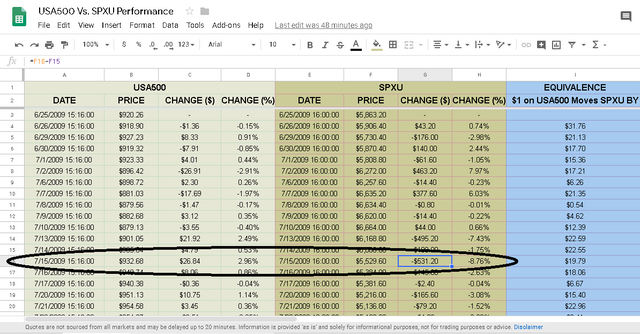

The biggest move ever seen on SPXU was a whole $531 downmove made over a single day.

This sounds like a horrific amount of money for a single daily move and it was caused by a 2.96% / $26.84 move on the USA500 back in July 2009 during an intense spree of buying on the USA500 right at the bottom of the market after the crash.

As such, these are the kind of sums our CFD positions will have to deal with.

My solution to this is to divide SPXU's historical chart up into segments where each dollar-leveraging effect is most defined and ensure that positions are calculated in advance to suit the needs of the trades.

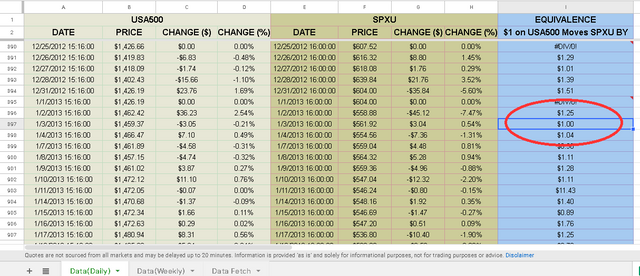

A prime example of the tapering of dollar-leverage can be shown by looking at the 2013 period on the spreadsheet.

The etfs reached roughly equal power on 1/3/2013 where each USA500 move was worth the same amount on SPXU in raw $dollar value.

This occurred at roughly around the $2000 price point on the USA500 / around the $1500 area on SPXU.

As such there is a "shallow trade" zone above the $2000 price point (on the USA500) and a "deep trade" zone below it.

• Shallow Zone = leverage equivalent to less than $1 SPXU movement per movement of $1 on the S&P500

• Deep Zone = leverage equivalent to more than $1 SPXU movement per movement of $1 on the S&P500

CFD’s In Practice

All of this is relevant because, in practice, to successfully trade a CFD you have to be very careful about volatility which might ruin your position and subject you to expensive margin calls.

If we look at the histogram of the SPXU’s price performance then we can see that the SPXU has sometimes moved by more than $400 in a single day.

Thus, with the effect of margin coming into play via CFD contracts against any trades here, we must calculate out our positions in advance thusly.

The compounding effects of the ETF are a real issue and as such we must check against what might go wrong.

The good news is that the SPXU’s performance yields smaller “blocks” when the USA500 is at top of the market. This is a good thin

Thus I believe the obvious solution here is to adjust trailing stop-losses (or in fact any kind of stop-losses) before the S&P500 breaks into the deep zone and then closing up at entry into it and reentering with a new configuration as the SPXU move into it to account for the dollar leveraging effect.

Of course this presumes that IT WILL break into the deep zone.

Only time will tell whether this is on the cards or not and ultimately anyone following the outline for shorting United States equities through using the SPXU must be prepared for this possibility as the leveraging effects of SPXU manifests itself in an extreme fashion later on down the line.

Conclusion

Check out the SPXU leveraged ETF. I believe it offers many key advantages. More importantly it may help you find a way to attack equities which yields the most benefit all-in-all.