Why is ETH silent in the DeFi carnival?

Content

In recent times, it has basically been a feast of DeFi. From Kyber to Compound, a series of DeFi projects have continued to break new highs. The overall market value of DeFi has exceeded 5.5 billion U.S. dollars. This breakthrough is not only a breakthrough in its market value, but also a continuous increase in business volume.

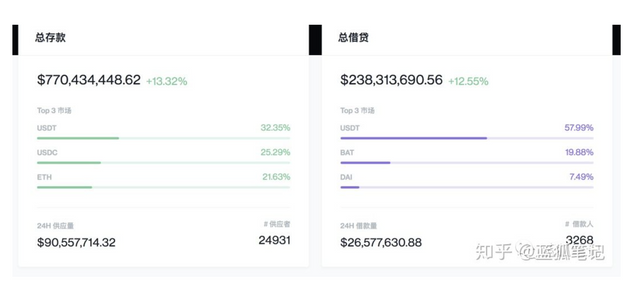

(Even for the purpose of pressing COMP, Compound’s total deposits and total borrowings have increased several times within a week)

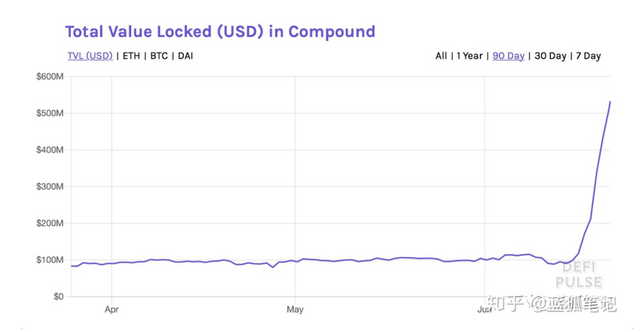

For example, Compound's locked assets amounted to less than US$100 million a week ago, but now it has exceeded US$500 million, surpassing Maker to become the project with the largest amount of locked assets in DeFi.

(The total amount of assets locked by Compound exceeds 500 million U.S. dollars, source: DEFIPULSE)

This speed of development is somewhat magical. You know, DeFi has always spent a lot of effort to lock up the total assets of more than 1 billion U.S. dollars. The previous breakthrough of 1 billion U.S. dollars basically relied on the rise of ETH, but this time it was easily broken.

However, during the DeFi carnival, as the public chain on which DeFi was built, ETH fell into silence. Recently, many readers of Blue Fox Notes are asking: What happened to ETH?

Stable currency pulls Vs ETH crowdfunding pull

The 2017 project crowdfunding token was ETH, which greatly stimulated the demand for ETH. After 2018, the Aixiou model basically failed and turned to the VC model. For most early participants, this model cannot participate.

For example, Compound raised more than US$30 million from VCs, less than a year after the last round of US$25 million in financing, and now they hold tokens worth more than US$500 million, with a return of more than 17 times in less than a year. Is this really a better model than Asia? For VC, yes. Because only they can participate in the early days.

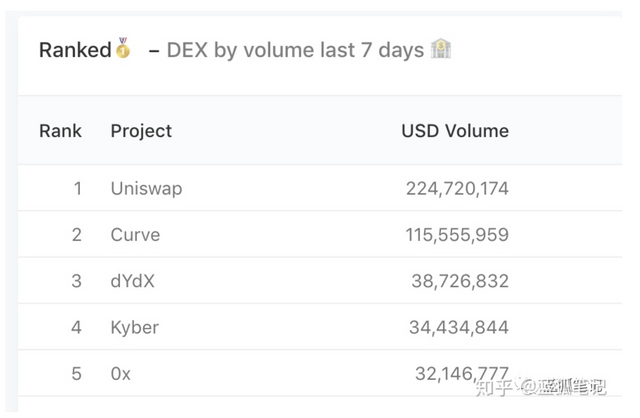

In the 2020 round, stablecoins have been used the most so far, not ETH. There are billions of dollars of stablecoins flowing on Ethereum. Curve's stablecoin transaction volume has remained high in the last two days. Its total transaction volume reached 115 million U.S. dollars in 7 days, which is close to Uniswap's 224 million U.S. dollars. It is developing rapidly and far. Super other DEX.

(DEX ranking of the most seven-day trading volume, source: duneanalytics)

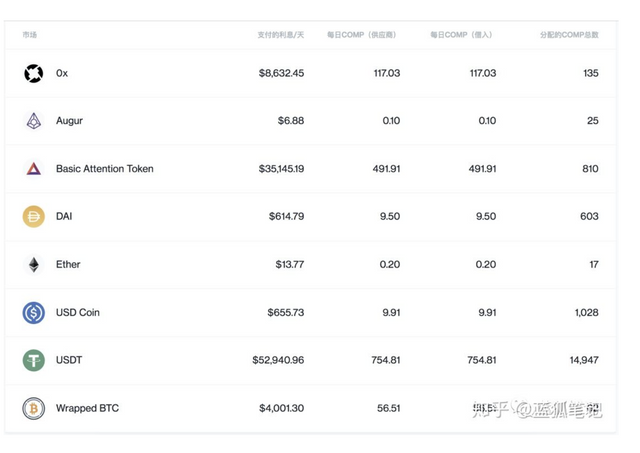

The most profitable mining tokens on Compound are USDT and USDC, which account for the vast majority of shares.

As can be seen from the above figure, in Compound's liquidity mining, stablecoins are the dominant currency so far, not ETH. This is completely different from the 2017 crowdfunding.

ETH opportunity is coming at Phase0

It will take some time before the phase 0 phase of ETH2.0 is fully launched. I don't know whether it will be at the end of August or before the end of the year. No matter what, it is still being tested, so the temporary dormancy is understandable. Once phase0 comes, the PoS mortgage comes, and the follow-up EIP1559 comes, the demand for ETH may far exceed the demand for Western Europe. The subsequent feast may not be inferior to DeFi today.

The two engines are still accumulating power

The cycle relationship "Encryption Cycle and Value Flow" that Blue Fox Notes talked about last time is currently in the small cycle stage. The big cycle requires the driving force of a big engine. The two major engines in the crypto world are Bitcoin and Ethereum. The Bitcoin engine is accumulating in the halving effect and macroeconomic changes, the Ethereum engine is being launched in ETH2.0 and DeFi continues to evolve. These two engines are accumulating power. Once the two engines are ready, their power is so powerful that it cannot be compared with today's DeFi. Of course, the future of DeFi is another matter.

Judging from the costs captured by public chains today, except for Ethereum and Bitcoin, the costs of other public chains are almost negligible. It should also be noted that the cost of Ethereum not only exceeds that of Bitcoin, but also far exceeds that of Bitcoin. If Ethereum's roads are widened in the future, the expenses it can capture will only be more. From this perspective, the Ethereum engine will not be inferior to Bitcoin in the future, and it is not impossible to surpass Bitcoin.