Dotcom bubble & Cryptocurrencies bubble

A lot of CryptoCurrency enthusiasts like to compare the Dotcom bubble with the current Cryptocurrencies market capitalization, but some do it in a negative context (people like me), some do it in a positive context (by showing that current crypto market capitalization is so small in comparison to the Dotcom peak in 2000).

Today I would like to show you why it is naïve, overly simplistic, and preposterous to compare capitalizations of Dotcom companies with Cryptocurrencies. (Thanks to Kojin Sama for raising the question https://medium.com/@kojin_sama/thoughts-on-the-digital-economy-4f88917bf6fe)

I called this slide “willfully blind” because I think that a lot of crypto experts actually see the flaw in their comparison but still do it for the sake of attracting more investments into Cryptocurrencies. Well, I value truth more, so I will show why comparing capitalizations of markets mentioned above is wrong.

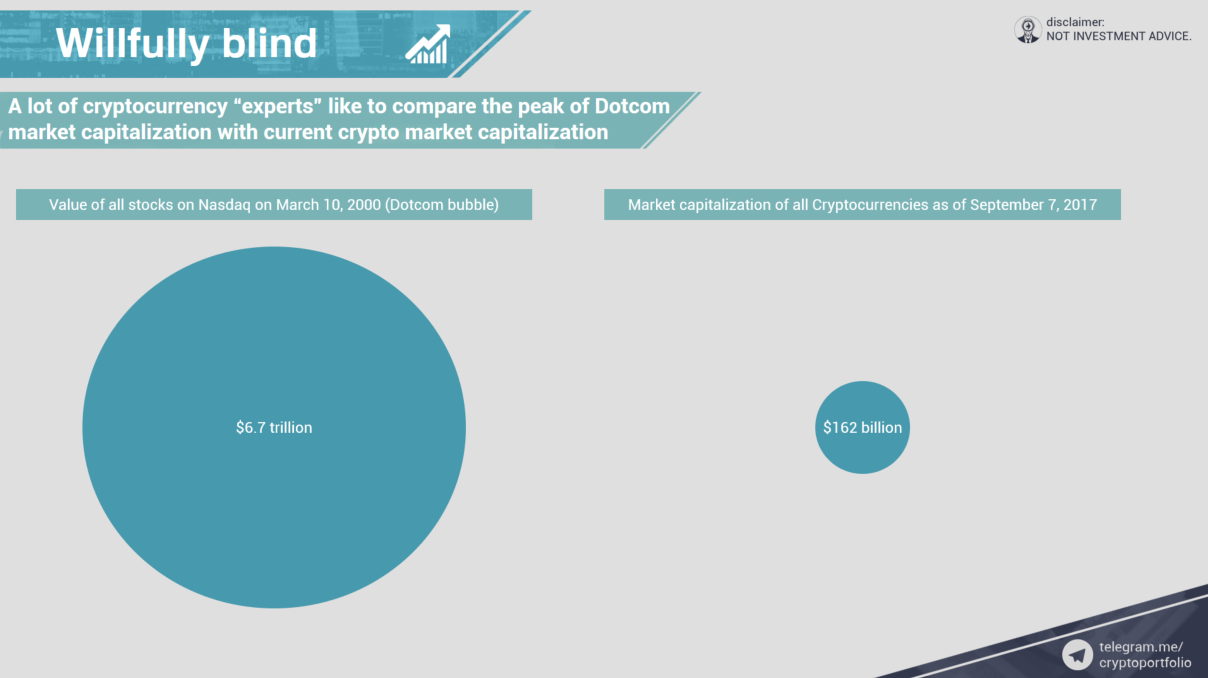

First of all, let’s see what image has become very widespread lately. Here is the capitalization of all Nasdaq companies during the Dotcom bubble peak in 2000. It is $6.7 trillion.

Here is the capitalization of all cryptocurrencies as of 7th of September, 2017. It is $162 billion.

Attractive image, isn’t it? =)

The main reason I was “triggered” while seeing this image is that you cannot compare such things. Nasdaq listed companies and cryptocurrencies are uncomparable. How?

Listed companies have cash flows, profits, costs, margins, balance sheets, net income statements, audits, and so on. Cryptocurrencies do not possess these features.

Also, listed companies pay out dividends while cryptocurrencies are unable to do this legally. At least now. The cryptoprojects which are centered around paying out dividends are illegal. You need to register your tokens as securities if you want to sell those tokens to other people. For example, a lot of casinos which collect money on ICOs and pay out dividends are illegal. Even buying tokens can be dangerous for investors (especially, if you are a citizen of US of A).

In reality, this $6.7 trillion Dotcom bubble is not accounted for inflation (more than 17 years have passed). Now it is $9.65 trillion.

Cryptocurrencies should be compared to other financial instruments. For example, gold, currencies, and securities without dividends.

We already understood that comparing capitalizations of real world companies and cryptocurrencies is wrong. Now what? Let’s find out what aspects of Dotcom bubble are actually comparable.

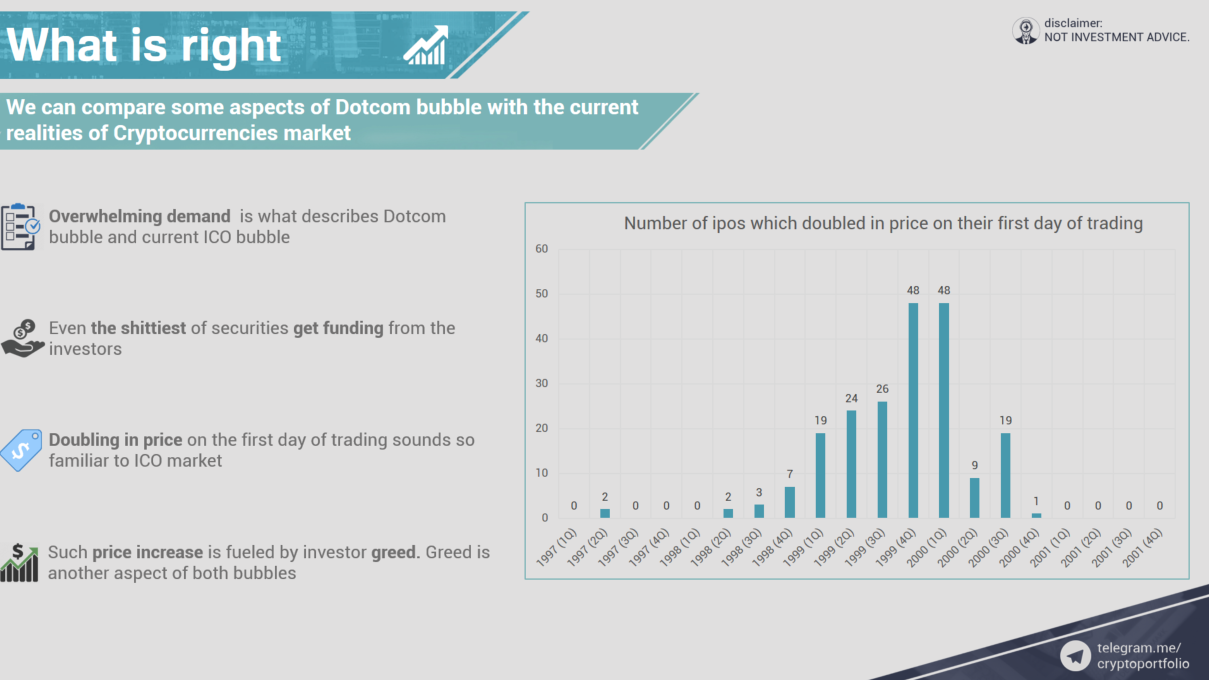

Overwhelming demand is what describes Dotcom bubble and current ICO bubble. Nobody can challenge that point. Many crypto experts agree that current ICO situation is toxic for cryptocurrency community.

Even the shittiest of securities get funding from the investors. Yep, the same here in the cryptoworld.

Did you know that during Dotcom bubble a lot of companies’ shares doubled in price on the first trading day? Sounds familiar, right?

Such price increase is fueled by investor greed. Greed is another aspect of both bubbles.

What other aspects of Dotcom bubble can be compared?

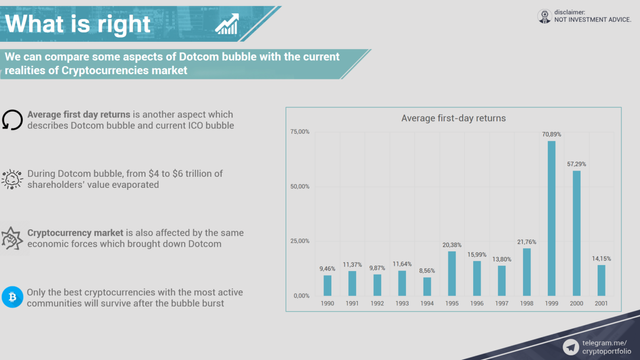

Average first day returns is another aspect which describes Dotcom bubble and current ICO bubble. From the graph you can see that during 1999 to 2000 the average first day returns were abnormal.

During Dotcom bubble, from $4 to $6 trillion of shareholders’ value evaporated. This is just an interesting fact which is also applicable to crypto.

Cryptocurrency market is also affected by the same economic forces which brought down Dotcom.

Only the best cryptocurrencies with the most active communities will survive after the bubble burst.

Don’t forget to subscribe and see you next time. And remember that real capitalization of cryptocurrency is not circulating supply multiplied by price, but TOTAL supply multiplied by price. Don’t let coinmarketcap fool you!

I feel the dotcom stocks really can't be compared to cryptos due to the distributed nature of the these blockchain-based assets. It's like comparing apples to trees, or apples to spiderwebs.

Secondly, bitcoin is already being used in certain countries to escape hyperinflation and devaluation. This was never the case with any of the dotcoms.

Thanks for this. It's unbearable to reason with people spouting "BUBBLE" as loud as possible, and this post will be a good addition to my copy&paste list of links response that most of them will ignore. Regardless, great content as usual, keep it up.

I personally think we're still far from bubble territory & agree that crypto can't really be compared with stocks since this would be saying like fiat currency is a bubble even though it inflates overtime. Of course, the ICO market will probably be what causes the next long bear run like what happened with alt-coins around 2013-2015 until enough crap fades away then more cream rises to the top. That's why I also think bubble economics will probably subside in crypto-currencies whenever their prices stabilize to the point where post bubble ICO's deliver more steady returns with, hopefully, much better products which serve larger numbers of people.

They are pretty much the same....most are out to scam people..just different time different technology, but the same motive!

Hi! I represent the official ICO bounty program https://crypto.tickets.

We really like your activity on Steemit and I want to invite you to our automated Steemit bounty program.

You can get Stakes easily for every repost or post.

About project: https://steemit.com/@crypto.tickets /@crypto.tickets

Official bounty page https://crypto.tickets/bounty.program.en.html and bounty thread – https://bitcointalk.org/index.php?topic=2164768.msg21681052#msg21681052

Please, let me now about your decision in return message 😉