Is Ethereum Taking a Hit by the Downtrending ICOs?

Is Ethereum Taking a Hit by the Downtrending ICOs?

In only a few years, Ethereum has established itself as the go-to coin for the global cryptocurrency ecosystem. Widely acclaimed for its role in the initial coin offering (ICO) space, Ethereum has to its credit to be the second most sought-after coin on the market. This factor inflated Ethereum (ETH) price from a mere USD 10 to more than USD 1300 by January 2018. This impressive growth of 3900% can be rightly attributed to the mass sensation and buzz surrounding the cryptocurrencies. However, behind Ether’s rapid price inflation lies a different reason. It was the mushrooming number of ICOs that lead to Ethereum’s price spurt. But is the case same now? It certainly is not.

Since the beginning of 2018, Ethereum was seen struggling to manage even a modest valuation. Common sense would dictate that if the price inflation was related to ICOs, then the downfall must be too! True. ETH prices are getting hit by ICOs currently. To get a hold of this ETH dynamic, we first need to see how ICOs affect Ether’s price function.

How are ETH prices related to ICOs?

Fundamentally, an ICO is a way to raise the capital/funds for a Blockchain based project. In an ICO, the ambitious project appeals to individuals and groups to buy their token, and support the platform’s growth. People purchase these tokens in the hopes that the price will appreciate with time. Note that these tokens may not necessarily represent the ‘equity’ within the company, but access to the company’s services or exclusive features.

ICO stage

What ICOs have been doing since their inception is piggybacking on the ETH platform. Due to this, Ether price is taking massive hits, simply because of the amount of ICOs that were and are still going on. For instance, take the example of the blockchain projects that generated a lot of interest and had no cap limit to raise funds via the ICOs. Such project leads to the raise of hundreds of millions of Ether, and in turns a sudden boost in ETH prices. People were in a rush to buy Ether to step into and launch the ICOs. This resulted in Ether being slowly removed from the market widening the demand gap for liquid ETH.

Post-ICO stage

ICOs generated a buzz, raised the necessary funds, and kickstarted their projects. What we are witnessing now is the developmental stage of the companies/blockchain projects that people invest in, aka Post ICO-stage. To understand why Ethers prices are being driven down by ICOs, consider the following points:

● Companies that managed to raise funds in the ICO rounds will not wait to sell the substantial amount of tokens to fund their projects until the ETH price goes down.

● Whatever amount a company raises, it will use it for as long as it can.

● Some newer companies simply cannot risk it and wait for ETH prices to shoot up before selling their tokens.

● Companies that promised their backers to hold their respective token for a said amount of time cannot keep their promise if the ETH prices fall below a particular mark.

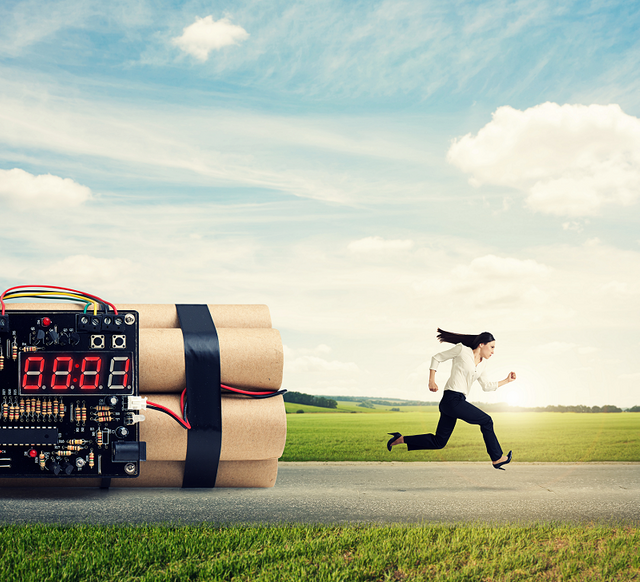

Crypto Pricing Time Bomb

Once companies accumulate a currency like ETH and removed from the market, it loses liquidity. Once the ICOs begin their sales rounds, ETH suddenly gets released into the market, thereby booming the availability of ETH which was scarce a few months back. This cycle creates a negative impact on long-term pricing of Ethereum. A large number of ICOs pull in way too much of a cryptocurrency (Like ETH) from the market, essentially creating a ticking time-bomb of crypto coins ready to flood the market. This creates two key effects:

- Companies are always in a hurry to liquidate (sell) the raised ETH as soon as they can. They do not wait for prices to appreciate, rather sell the tokens rapidly.

- Mimicking other companies that are busy selling-off their ETH without anticipating a rise in the future, many companies liquidate their ETH stock immediately.

The effects mentioned above create a race, but, to the bottom. For instance, an expert says that a drop of 20% in the pricing can trigger companies to unload and sell ETH rapidly. All the factors combined bring down the ETH prices.

Why ETH for ICOs?

The inherent difference between ETH and most of the other cryptocurrencies is that the latter ones are meant usually for transactions only. Ethereum, on the other hand, is a blockchain platform that allows the developers to create smart contracts and Decentralized Apps. Since most ICOs involve blockchain technology, it makes sense that ETH would be a more favorable currency during ICO rounds. Due to Ethereum’s versatility, there was a surge in demand for ETH to launch and take part in ICOs. This, in brief, shot up the Ether prices.

Ethereum is not the only blockchain platform used for ICOs, but is the most popular one. According to ICOWatchList, more than 82% of projects choose to issue their tokens on Ethereum.

What other factors affect ETH pricing?

Several other key-factors affect Ether’s pricing. They are:

● Mining: The mining profitability is also a reason behind the fluctuation in Ethereum’s price. If one mines Ethereum with a decent hardware, it is definite to attain a profit, even if the Ethereum’s price at not very high level. However, with the involvement of more people in mining, the profitability gets reduced drastically. This will result in subsequent delay in sale of coins until the prices rise again.

● Cryptocurrency Exchanges: High interest in the cryptocurrencies has put pressure on the way the current crypto-market is functioning. First, many exchanges have halted signing-up new users. To quote an example, Bitfinex account registrations were temporarily curtailed in December. This step was taken to preserve the experiences of their existing customer base. To add, introducing users into an unknown technology system is a ball game al-together. While many people understand it, some get worried about it as they can be exposed to problems due to This again leads to ‘panic’ liquidation of ETH like currencies hitting their price towards the lower end.

● Regulations: Strict regulations and their enforcement causes investors to pull their money back from the cryptomarket. This has already been noticed when China banned all its cryptocurrency operations. Similarly, South Korea’s high-handed approach and scrutiny witnessed a decline in investment, leading the overall fall in cryptocurrencies worldwide. In India too, the market has seen a fall since Reserve Bank of India (RBI) declared use of cryptocurrencies as ‘illegal.’

Is ETH doomed?

A sharp fall in ETH price certainly does not imply that the currency is doomed to die in the near future. The fluctuation is just an indication of factors not working in favor of Ethereum. The major success of ETH must now be judged on how many of the companies are actually producing valuable products that solve a problem and fulfill a purpose.

ICOs are the most crucial use-case for ETH. However, this is not the only one application, nonetheless, it is a significant one. One possible way this vicious price cycle can be broken is by seeing whether ICOs have a significantly high success rate or not! If majority of them fail, it can be concluded that they are not the most efficient way to raise funds for a project.

As of now, it’s impossible to project the trajectory of Ethereum. This is primarily due to an array of variables that affect its price function. For these sort of fundings, regulators are continuously and rapidly forming frameworks. Which direction will ETH take in the long term? It is only the power of time that will tell.

Very interesting article with valuable facts of Ethereum. It is true that Companies are always in a hurry to liquidate (sell) the raised ETH , they need to make them to fiat to start up their business or project. So they need to sell them and make them fiat, can't blame them.

Exactly. How can the execute the project without converting the funds gained

very informative article about Etherium and got a great idea about current situations and about the facts which are the reasons for this current crypto market.

I agree with your point ICO's are the most crucial use-case for ETH. These Eth base projects , most of them are scams. Etherium must be more organized to avoid these.

I lost lot of money investing in Etherium recently. Bought them when the price 1 Eth = 470 $ and lost half of my money in few weeks. very disappointing. This is a field we should invest after proper study. very high risk.

I think it will be okey , probably at the end of 2018. Hopefully !

Another reason I like to add it the government regulations , specially for crypto currency investments. So this point also affected very negatively for Eth price.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/altcoin-magazine/eth-prices-getting-hit-by-icos-da906f31d575

Given the surmounting problems faced by Ethereum, it’s hard to understand why people are still investing. Anyone who knows anything about the past and more recent history of ETH, after all, should not be pumping more money into the cryptocurrency

Is ETH doomed? It's decreasing it's price. Some predictions said it will get low as 100$ at the end of the year. direction will ETH take in the long term? nobody knows

Thanks for sharing this information. very informative article. I'm very sure Etherium will increase its price at the end of the year when referring to prediction.