Your take on the Ethereum 24% plunge due to massive selloff

Investors who are trying to speculate in Ethereum and Bitcoin, be extra careful. This may be wrong but their charts look toppish to me.

Source: http://www.newsbtc.com/2017/06/27/bitcoin-price-technical-analysis-06272017-clearer-reversal-pattern/

Bitcoin Price Key Highlights

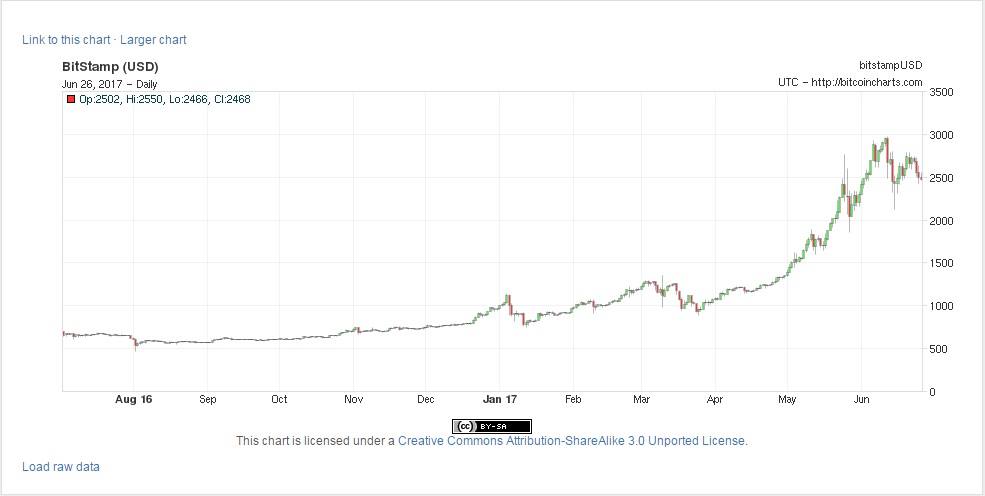

Bitcoin is still selling off, making the head and shoulders pattern previously hinted at earlier this month more visible.

Price is on its way to complete the right shoulder and to test the neckline around the $2300 level.

A break below this level could confirm that a long-term selloff is in the cards.

Technical Indicators Signals

The 100 SMA is above the 200 SMA for now, but the gap is narrowing to indicate that a downward crossover is looming. If this is completed, more bears could join the game and push for losses in bitcoin price.

The neckline is a diagonal one around the $2300 mark, so a break below this level could send bitcoin price lower by around $700 or the same height as the chart pattern. If it continues to keep losses in check, a quick bounce could be seen.

Stochastic is already indicating oversold conditions, which means that sellers are getting exhausted and could take a break soon. RSI is still pointing down to show that there’s bearish pressure in play but this oscillator is also nearing the oversold area.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.newsbtc.com/2017/06/27/bitcoin-price-technical-analysis-06272017-clearer-reversal-pattern/

today is the day to buy, upvote and follow if you agree... more to come! https://steemit.com/dgb/@cryptoknight12/time-to-buy-list-of-safe-bets

My take to is to sit back and watch the trend

https://steemit.com/ethereum/@ericjuanderboy/your-take-on-the-ethereum-24-plunge-due-to-massive-selloff#comments