Bitcoin's Rally above $5000 isn't the Real Story, Ethereum is

This article originally appeared at Seeking Alpha

Friday, Bitcoin pushed through its previous high near $5000 like there was no resistance. The digital currency spent a couple of days pushing up against that limit until a number of minor news items brought in a massive wave of buyers.

What was interesting was watching most of the rest of the crypto-market not respond alongside Bitcoin. Unlike in rallies past where Bitcoin’s success was a rising tide lifting all boats, yesterday saw continued selling in a many coins/tokens with bright futures.

In effect, we saw liquidity drain out of coins like NEO, Waves, Monero and STEEM and back into the big three, Bitcoin, Litecoin and Ethereum. This makes the argument pretty clear that some of these coins were way ahead of themselves.

They were the recipient of profit-taking out of the big three. Most of the money that moves into the crypto-space isn’t coming back out again because of uncertainty surrounding taxes. This is part of the reason why the ICO – Initial Coin Offering – market exploded this year.

All of these profits can’t be brought back to the ‘real world’ lest these newly-minted ‘Crypto-Millionaires’ get rapped with massive capital gains taxes, especially here in the U.S.

The I.R.S. classifies Bitcoin as ‘property’ and hence is taxed at the capital gains rate. If your cost basis is next to nothing, pulling that money out for any purchase bigger than your mortgage or car payment makes little sense if you think the correction in Bitcoin is a temporary one.

Hence, using that new capital to fund new projects as a form of tax shelter makes sense. So does booking profits in the ‘under-valued’ coins. And it doesn’t take a lot of this rotation to send some of these coins up by factors of five or ten.

But, once Bitcoin cleared the next technical hurdle those profits can then be rolled back out of these ‘alt-coins’ and back into Bitcoin to chase the momentum.

And that’s what happened of Friday.

Ethereum’s Hard Fork Fears

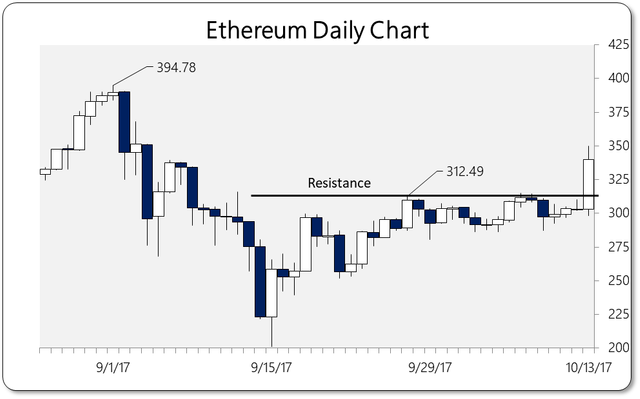

On the other hand, Ethereum languished below the technically significant level of $312 (See Chart) for a few extra days on fears of turmoil surrounding its upcoming upgrade to its blockchain, known as Byzantium.

Byzantium is a major upgrade to the Ethereum blockchain to radically improve transaction throughput. It is being weakly fought by the miner consortiums, unlike the bitter fight over Bitcoin’s fork in August which resulted in the creation of Bitcoin Cash.

But, with only a few days to go until Byzantium’s implementation, fears of a miner’s revolt and a split of the Ethereum blockchain are receding. Because of this, Ethereum finally broke through resistance at $311 last night and is now trading above $330 with its eye on the all-time high at $400.

And with Bitcoin spiking so far, so fast there will likely be another round of rotation into alt-coins in the coming days, including Ethereum. Byzantium’s network upgrade, if it goes smoothly which is expected, will likely take Ethereum up through its all-time high in the next few weeks.

Why? Because we’re still staring at another potential fork of the Bitcoin blockchain as miners continue to balk at adopting the ‘segregated witness’ protocol along with doubling the size of the block. This is known as ‘Segwit 2x’ and November 1 st is the day to watch there.

The Crucial Differences

With Byzantium Ethereum begins the process of scaling its architecture to handle the volume of transactions its price currently commands. It has seen tremendous investment in the past year. There is still a lot more technical work to be done in the future, and I’m not going to bore you with the details.

Understand, for the layman, that cryptos like Ethereum are more akin to application platforms, APIs, than they are digital analogues of gold (GLD) or silver (SLV) like Bitcoin and Litecoin are.

And because of that their value is derived more on the applications built on them than as any form of medium of exchange. That function, the tokenization of its value, is a measure of their platform’s performance running distributed applications.

That’s why I find them so much more compelling than Bitcoin as an investment vehicle. They feel more like stocks than they do forex. Analyzing Bitcoin as a forex pair makes perfect sense. And in the crypto-world Bitcoin is like the U.S. dollar (UUP), that which everything else is measured against.

It is the crypto-world’s reserve currency. And as such, it sits at the bottom of its version of Exter’s Pyramid.

But, Ethereum, and coins like it, are fundamentally different. They have the potential to change the way we exchange value for value on the internet. And, as such, investors need to be aware of this before writing off the insane volatility as just another bubble.

Ether or Reality?

That volatility is the result of billions of dollars flowing into a market in a short period of time. The short-term effect is bubble-like. But, beyond the speculative frenzy there is a real desire to change the way we handle money and investment.

And the now $174-billion-dollar market cap of the cryptocurrency market is a testament to the desire of people to begin building that new world. Not all of these ‘Platform Coins’ like Ethereum will be successful. As an investor I look at them the same way I look at any penny stock, as a sincere risk where I’m only putting money I’m willing to lose on the table.

But, with the current influx of real world capital the day where their malinvestment reveals itself is a long way away. People still believe Tesla’s (TSLA) story even though the company has never hit its production or cost targets. The same thing will exist in the crypto-space for the next couple of years.

And, as always, the market will separate what’s real and what’s fake. For now, Ethereum is the real deal.

For Steemian Eyes Only

I wrote that article Friday morning and it took 36 hours to get through editorial (even though I 'Fast Tracked' it). What I find funny is that throwaway Tesla reference is now looking really timely. The Zerohedge article from yesterday tells us that there is a whole other wave of investment capital that's going to be looking for a home soon.

One month after Tesla lost its head of business development who wished to "spend more time with his family", and just weeks after the EV company's veteran battery technology director also unexpectedly quit amid a growing senior management exodus (full list at the bottom of this article), Tesla decided to even out the ranks on the bottom as well, and fired "hundreds of workers" this week, including engineers, managers and factory workers even as the company struggles to expand its manufacturing and product line, according to the Mercury News which first reported of the mass layoffs.

Workers estimated between 400 and 700 employees have been fired, although Tesla refused to say how many employees were let go, and added that it expects employee turnover to be similar to last year’s attrition. Tesla employs about 10,000 workers at its Fremont factory; it lost $336 million in the second quarter, and burned through a record $1.16 billion in cash in Q2, or $13 million per day.

Tesla is worth more than $100 billion dollars and they don't have a functioning modern production line. How in the holy fuck are they going to compete with a logistical giant like Ford? Say what you want about Ford's cars but that company is a supply chain management monster.

So, halving Tesla's market cap in a bear market for automobiles is absolutely a real possibility here. We'll see the Mo-Mo Monkeys rotate out of Tesla (and others TFANGS) and into cryptos over the next six months.

And the governments will really be on their back feet trying to figure out how to contain the exodus from their criminal system.

Another great article and explanation! Up voted and re-steemed.

I learned some stuff. (diversifying/profit taking into alts to avoid CGT).

I love when I learn stuff. Thanks mate.

you are welcome. Getting an article like this into the hands of Seeking Alpha readers (and TSLA fans) is a bit of a subversive coup, if you think about it.

@goldgoatsnguns you raise some interesting points. I agree with you that the short-term effect is bubble-like due to the high levels of volatility, but it's only a matter of time until the dust settles and it Cryptocurrencies become the norm. As you rightly said there is a desire in the way we hand money and investment.

Byzantium is a new one to me. I hadn't heard of it until reading this post, so I'm definitely going to check it out, so thanks for sharing it with us.

However, what I do have to challenge you on is your perspective on Tesla. I think there is much more to it than is let on. Do you honestly not believe they have a functioning production line. Elon Musk is one of a handful of individuals of our time who is trying to push for a positive impact on this earth. He's a man that works in ways we can't initially understand, but time and time again he seems to prove his critics wrong.

Once again, a great post.

Up-voted and followed.

Anton

Anton,

the early model 3's have parts that reportedly been banged out by hand. Check the latest news on this:

http://www.zerohedge.com/news/2017-10-14/there-are-27-trillion-reasons-why-tesla-wont-rule-world

http://www.zerohedge.com/news/2017-10-14/amid-management-exodus-tesla-fires-hundreds-workers

I think there's a company there... I don't think there's a company with a bigger market cap than Ford, however. It's ludicrous.

And, I don't buy the Elon Musk bullshit being blown around. Let's see his cars compete on a non-subsidized market and then I'll buy it... and be happy to be wrong...

Electric car sales are near zero without subsidies. Real products do not have to be coerced into being.

I think you are wrong. Electric cars are gaining huge popularity. Plenty car manufacturers have agreed to manufacture only electric by 2020:

https://www.theguardian.com/business/2017/jul/05/volvo-cars-electric-hybrid-2019

https://www.theguardian.com/business/2017/sep/07/jaguar-land-rover-electric-hybrid-cars-2020

And in the UK, there will be a ban on Petrol and Diesel cars in 2040:

http://www.telegraph.co.uk/news/2017/07/25/new-diesel-petrol-cars-banned-uk-roads-2040-government-unveils/

Tesla are offering fantastic benefits to attract new customers as Elon understands that many people are late adopters.

and where government subsidies are removed sales drop to zero.

I do like BMW's electric car lineup and technology. Tesla is close to a ponzi scheme at this point. Volvo is a dying brand. The EU will likely not exist by 2040. I do think there's a future in electric cars, but, I don't think Tesla is the future.

In fact, I'll bet on Ford, Toyota and BMW first over Tesla. Tesla is literally a scam. They've taken 450,000 pre-orders for the Model 3, are burning cash and people and still can't even come close to hitting their production or cost targets.

As a lifestyle vehicle, it's interesting. As a consumer product, leave that to the guys who know how to actually build cars.

We'll see who's right.

and the next level of Tesla's production woes.

http://www.zerohedge.com/news/2017-10-16/bizarre-reason-why-tesla-struggling-ramp-model-3-production

A company is only as good as its management. And if management can't hire people who know how to weld steel, it is a real problem.

Leadership matters.

great work thanks