Ethereum potential gems

Today I am going to discuss some potential upsides, particularly in regards to ETH prices

Enterprise

For those who follow Ethereum or trade Ether should be well aware of EEA (Enterprise Ethereum Alliance), the enterprise comprises of 108 companies thus far, with some fortune 500 companies on the board. Chances are, members will continue to grow, with an objective to build a standardized, enterprise ethereum private chain. This is one of the fastest ways to grow Ethereum, as some delegation of resources from these top companies means a whole lot in terms of devs/money/reputation/credibility etc.

Also a fellow member from /r/ethtrader digged a little into leveldb and found some interesting data Companies secretly using ethereum. Blockchain analysis(an early look). It doesn't necessary mean these companies are working on Ethereum, but I see it as a wish list for EEA :)

The alliance is also looking to expand its portfolio globally, one recent event held in ChengDu China (see my coverage from this post Global Blockchain Conference ChengDu 2017 ), they announced a SouthWest Ethereum alliance, as well as future EEA China alliance. The event did not formally announce any members, but we have been seeing 'experiments' from top companies in China, namely Alipay, Huawei, Mi etc. (example: Ant Financial, the subsidiary company of e-commerce giant Alibaba, is also utilizing the Ethereum protocol to develop various applications and platforms. Ant Financial is the company behind the $60 billion financial network Alipay, which is used by 450 million users in China.) I think its safe to assume that one of these companies will eventually be included in EEA china, or perhaps deploy a commercial service built on top of Ethereum. Either way ETH prices will likely gain major boosts for such involvements from top companies. You can also check back on EEA China members list to see its latest recruitment progress.

Obviously this is only tip of the iceberg, we should expect more countries to follow, such as S.Korea where ETH trading volume at one point account for 40% of total global trading volume! Russia where Putin met with Vitalik expressing support for Ethereum, Japan where BTC was recently legalized as a proper form of payment, and so on.

Individual investors with billions, converting their wealth to Ether is also a big deal Billionaire says he has 10% of his money in Bitcoin and Ether. This can represent smart money going into ETH, since people trust billionaire investment decisions. More investors like these, more fame and more credibility for ETH.

Bitcoin Battle

Comparing Ether to Bitcoin is fair to certain extent, they both can serve as digital currencies, payment infrastructure, as value hold and used as investment vehicles.

But Ether is a bit more than that, Ether is also 'Gas' that's spent to buy hash power on the chain. So as we develop more dapps on Ethereum, ether will always be needed in order to keep the hash power up, more apps = more demand = more ether needed and it becomes a healthy self-sustainable ecosystem. Ether will be mined, ether will be generated, ether will be spent.

Comparing Ethereum to Bitcoin is comparing apples to oranges, so let's not even go there.

Another important event is the so called "Flippening", this is essentially a battle between these two cryptocurrencies, where market dominance is about to flip, you can see live data here Flipper. When ETH exceeds BTC in market cap, we can definitely expect mainstream media jump in to report such event, Ethereum is already catching the eye of some media with its exponential growth in price, but in reality it is much less known and less covered compared to Bitcoin. You can also tell from actual data like Google trends compare, experiment with a few keywords like BTC against ETH. They more or less show the same trends, that BTC is still searched a lot more often. The 'flippen' of keyword searches will be a good metric to see if Ethereum has gained enough popularity in the general public.

Bitcoin internal conflict, on Aug. 1, 2017 there will be a critical decision for the miners to make, see this post for a good explanation BIP148 and the risks it entails for you (whether you run a BIP148 node or not).

I will ELI5 again in this post, this time leaving out scary looking terms since I see people utterly confused by the situation with

keywords like BIP148, SegWit etc.

Bitcoin needs to solve scalability, core team implemented it, users want to activate it using their own code by ignoring mining power. Mining power, well, has power, and they hate that idea cus it can compromise their profit, they want to stay with legacy chain where they have control. This in turn might cause a split in the bitcoin chain.

(I know this is overly simplified but for the sake of the point of this post, lets just leave it at that).

Ok so what does that do to ETH prices?

Pre Event

BTC flows into ETH as hedge and potentially migrate to ETH permanently, effectively drive ETH prices up and push flippen closer or eventually flips. This is already happening as we see ETH/BTC pair account for highest trading volume in ETH trading recently. This is generally speaking a good uncertainty for ETH price, but nobody wishes ill for BTC, hopefully they come to a good resolution.

Post Event

Scenario 1) There is a chain split

- Possibility 1) BTC market crashes, the entire cryptocurrency space bursts bubble as a whole, ETH goes down the drain with it.

- Possibility 2) ETH becomes less correlated to BTC prices, potentially becomes leader in market cap, unaffected by BTC crash, even benefit from the crash (hedging on ETH from BTC).

Scenario 2) There's no chain split

- Possibility 1) BTC fixes slow transactions and becomes more scalable, BTC price surges and potentially hits another ATH. This drives the entire cryptocurrency market cap to its new height, ETH moves in direct correlation and potentially hits another ATH as well.

- Possibility 2) ETH hedgers move their funds back to BTC, flippen rate diverges, ETH takes a hit.

What's going to happen? Nobody knows. My guess is that the chain split is not going to happen and BTC internal conflict will peacefully resolve.

Update: seems that the BTC community have come to an agreement, SegWit2x

Bitcoin Miners Are Signaling Support for the New York Agreement

Kickstarter

Hundreds if not thousands of ideas form everyday. Choice of technology is usually not the biggest barrier of entry, ie. languages you develop in, frameworks you choose, infrastructure you architect to host the app etc. These choices change often, and devs usually aren't limited to technical challenges. Down the road what startups lack is usually the same thing, money. Raising funds from VCs, you will need to pitch with all these fancy financial models, explaining numbers and projections, not what devs are good at. ICOs provide a new way of raising funds, instead of talking to these 'evil' financial investors who just want to flip their money, you explain to your audience in your choice of words. People like it or people hate it, similar to kickstarter projects, you validate the idea through people's opinion and general consensus, before you build.

It is also kinda cool to build dapps on blockchains, because you're different and you're not competing in the same space as everyone else, you have more competitive advantages. If more and more talented devs or new graduates from top schools join the space for the sake of funding needs, I wouldn't be surprised.

Dapps

With the craze of ICO crowdfunding, money is in place for a lot of promising dapps. Sooner or later we can expect a killer app in the public, ideally replacing existing mainstream ones. Eg. Sia to replace AWS and becomes the go-to hosting solution. It's a long road, but with enough money to hire more resources, we'll get there sooner than we expect.

What happens when a killer app built in ethereum gets popular? Media coverage! More visibility for Ethereum, attracting more developers/investors/corporations to join. The network effect will not only drive ETH up but also improve Ethereum as a technology and community.

Other interesting projects include Brave browser from the creator of javascript, is will introduce blockchain based digital advertising that’s run on top of Ethereum with Basic Attention Token (BAT).

and Raiden for high speed asset transfers for Ethereum (similar to lightning network for bitcoin).. and plenty other interesting projects, just imagine the possibilities.. its limitless.

ENS

Ethereum Name Service, similar to dotcom, with people paying a fortune for domain names, this is also happening to .eth domains as seen here. Cybersquatting is 'bad faith' registration of another trademark, but it does drive up the value of domain names, paid in Ether.

Market

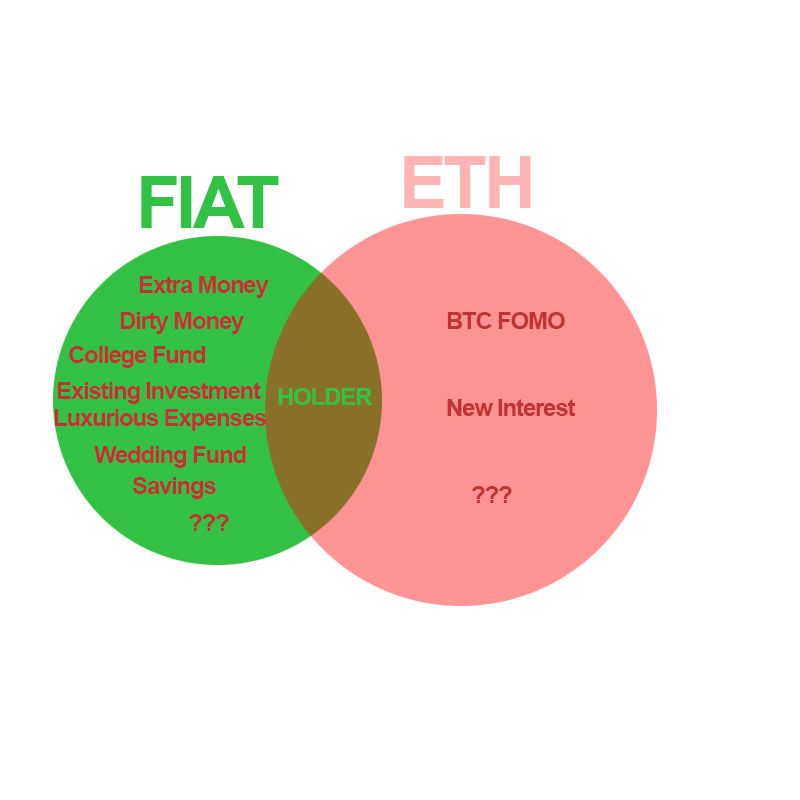

Ethereum is already catching the eye of mainstream media, eg. The New York Times - Move Over, Bitcoin. Ether Is the Digital Currency of the Moment.. More media coverage means more visibility for Ethereum and once we gain enough public interest, people will start investing from different sources of funding. Especially those who missed out on BTC, buying in with FOMO mentality, predictably a huge market.

Also after they dig deeper to find out that Ethereum is not only Ether but a revolutionary blockchain technology, they will HODL.

Barrier of entry from lack of exchanges and slow approval process should also improve overtime. (Speaking of which, my kraken account has been pending verification for over 2 weeks, not even tier 1 verified, wtf?). Also in some countries, these exchanges simply do no exist, but we're seeing new ETH exchanges from emerging countries like India India’s first marketplace for Ethereum tokens so that's definitely a good sign. There's a good population of people who can't even get in action simply because they can't, once ETH exchanges expand global wide, allowing deposits in their local currency, we can definitely expect more fiat currencies coming into ETH.

Technical

Granted Ethereum today is premature, not scalable and not very secure either, but this is expected in any early software development. Think of it this way, all these giant tech companies, Google, Facebook, Amazon you name it, they still dedicate a great amount of resources fixing and patching things everyday. After years of development and large scale real user testing, you still can't expect a bug free software. Nothing is robust enough to be unbreakable from day 1, especially when new features are being added. Eventually Ethereum will evolve to a more mature, scalable and robust blockchain, so will its value.

The next stage of Ethereum update, code named Metropolis, has been delayed for months, and we're expecting to see the release around 3rd quarter of 2017.

You can check latest dev log here Metropolis dev log , also check this youtube channel Ethereum Foundation for core devs meeting recordings.

There I've covered a lot of thoughts on top of my head, I probably missed a few points writing this middle of the night. If you have other things to share please leave them in the comment, and upvote so I know people want to see more contents like this, thanks for reading!