AFRICUNIA BANK: THE INNOVATIVE CRYPTOCURRENCY BANKING SYSTEM

Startups in the Cryptocurrency Technology space have begun to disrupt the highly clustered and over-regulated financial sector. In all these developments, the incumbents have not been left behind. Recently, the IMF and World Bank held a conference where an estimated 90 central banks committed themselves to researching into Distributed Ledger Technology (DLT), the Blockchain and the digital currencies to create a responsible digital currency. We firmly believe that AFRICUNIA is the company that will bridge the existing gap. The innovative banking model that we are introducing is the key to unlocking the tokenized investment funds by providing compelling advantages such as transparency, cost efficiency, and tradability. AFRICUNIA is well positioned to become an industry standard for seamless funds tokenization and management by leveraging the existing Blockchain Technology. AFRICUNIA is registered in the United Kingdom as AFRICUNIA LIMITED, providing Global Banking and Financial Services. The “CUNIA” in “AFRICUNIA’ comes from the Latin word “PERCUNIA” meaning “money” or “cash.” whereas “AFRI” is the abbreviated version of AFRICA. Therefore translated - AFRICUNIA means African Money or African Cash.

WHAT IS AFRICUNIA BANK?

AFRICUNIA is a third generation blockchain cryptocurrency system that uses the AFRICUNIA Blockchain Technology to create a bank-2-bank and peer-to-peer cryptocurrency called AFCASH. It is the digital coin that will be created by AFRICUNIA BANK. It is essential to point out that AFCASH would not just be a CryptoCurrency, rather it will create an Ecosystem that will help bridge the gap between the fiat and the crypto universes and enable users globally, but especially in Africa, to help themselves. By developing the AFCASH platform on top of a highly secure core Blockchain (using APCA), integrating it with the major decentralized technologies and creating use cases to demonstrate its ability in the financial services sector, AFCASH will help bring the mainstream currencies into the crypto universe. The AFCASH platform will unify all transactional aspects that are usually handled using the fiat currencies and provide multiple crypto-related services in one place. The list of potential features of the platform will be infinitely extended and will continue expanding as the platform evolves.

HOW DOES IT WORK?

The AFCASH platform will incorporate the following components:

• APIs

• EMIs

• Commercial Banks

• Digital Pass Technology

AFRICUNIA GOALS

AFRICUNIA intends to bring investment globalization, transparency, and decentralization to the next level by leveraging the ubiquitous Blockchain Technology. AFRICUNIA offers a vision for the new standard of tokenized investment platforms that will help to bridge the gap between the fiat and the crypto universes. At its core, AFRICUNIA will focus on all aspects of tokenized investment vehicles ranging from technology and infrastructure to legal compliance and the corporate structuring. In a nutshell, here is how AFRICUNIA intends to revolutionize aspects of tokenized investments:

• Providing instant, low-cost international payments by allowing conventional banks adopt the proposed Blockchain Technology just like SWIFT BIC.

• Assisting financial institutions to transfer money to international banks in real-time across diverse multi-layer networks.

• Ensuring a technology that complies with regulatory and security requirements.

• Implementing Digital Pass Technology that will serve as automation and digitalization system which integrates several industries to access financial and industrial services at a click.

• Developing the first Crypto-based POS (Point of Sale) System

• Developing a cost effective, seamless and easy to mine non browserbased and browser-based coin mining for simplicity.

ADVANTAGES

This platform operates at a high level of transparency

It enhances cost efficiency at a promising degree

It encourages and facilitates tradability.

PROBLEMS

It is a fact that the Blockchain Technology facilitates fast and low-cost transactions that are not controlled by any centralized source. While the economic gains of the current Blockchain Technology are without doubt indisputable, there are still challenges that must be addressed. At best, these hurdles can be looked at from three perspectives: correctness, consensus, and utility.

a) Correctness: The distributed system should be able to differentiate between a valid and a fraudulent transaction. In the conventional fiduciary settings, this work should be done by institutions and cryptographic signatures that guarantee that a transaction is indeed coming from the institution that it is claiming to be coming from. However, in the decentralized systems, there is no such trust, as the identity of all the members in the network are anonymous.

b) Consensus Consensus helps to achieve a single global truth in the face of a distributed accounting system. For instance, a malicious user can make two concurrent transactions with only enough funds in their account to cover each transaction individually, but not both together. In such a case, the transaction will be valid, but the whole network is not aware of both transactions.

c) Utility By utility, we mean the usefulness of the distributed payment system, which in most cases, simplifies to the latency of the network. For instance, a decentralized system that is both correct and in consensus but which takes one year to process the transaction is of course not useful. At best, a high utility system that incorporates levels of computing power to offer correctness and consensus.

SOUTIONS

To address the problems of correctness, consensus, and utility, our proposed algorithm will apply the “Byzantine Generals Problem” that has already been explored to solve a myriad of computing problems. Much research has been done on protocols that achieve consensus in the face of the Byzantine errors. But much of the protocols have not fully addressed the problems of correctness, consensus, and utility. Our technology will be based on the AFRICUNIA PROTOCOL CONSENSUS ALGORITHM (APCA). The APCA will incorporate the following components:

Server: The server will be an entity that is running the AFRICUNIA Server software that facilitates the consensus process.

Ledger: The ledger will contain records of the amount of AFCASH in each user’s account and will be regularly updated on the network.

Last-Closed Ledger: The last-closed ledger will be the most recent ledger that has been confirmed by the consensus process and represents the current status of the network.

Open Ledger: The open ledger will be the current operating status of the node.

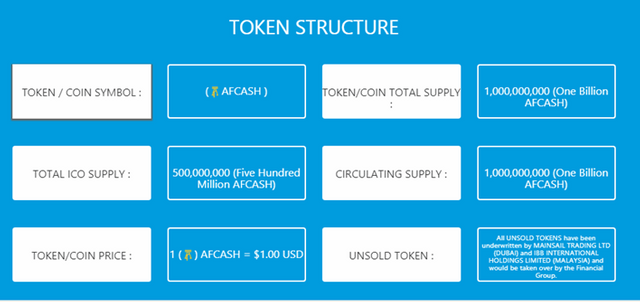

PRE-ICO

The AFCASH pre-order will open on 1st December 2017 and run for 4 weeks up to 31st December 2017. We are targeting a yearly supply of 1 Billion AFCASH tokens but ICO circulating supply of 500 Million AFCASH.

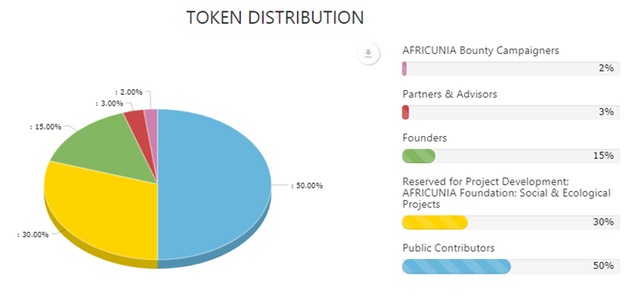

TOKEN DISTRIBUCTION:

• The public contributors will be allocated 50% of the AFCASHs.

• The company reserve will be assigned 30% of the AFCASHs. The reserve will form part of the company’s source income after the distribution period and will be allocated on a partial basis among the direct contributors and the core team of the business where necessary.

• The remaining 20% of the AFCASHs will be allocated to the Founding Africunia Members and its advisors, partners, and campaigners as follows: 15% (Africunia Founders); 3% (Advisors & Partners); 2% (Campaigners). These funds would not be immediately tradable in order to continue motivating the core team after the distribution period.

For more consequential Information about this exceptional innovation, please consult the links below.

WEBSITE: https://www.africunia.com/#/app/home

WHITEPAPER: https://africunia.com/docs/whitepaper.pdf

ANN THREAD: https://bitcointalk.org/index.php?topic=2847593

FACEBOOK: https://www.facebook.com/africunia/

TWITTER: https://twitter.com/africunia/

TELEGRAM: https://t.me/africuniabounty

Author: Ever-young

BTC Profile Link: https://bitcointalk.org/index.php?action=profile;u=1760289