Main Differences Between Ethereum and Bitcoin Every Beginner Should Know

What is Ethereum?

Ethereum is a decentralized platform that allows developers to create and run applications without intermediaries. It was launched in 2015 by Vitalik Buterin and, like Bitcoin, is based on blockchain technology. However, unlike Bitcoin, Ethereum enables the creation of "smart contracts," programs that automatically execute when certain conditions are met.

Bitcoin vs. Ethereum: Key Differences

Purpose and Functionality

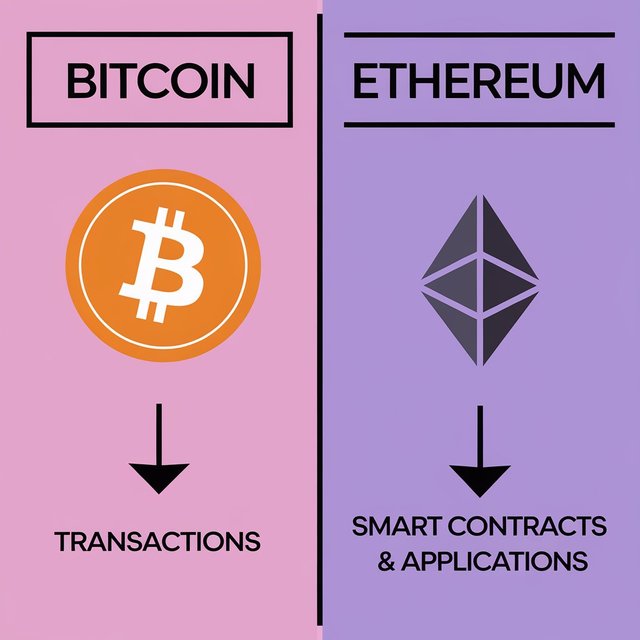

Bitcoin: Bitcoin was designed exclusively as a decentralized digital payment system and store of value. Its primary goal is to serve as an alternative to traditional money and offer a secure way to conduct transactions without intermediaries.

Ethereum: Ethereum’s scope is much broader. It is not only a cryptocurrency (ETH) but also a platform for decentralized applications (DApps) that can execute smart contracts.

Smart Contracts

One of Ethereum’s biggest innovations is smart contracts. These are programs that run on the Ethereum blockchain and enable automatic agreements without the need for trust between parties. When the programmed conditions are met, the contract executes automatically.

Transaction Speed

Bitcoin: Transactions on the Bitcoin network can be slower due to a block time of approximately 10 minutes.

Ethereum: The Ethereum network has a block time of around 12 to 15 seconds, allowing transactions to be confirmed much faster.

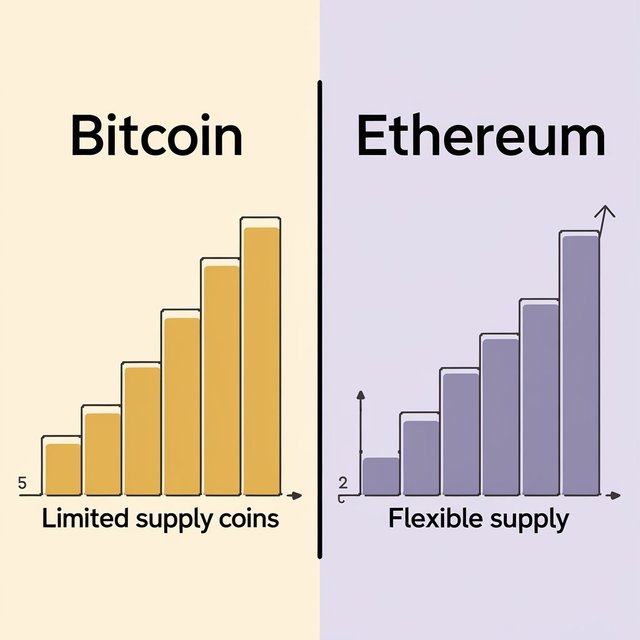

Coin Supply

Bitcoin: Bitcoin has a limited supply of 21 million coins, meaning it will eventually reach this cap, and no more Bitcoins will be issued.

Ethereum: Ethereum does not have a strict supply limit like Bitcoin, although changes are being implemented to gradually limit its issuance to help prevent inflation.

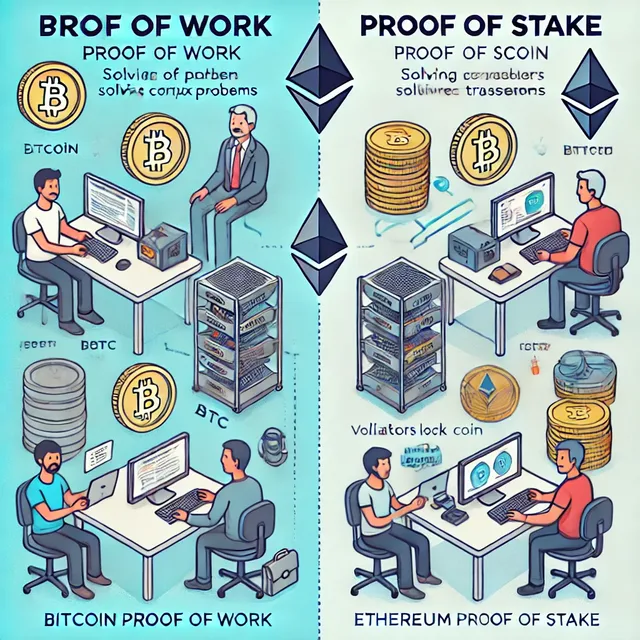

Consensus: Proof of Work vs. Proof of Stake

Bitcoin: Uses a consensus mechanism called Proof of Work (PoW), where miners solve complex mathematical problems to validate transactions and secure the network.

Ethereum: Although it initially used Proof of Work, Ethereum has transitioned to Proof of Stake (PoS), which is more energy-efficient and allows validators to lock up their coins to verify transactions instead of mining them.

%20Proof%20of%20Work%20with%20miners%20solving%20complex%20problems%20and%20Ethereum%20(ETH)%20Proof%20of%20Stake%20with%20validators%20.webp)

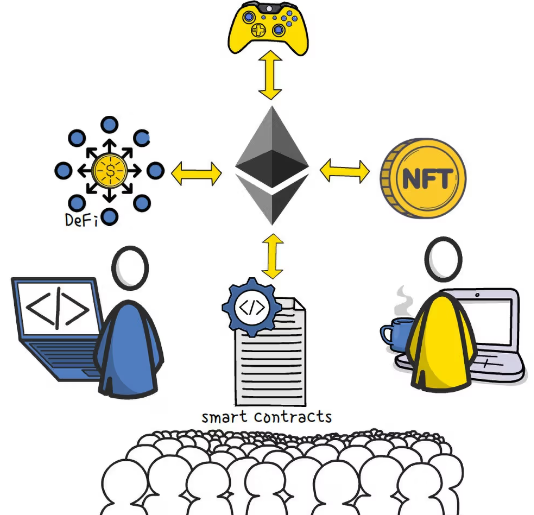

Ecosystem and Decentralized Applications (DApps)

Ethereum is popular for its ecosystem of decentralized applications, or DApps, which can cover areas such as decentralized finance (DeFi), video games, and digital collectibles (NFTs). These applications allow users to perform actions such as taking out loans, exchanging assets, and much more without intermediaries.

Which is Better?

Both Bitcoin and Ethereum have unique roles in the world of cryptocurrencies. Bitcoin is ideal as a store of value and a secure digital medium of exchange, while Ethereum has revolutionized the sector with smart contracts and decentralized applications. The choice between one and the other depends on each user's goals: storing value or interacting with an ecosystem of applications.