Ethereum’s ICO Whales Can Crash the Market at Any Time

Crypto whales are for the most part thought of as rich dealers with the capacity to move markets through a solitary offer request. However the best whales of all aren't dealers yet ICOs which possess a great many ether worth billions of dollars. More than 3% of the aggregate ethereum supply is assessed to be in the hands of ICOs, and when those activities money out, as intermittently happens, the impacts can be emotional.

Ethereum Is at the Mercy of ICOs Cashing Out

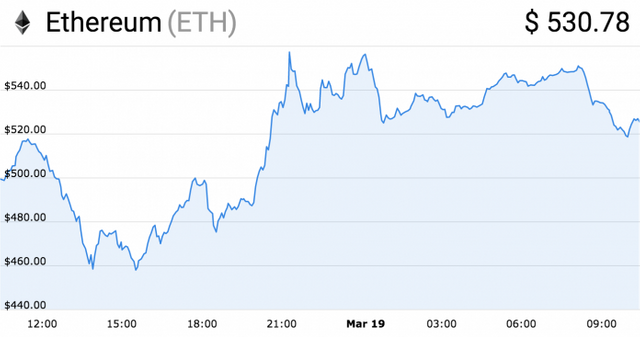

On Sunday, while the crypto markets were continuing yet more turmoil, ethereum took a sudden crash, going from $516 to $464 in less than two hours. Up until at that point, it had been one of the more steady coins contrasted with alts still in the test arrange, which have ingested the most noticeably awful of the misfortunes. Ethereum's blaze drop made it one of the most noticeably awful entertainers in the cryptographic money top 100 yesterday, shaving around 16% off its valuation. The reason for the auction has been ascribed to one of a year ago's ICOs offloading a critical part of its ethereum saves. Provided that this is true, it's not the first run through something like this has happened, and it unquestionably won't be the last.

Reasoning the aggregate sum of ethereum that has been put resources into ICOs is moderately direct. Around 66% of the $5.7 billion brought by crowdsales up in 2017 was as ether. These ventures are obliged to sporadically money out their property for fiat cash, to cover costs that can't be paid in crypto. Furthermore, when they do, it bodes well for those undertakings to pull back a singular amount. What's beneficial for them isn't really useful for the market however, particularly merchants whose yearns are rekt by a sudden dump of ETH.

The Thread of the Whale

Cryptographic money markets are considerably less fluid than conventional budgetary markets. At the point when a huge number of ether is sold on the open market, ordinarily by means of a trade, for example, Bitfinex or Kraken, it will in a split second discourage costs. Merchants, ever cognizant to even the scarcest indications of market development, are touchy animals, and even the likelihood of a coming dump can be a cause for worry, as proved by the current feelings of dread over the Mt Gox whale dumping BTC all at once – despite the fact that those apprehensions have since been mollified.

12 hours before ethereum dropped on Sunday, EOS moved 50,000 ETH to a Bitfinex address. It is difficult to decide when an element offers the assets they have moved to a digital currency trade; the store just demonstrates a plan to offer. The commitment locations of major ICOs are observed by recognizing brokers, be that as it may, and hence when a crowd sale exchanges ETH to a trade, it can turn into an unavoidable outcome that serves to flatten costs.

No less than 3.4% of All ETH Is Locked Up in ICOs

One crypto merchant pronounces to have seen figures demonstrating that 3.4% of all ETH, or around 3.4 billion coins, are in the ownership of ICOs. At the point when these activities have bills to pay or dread that the market is probably going to flatten further, they learn about committed to money. These whales are under no commitment to offer OTC; utilizing a trusted trade is, for the most part, the favored course. The majority of this makes descending weight on ethereum on a scale far higher than that looked by some other crypto resource.

For inasmuch as ethereum remains the favored raising money stage for ICOs, the digital money will stay gathered in the hands of 100 or so extends, each with the ability to offload available whenever. In each example, the market will recuperate, however not before a few merchants, particularly those utilizing influence, have ingested overwhelming misfortunes. Each cloud has a silver coating, however, and when major dumpage happens, it's a prime open door for different merchants to gather up modest coins previously the value bounce back.

Hello,

We have found that all or part of the above post may have been copied from: http://www.startup365.fr/blockchain-ethereums-ico-whales-can-crash-the-market-at-any-time/

Not indicating that the content you post including translations, spun, or re-written articles are not your original work could be seen as plagiarism.

These are some tips on how to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

More Info: Abuse Guide - 2017.

If you reply to this comment directly, we may not notice your response.

It is recommended to contact us in our Discord Channel, instead.

Thank you.

hey I did not copy any data it's my original search work and I was searching on a different website and then i write this, and it's my original work 100% it's my work i don't know if it's matching with any website content. So please do not ruin my hard work Thanks

For future viewers: price of bitcoin at the moment of posting is 8355.00USD

Congratulations @muhammadzubair1! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!