Ethereum Price - What's next?

After reaching its peak in mid-June, Ethereum's price is undergoing a substantial collapse these days. On June 12th, in fact, the second capitalization cryptography had seen the price of its token to $ 400, while today it stands at $ 250, a downturn of 40% in almost 2 weeks.

Why this decline?

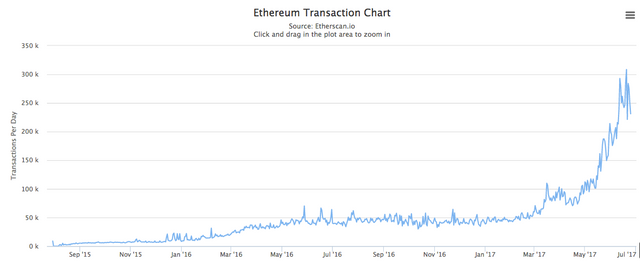

Many attribute the decline of these days to an overload of Ethereum's blockchain. As we can see in the chart below, daily transactions on the Ethereum network have tripled in less than a month, reaching the maximum threshold of 300,000 daily transactions.

New projects have been launched in the last few days, such as Status, which, fomenting the rush to acquire new ICO tokens, contributed to clutter the network. This clogging has caused new delays in transfers from wallets or exchanges. For example, there have been many complaints about delays in fund transfers on Coinbase.

But is this really the main reason for the collapse of the price?

Hard to say but one thing is certain: the cryptovalute market has often used us to collapse or swift ascents that are not closely related to its blockchain or software problems. Certainly, these factors are important and can cause significant oscillations especially in case of leaks (see DAO), but the market has also been shown to move independently when buyers are in FOMO (Fear Of Missing Out) status.

How will the price move from now on?

To make predictions in such a volatile status we can only turn to the long term. While Ether has devalued 40% over the past few days, it is true that at the start of the year it was estimated at just $ 10, and therefore who had invested in January would be in active 2500%.

Although growth on the network is bringing new problems to be solved and new obstacles to be circumvented, many experts believe that Ethereum will continue its growth both at infrastructure and capitalization level. In a recent Bloomberg interview, Carlson-Wee (CEO of the hedge fund Polychain Capital) stated that Ethereum is a much more rich organic development ecosystem than Bitcoin that developed much faster than Bitcoin and contributed to Ethereum's price increase in a much more aggressive way (still with respect to Bitcoin).

Commenting on a prediction made by Fred Wilson (co-founder of Union Square Ventures) that in mid-May had assumed a success and overtaking in terms of capitalization on Bitcoin by the end of the year, Carlson-Wee stated: "I agree With Fred's prediction, I do not know whether to agree on timing, but I think it will happen in the long run. I would extend the 1-year timeline by the end of 2018. "

What will be the future price of Ethereum?

If the forecasts mentioned so far happen, Ethereum's price could be substantially increased again. Since Ethereum's capitalization is currently worth $ 25 billion, while Bitcoin is worth $ 40 billion, in the case of overtaking, the total capitalization of Ethereum could reach at least $ 50 billion.

If the price of Bitcoin were to remain in the range of $ 2500 to $ 3000, the price of Ethereum should reach $ 500 and perhaps even exceed them to get the overtaking of the marketcap.

Meanwhile, there may also be substantial fluctuations leading to 1 Ether being traded even lower than the current level. It will be interesting to check the long-term forecasts and also to understand what will be the impact on Ethereum's token prices such as Golem, Gnosis, Rep, and also with respect to the Ethereum Classic alternative blockchain.

Nice article! Followed. I bought some Ether yesterday during the dip. Long-term hold I think. You may also find my article about valuation interesting: https://steemit.com/cryptocurrency/@patcher/investments-in-cryptocurrency-valuation