Getting in to ICOs - A Guide and Some Tips & Tricks

Purpose

Recently, popular initial coin offerings (ICOs) have been selling out in a matter of minutes. Aragon met their 275,000 ETH cap in just 35 minutes! TokenCard raised over $16.7 million in ERC20 tokens in just minutes aswell. This post is aimed at helping you be prepared to invest within that short window of opportunity!

ICO Readiness Checklist

First

You want to do your due diligence and research the ICO before even considering investing. Some things I do are:

- Look up the developers and important lead roles on LinkedIn, GitHub, Twitter, etc.

If you can't find consistent accounts with names, faces, and past projects, this is a BIG red flag that the ICO may be a scam. - Read the white paper!

Yes, this takes time. Yes, it can be complicated. Still, this is a great way to understand your investment BEFORE YOU INVEST. - Ask questions.

Reddit, slack channels, email, whatever; give the devs a poke and ask about the project. r/ethtrader is generally a good jumping-off point. - Check out the project code.

See if development has been progressing, dig into the code itself if you're a programmer. Since many projects built on Ethereum are open-source, it's not unheard of that a company copies parts or even entire projects.. cough Monaco - Keep up with some of the great community members that do a lot of this for you!

I personally keep up with @crypt0 and his youtube channel, CryptoPortfolio, and the folks over at ICO Alert to have a good idea of what ICOs are coming up and the ideas behind them.

*Although I highly recommend keeping in touch with members of the community, it's essential that you do your own due diligence

Second

Once you've done your research, subscribed to any mailing lists, asked your questions, and decided you want to invest, the next step is preparing for the ICO itself. The most important thing to remember is that not all ICOs are created equal. There are many different was to raise funds and distribute coins, and understanding the process you're about to participate in is critical.

Take the Gnosis ICO for example. The price of GNO tokens were set to decrease near-exponentially over the ICO period, while the percentage of GNO kept by the company decreased linearly. Since the Gnosis ICO sold out in 10 minutes, 95% of GNO is now owned by the company and the tokens all sold at near the maximum $30 value. Many investors were upset at the lack of clarity in the ICO structure, don't get hit with a surprise like this.

Things you absolutely must know before the ICO:

- When is the damn thing??

When we get down to the tips & tricks, knowing the exact time or block number can be very useful - Is there a cap the the amount of funds they are raising? If not, why?

- Is the price uniform throughout the investment period? Is token distribution the same? Early investor bonus?

- What is the contract address?

This may not be known until the ICO begins, which is bad practice imo.

Third

Most of us used something like Coinbase, GDAX, Poloniex, or some other exchange to get our Ethereum, and it may be the case that our funds are still in these systems. Let me make this very clear..

Why? This has to do with the way Smart Contracts used in ICOs work. The address that sent ether to the ICO contract address is the same address that will receive the ERC20 tokens, and your funds are not stored in one permanent wallet on an exchange. You must use your own wallet address to send ether to the ICO contract address if you want to receive any tokens. For this, I highly recommend MyEtherWallet, but there are many others that are arguably as good or better for this.

If you're not day trading, your funds really should not be on an exchange at all since there is risk that the exchange is compromised in some way.

Tips & Tricks

So you've read up on the project, know everything you need to invest, have transferred your ether to a wallet where you can receive the coins, and are just waiting for ICO to start... Here are a couple tips that can help you beat out the competition and save you some stress.

Use Parity's Advanced Sending Options to Automatically Send Ether

I really owe CryptoPortfolio and his video "How to be on time during crazy ICOs" for this first tip. It requires that the ICO address is known ahead of the ICO, but can really help you get those early investor bonuses!

- Download and install Parity.

- Create an account and send ether to the address or simply import your current address via the private key.

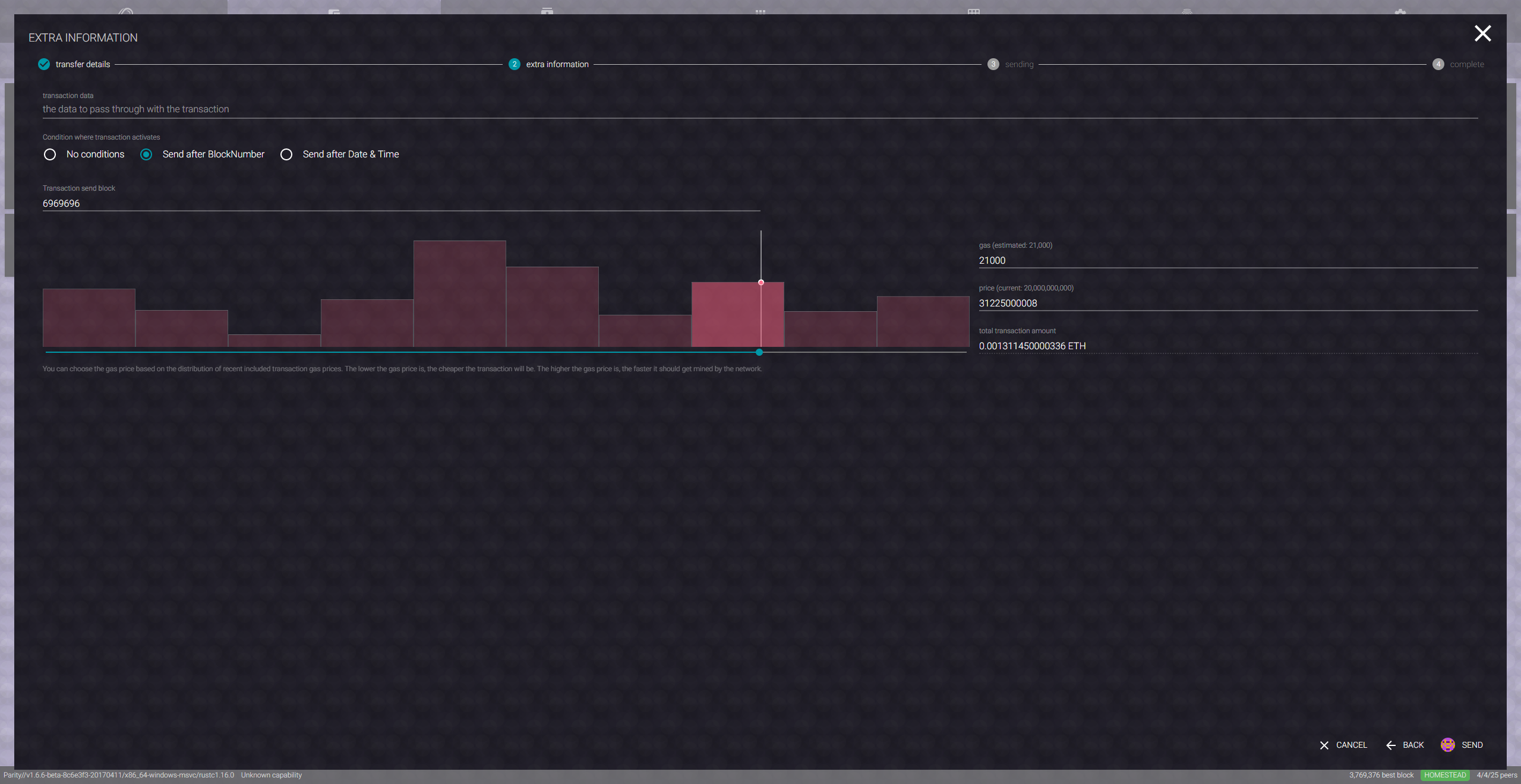

- Select the account, click transfer, put in the ICO contract address and amount you want to invest, and check the "advanced sending options" box and hit next.

- Use either the "Send after BlockNumber" or "Send after Date & Time" option to schedule the transfer.

And there you have it, you're free to go about your business while Parity does all the work for you!

Parity MUST be running during the scheduled time in order for it to broadcast the transaction for you.

See Notes below about additional important information.

Create the Signed Transaction Early

I picked this one up from Taylor Monahan, one of the two developers of MyEtherWallet on one of @Crypt0's videos with her. This still requires that you know the ICO contract address ahead of time.

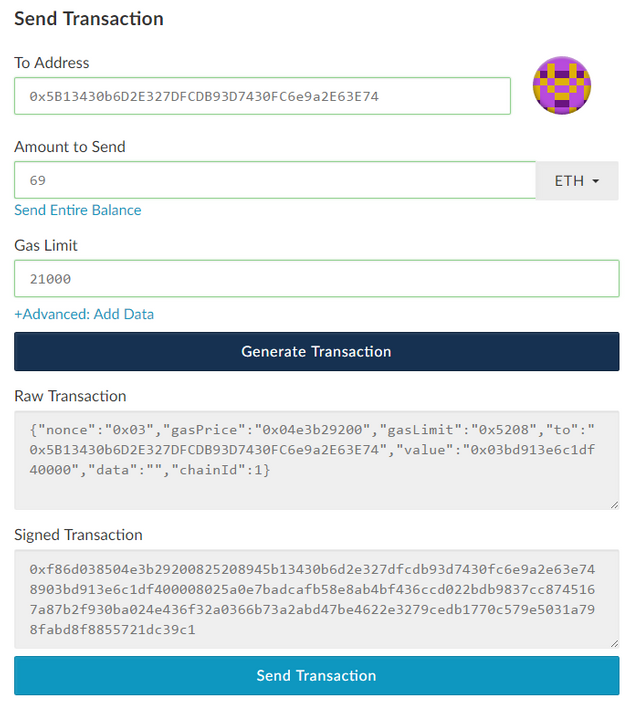

- Have access to your funds on MyEtherWallet, whether that means created a wallet and transferring funds to it, or accessing the address via private key.

- Go to "Send Ether & Tokens", access the wallet, plug in the ICO contract address, amount, and other information.

- Click "Generate Transaction"

- The field marked "Signed Transaction" is what you want here. Copy the raw hex dump and hold on to it until the ICO is live.

- Once the ICO is live, head over to Etherscan to broadcast the signed transaction to the Ethereum network.

See Notes below about additional important information.

Important Notes

The above tips both require you to know the ICO contract address ahead of time, but another VERY IMPORTANT parameter to know is the Gas Limit. Check out my other post about Gas if you don't know what I'm talking about. The project will generally announce the recommended Gas Limit for their smart contract once the contract address is publicly known. You do not want to set a value less than this or you run the risk of running out of gas and failing to complete your transaction. You also do not want to set this significantly higher or you run the risk of miners prioritizing more operation-dense blocks.

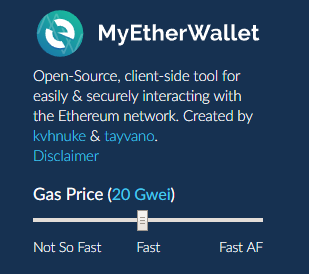

Another important parameter to know is the Gas Price for your transaction. On Parity, it is a parameter you must type in. On MyEtherWallet, there is a slider at the bottom left to adjust the Gas Price.

As it indicates, a higher Gas Price will incentivize miners to process your transaction. You can check out ETH Gas Station to see the minimum gas price accepted, and Etherscan to see current average gas price on the network. During ICOs, the average gas price increases due to network demand, raising the gas price is a must if you want in quickly.

Summary

- Researching ICOs and doing your due diligence is critical before an ICO goes live. There are many different ways ICOs can be structured, and the only way you can avoid scams or misinformation is to go out and verify things yourself.

- When you've decided to invest, make sure you are not using an exchange to send funds.

- If you know the ICO contract address and Gas Limit ahead of time, make use of the Parity auto-send option or generate your signed transaction on MEW and broadcast it on Etherscan once the ICO goes live.

- Make sure your Gas Limit and Gas Price are set appropriately.

Consider leaving a like or even resteem if you found this helpful! If you're really crazy, my MEW address is 0x5B13430b6D2E327DFCDB93D7430FC6e9a2E63E74. Please feel free to leave corrections and comments below :)

Would generating a signed transaction prior to the ICO start time and broadcasting it at ICO start time risk rejection on basis of it being signed too early and not within the parameters of the smart contract ?

Nope. Signed transactions don't contain any time-relevant data, so there's no way to tell if it was signed weeks ago or just recently.

thank you

A great article; very well worded for the beginner. Thank you. Would be nice to get some recommendations on Gas Limit and Gas Price for ICOs based on your experience...

Gas limit should be something the project tells you about beforehand. Gas price should be as high as your comfortable spending for a better chance. In my case, I might use a price that results in a ~$10 total fee if I'm investing something like $5k.

I should also add that transaction data used to interact with the ICO contract may be required to know ahead of time. Unfortunately, it's often unclear what exactly you need until the ICO has already begun.

If identical copies of a signed transaction are sent twice to an ico contract and both go through, would both transactions be executed or would the second copy be rejected as a duplicate ?

Each address has a nonce, a number that begins at zero and is incremented after every processed transaction.

Each transaction also has a nonce. Part of signing the transaction requires the address to have exactly the same nonce of the transaction. This forces all transactions to occur in the order sent, and also prevents a duplicate transactions.

I also want to know if you now Coinomi wallet ? And if you already have used it for an ICO (it is possible apparently, but don't find much on it on internet..). I am a bit hesitant to use this for the first time. Thanks!

I've never used Coinomi, but it seems reputable.

As far as using it for an ICO, that sort of depends. If you have to set a higher gas limit or add transaction data and the wallet doesn't support that, then you can't use that application for the ICO. Most ICOs will require these things. I use MyEtherWallet on an offline bootable USB to sign all of my transactions, both normal and ICOs.

Ok, I'll check that in Coinomi. Maybe I'll switch to MEW since it seems to be the easiest. Thanks.

Excellent article! ICO are still a bit geeky and techie for a lot of people including myself. Here is a tip! hide

Priceless info! Thank you for sharing

Thanks for the great advice.

Very interesting introduction!! Thanks!!!

Excellent content. Thanks for the hard work.

Thanks! Feel free to leave any suggestions for future content if you liked how I cover things.

With ICOs you can you lose 100% of what you have invested but your earning potential is unlimited. Long life to ICOs!!

Hope you get lucky with yours :D

This is not true in any way..

How so? It's very true you could lose 100%, granted 'unlimited' isn't a real measure of gain you could receive, but it's ~75% true if you consider potential growth >>> potential loss.

You can lose 100% if you're completely scammed and the price drops literally to 0, which isn't the case for any ICOs I've seen, even scam ones.

Earning potential is strictly limited by many factors, it's false to say otherwise. It's true that some ICOs will have large returns, but few actually outperform the growth of Ethereum. When comparing ICO value to the value of crypto as a whole, most are not very good investments (and that's while ICOs are in their prime right now, when the ICO bubble bursts it's going to be much, much worse).