Decentralized exchanges - the future of crypto trading

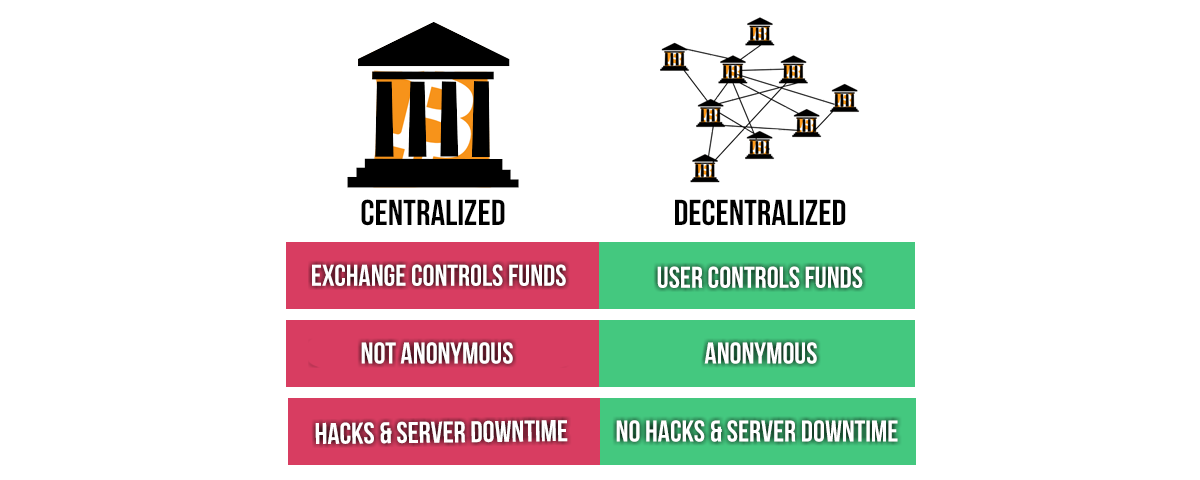

Centralized exchanges have been the only solution to exchange assets and funds for many centuries, it is only now that features of technology are allowing us to create decentralized exchanges for first that which efficiently removes many problems that society could not solve in past years in financial markets.

Security of funds

Well known examples in crypto space are Mt.Gox and latest Coinbase which need no further intruduction. Safety of funds in centralized exchange in crypto space is often all on shoulders of user him/her self since majority of those are not properly regulated, which means in case of fraud, attack, or any other harmful action it is nearly impossible to claim back the money one had deposited with exchange.

Decentralized simply solve this problem by being un-exposed to hacking attempts such as DDOS attacks, and due to their nature of speed in exchange there is simply no need any more to wait days to exchange assets as long as liquidity is provided.

Trust

One of the key benefits of blockchain technology is decentralization, which in its core provides no need for trust on single institution or individual. But since the initial entry stage of crypto currencies was based around capital exchange between fiat and crypto space, it needed support of centralized exchanges which are easier to follow regulations that are already in place. This was best solution to go with for initial phase to gain adoption of this new technology but it is by far the best option to go with.

Main benefit that marriage of blockchain and decentralized exchange platform allows is to truly harvest the potential of blockchain and allowing exchanges to work in space where there is no need to provide users with clear instructions not to put any deposits into exchange, since decentralized exchanges by their nature (as long as they access large pool of liquidity and gateways) can perform very quick exchange between assets. This allows quick in -go and -out solution to exchange assets, removing the need for long term waiting and deposits to hang around the exchange. It also prevents DDOS attacks that can harm the exchange functionality, thus removing the need of user to put trust into any person that is actually developing the exchange platform, since in the essence noone is really in control of running it.

Ease of use

Centralized exchanges can be pain to register with and to use them (downloading proper software, filling and purchasing external data feed, etc..) while decentralization really makes things much easier in this case. I am drawing here mostly conclusions from white papers of DCORP and 2 additional projects, which might be a bit biased since there are probably other ways to approach the structure of such exchanges, but so far from what they promise it seems to be quite a more straight forward process to exchange assets.

Number of instruments

This is huge potential, that can open very large amount of instruments to decentralized exchange, which is currently one strong weak spot of centralized exchanges. For every trader its very common to go trough number of centralized exchanges in order to find the one with good number of instruments, and even when there is decent fit it is usually never perfect becouse there are at least dozen of instruments missing from that exchange which trader would like to have access too. Decentralization can solve this problem by combining all gateways and providing much larger pool of assets trough single entry, eliminating this problem. This is just matter of question how many gateways would be willing to join each decentralized exchange to make the pool larger.

Fees

Fees can be a huge problem or a lesser problem in centralized exchange, it really depends who you ask. It depends on trader or investor and the time frame one chooses to form the investments. For short term trader on very low time frames (bellow 15 minute) high fee can be a killer to trading strategy or investment, since the fees can hold over 50% of total gains, which is unacceptable over long term. This is simply the problem due to centralized exchange and the inability to process very huge amount of trades/transactions in short amount of time due to how they are structured.

Decentralized exchanges solve this problem as user is able to directly asset the exchanged asset trough many different gateways, and possibly even doing it micro fractionally increasing the speed and the amount of transfers per each decentralized exchange. This by default lowers the amount of fees on each transaction drastically.

Blind spots

Like mentioned above ease of use can be advantage for users to quickly jump into platfrom without providing documents of legal residence and several day deposit/document checking process that centralized exchanges go trough, but in reality it is one huge blind spot in terms of politics and laws for now. This kind of blind spot means that regulation could force such platform to adjust to specific requirements by regulators in order to achieve proper legality, or on other hand a bill in senate or parlament could easily target such exchange as money laundering platform by default since state cannot properly access or control the participants behind such exchange. Simply technology is in this case one step ahead of legal and state process which can cause large problems in future, for any investor or user of decentralized exchanges this should be something to think about.