Cryptocurrency trading learning the hard way

Fairly new to the world of cryptocurrencies and trading in general. My background is in design and not in finance. Anyway very curious to learn more about the background of blockchain and the emerging communities.

Consider looking at my previous posts where I share my day to day findings. https://steemit.com/@sanb

Finding the sweet spot

As I am diving deeper into the communities I am totally fascinated by the blockchain possibilities and opportunities they create. One aspect is of course also the cryptocurrency. The recent surge attracts more and more people into the game, and we are being blinded by the gold digger stories. As I am reading more and more, it becomes clear when you step in now you are in for the long run and not going short.

Reading, adopting, watching YT

I tend to follow the conversations of @suppoman, @brandonkelly, @ryanlye, @AmeerRosic, @jerrybanfield and others. Imo they are on top of the cryptocurrency game and very aware of whats ahead in the short and longterm future. I especially like the way they all share their ups and downs with the community.

I was asleep…

In the recent days there was a big surge on STEEM and BITSHARES. All of the people I follow where talking about those shares and how they might increase in value. As I am holding shares of other cryptocurrencies that where doing relative good the last week, I though I am okay for now.

What turns out! Many of the cryptocurrencies that had increased over the last two weeks or so are dropping like its hard. Yes, pump and dump. And the stocks the industry leaders talked about are surging at the same time. While I was thinking all the stocks would benefit from the rise, I couldn’t be more wrong.

FAIL and TRY AGAIN!

I started to try to rewind the game a bit. Aha, there has been big moves from the ‘other’ cryptocurrencies into e.g. STEEM and BITSHARES. Meaning the big losers from last week like DigiByte, Stratis, Ripple, Monero and Dogecoin are put to sale in order to buy e.g. Steem and Bitshares.

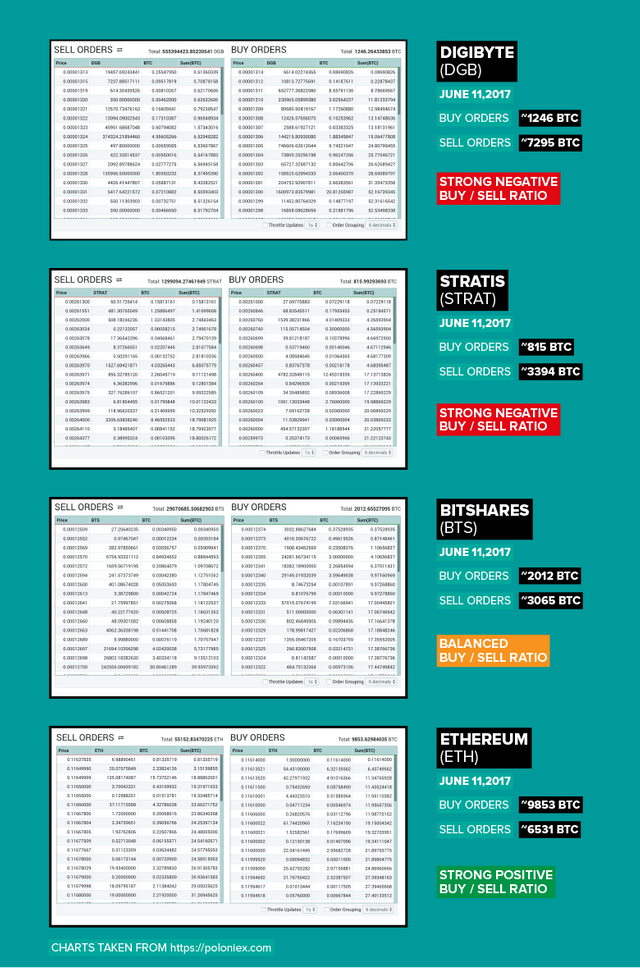

Finding buy/sell volumes to anticipate better

As I had my aha moment, I started to realize the only way to know what is happening is to closely watch the buy/sell volumes. I went to https://poloniex.com/ and started looking at the buy/sell volumes of a few of the cryptocurrencies. And yes, this confirms my thinking. E.g. DigiByte, Stratis, Ripple, Monero and Dogecoin has a way higher selling volume than buying volume. And e.g. Steem and Bitshares had a higher buy volume over selling volumes.

Confirming my way of thinking

I got into the cryptocurrency community because I was triggered by Ethereum. The technology, the community this was what got me really excited. This year has been very strong for Ethereum, as more and more ‘traditional’ companies and countries starting to embrace the Ehtereum community. This results in a strong and steady surge of the coin.

So to confirm my suspicion of buy/sell volumes I looked at Ethereum, and confirming my thinking. More buying than selling at the moment.

Watch more closely

What will be my next steps? I will look more affectively into buy/sell volumes in order to make judgements on buying or selling cryptocurrencies. For now holding on to the investments in my current portfolio as I see them as long term investments.

High trading groups

I have heard about high trading groups, if anyone can point me in the right direction I am all ears.

How about your strategy?

If you have any points of reference, please leave your thoughts in the comments below. Lets start a new revolution for the newbies into cryptocurrencies.

As always thank you for reading!

Sander

Great info. thanks for posting - Voted & Following!

Thank you! Appreciate the feedback 👍