Will Central Banks Issue Fedcoin?

While It’s interesting to see how quickly cryptocurrencies have burst into the financial scene, it’s not all that surprising. Here we have revolutionary technological advancements that are directly applicable to our economic systems, all made possible by the internet — which is a very recent development in itself.

While crypto enthusiasts all over the world are dying to see a massive financial shift take place, the centralized banks aren’t going to hand over their power without a fight, no matter how much sense it makes. It seems as though the only way cryptocurrency will make history is if the powers that be usher it in, and for that to happen, they’d need to retain their control.

As valid as this might be, it’s likely a gross oversimplification of the situation. The institutions in question aren’t purely monolithic, and there’s a chance we see some change occur from within; change toward a more decentralized future.

An IMF Director’s Take on ‘Fedcoin’

At the Singapore Fintech Festival in November 2018, IMF Managing Director Christine Lagarde made the case for taking a serious look at what digital currencies can do for our monetary systems.

After referring to ancient Greek philosophy by stating “Change is the only constant.”, she went on to describe how the change cryptocurrencies are bringing has the potential to be disruptive to the lives of many, and that “the key is to harness the benefits while managing the risks.”

Lagarde then outlined the history of money, and how it has changed based on the needs of those using it. She makes the case for Central Bank Digital Currencies (CBDC), then announces the release of an IMF document detailing the pros and cons of central banks created their own digital currencies.

She balanced the presentation out by presenting the risks of Bank Digital Currencies, then wrapped it up in an optimistic light, giving the impression that she believes we, as a society, would be able to effectively mitigate the risks of cryptocurrency adoption — and be rewarded as whole for doing so.

What the Federal Reserve Thinks About a CBDC

A similar sentiment was shown by Kevin Warsh, who was a governor for the US Federal Reserve, and also a candidate for Fed Chairman. In a May 2018 interview with the New York Times, Warsh displayed his openness to the idea of a “FedCoin”, stating that “a central bank digital currency might have a role to play there”.

He also stated the following:

Not that it would supplant and replace cash,” he said, “but it would be a pretty effective way when the next crisis happens for us to maybe conduct monetary policy.As previously stated, these organizations are not monolithic, and Warsh’s opinion is just that — his own.

According to Federal Reserve Research Experts

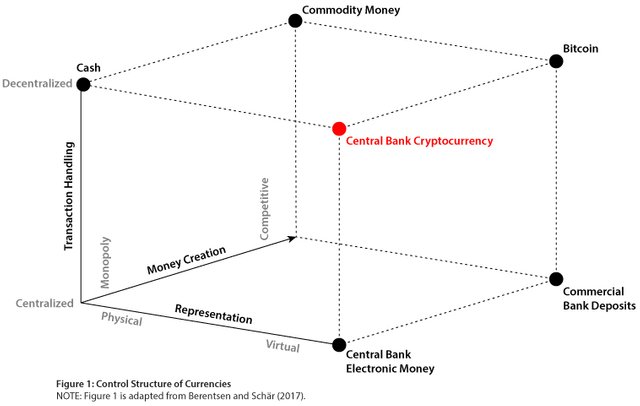

In a Q2 research article written by Aleksander Berentsen and Fabian ScharThe Case for Central Bank Electronic Money and the Non-case for Central Bank Cryptocurrencies, the idea of a digital asset issued by centralized banks was more heavily scrutinized.

Source: Federal Reserve Bank of St. Louis

Theoretically, if the Federal Government wanted to create a central bank cryptocurrency, they easily could, according to this research article. The problem is that (and it might be obvious to our readers already) cryptocurrencies and centralized banks are fundamentally oppositional to one another.

Once we remove the decentralized nature of a cryptocurrency, not much is left of it. Virtual money that is centralized and issued monopolistically by a central bank is electronic central bank money.They go on to explain that “calling such a centralized form of virtual money a cryptocurrency is misleading”, and that the technology required for issuing centralized digital currency has existed much longer than blockchain technology has.

What Does This Mean For Cryptocurrencies Moving Forward?

Decentralized cryptocurrencies were built to empower all people to exchange value easily and anonymously, which simply doesn’t mesh with the Federal Reserve’s modus operandi. Berentsen and Schar’s research paper concludes in a way that aligns with crypto purists, and more succinctly, aligns with common sense.We welcome anonymous cryptocurrencies but also disagree with the view that the government should provide one.It’s difficult to neatly wrap these ideas up, but one of the more optimistic perspectives is that the original vision of the Bitcoin whitepaper has been solidified by those with the most incentive to oppose it. In general, there are 5 possible (yet oversimplified) outcomes stemming from the invention of cryptocurrencies

- The technology alleviates economic oppression worldwide.

- A ‘compromise’ is made and the technology is used by centralized banks.

- Centralized banks do everything in their power to suppress the technology.

- The technology is inadequate and dissolves away naturally.

- The technology destroys the legacy banking system

Whether their recognition of this purpose benefits the common individual remains to be seen.

Get the latest Bitcoin, Blockchain and Cryptocurrency news only on TheDecentral.com. You can follow us on Twitter @The_Decentral and subscribe to our stories on Google News.

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

I have already appealed...