Why do Annuities have such a negative connotation to people?

When people hear the word “Annuity” there seems to be a black cloud that hangs over it, it doesn’t have to be that way. There are some pros and cons about annuities but please re-consider this as a strategy for your retirement. There are reasons and times when you want to use an annuity for retirement. I hope I can make some people feel a little bit better about them and answer some questions about annuities. I have had a few people come through my office and talk about what they hear about annuities or what they have experienced about them. Most of the time they listen to their friends and families. Those myths that they are told sometimes end up making people lose money because they fail to take advantage of these opportunities and listen to someone who isn’t well rehearsed in this area.

Here are some myths I want to squash regarding annuities:

Annuities are bad for you?

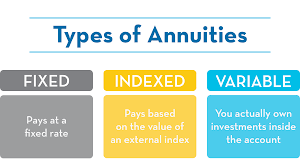

I would raise an eye brawl to someone who says, “all annuities are bad.” That's a pretty blatant statement to categorize all annuities as bad products as there are numerous different types of annuities and to categorize them all as bad tells me maybe someone had a bad experience with theirs and they don’t know that there are different types of them out there. Maybe they held the wrong type of account for them. Annuities can be categorized into two main types of columns: there are variable annuities and then there are standard fixed-rate annuities.

Standard-Rate Annuities

This annuity guarantees the return of principal. The money you invest is guaranteed to earn a fixed rate of return through its accumulation stage. During your annuitization the money you have earned minus the money distributions you take out still earn a fixed rate of return.Variable Annuities

This type of annuity is invested in a volatile manner. This type of account usually deals with the most optimized high growth funds, your R.O.I depend on the type of accounts you choose.

Here is where people can fall into the wrong type of annuities. Both types of annuities are good for different people, it just depends on what your strategy is and the amount of risk your willing to take.

Do Annuities come with high Fees?

This is why most people get turned off when it comes to annuities because I guess once they have seen or experienced one they are all the same. This is false, there are some annuities with high fees, but there are others out there that do not have high fees. There are some annuities that have no fees tied to them. Without going into the various types of them out there because this article can get drawn out and technical I just want to let you know that yes you should be concerned about the fees but at least know what types of annuities you are looking at have a high fee or not. It is good to know your type of account you have. This is an important question to ask your financial advisor. The most important thing I want you to take away is to ask all your questions make sure you write them down so you don’t forget to ask all your questions.

Annuities are inferior to mutual funds

This all comes down to how much risk you take on, you can be just as aggressive as you can be with mutual funds too. There are a lot of elements to consider when choosing the right annuity for you, just consider all the tools and resources to help you make the best choice when considering an annuity. Remember if you want to take on more risk a variable annuity might be your consideration, but if you want to stay safe and less risky then the standard rate annuity might be your path. I have seen some annuities just as strong as a mutual fund or even a CD. Some annuities have been able to outperform both mutual funds and CDs.

The idea of surrendering an annuity puts off a lot of people

You can take early distributions, but remember you will be faced with penalties on the distributions you take early. There are strategies you can take if you have to do this, but remember even if you don’t get penalized for taking out a distribution early there are ways to do this but remember you will be faced with taxable income. The surrendering of an annuity should not be a concern only if you are thinking you will need the money sooner, then just create a shorter type of annuity.

The benefits people don’t consider about annuities

Remember if you decide to create an annuity for you this can provide a source of income for the rest of your life.

There are types of annuities that let you access 10-15% of your annuitization every year.

There are also conditions if you happen to go into adult care home some annuities will waive surrender fees to access your money.

Don’t forget the benefits that are available if you happen to pass away such as beneficiaries.

The reason why annuities receive a bad rap is that they can seem too complicated. There is a lot of elements that you should consider when considering them. We are not taught this in school so how are you expected to know your financial opportunities to secure your future. The main point I would like to close with do your homework, take some time to read. Do not depend on a friend or a family member who thinks they know about finance if they are not well rehearsed in it. Find a reputable financial advisor in your local community who could help you. Remember people don’t plan to fail, they just fail to plan their future. If you live in the greater Austin area I can help you set up a financial plan for you and your family.

Rene Gonzales

Senior Representative

c. 512-568-7203

e. [email protected]

www.Primerica.com/ReneGonzales

Follow me on Facebook: Your Financial Freedom Network

Very valuable information! I know that research is very important when thinking of taking on an annuity. I was the executor for a will and I was required to set up funds for my brother - thus my research into annuities. His annuity has served him well and will take him comfortably through his life.

Hi Porters!

I upvoted for your response, it is good to hear how these types of investment products out there help families.

Congratulations @calastinone!

Your post was mentioned in the Steemit Hit Parade for newcomers in the following categories:

I also upvoted your post to increase its reward

If you like my work to promote newcomers and give them more visibility on Steemit, consider to vote for my witness!

Hi Arcange,

Thank you for your support, I will definitely follow back and support you

Annuities aren't bad and your right about it. I think the key is most financial products are not understood by people. Asset managers also tend to lack tranparency. Annuities should ve part of one's diversified portfolio and someone who isn't from a financial background should never put all their wggs in one basket, be it mutual funds or annuities. For someone thinking of retirement planning annuities may be a great thing. And then a part of wealth should be put in mutual funds. The right way is to go to a financial advisor who offers a range of financial products. Also, check with a number of financial advisors and friends in finance. This will help remove any doubts about the advice of the FA itself.

Great article.

Hi calastinone,

Visit curiesteem.com or join the Curie Discord community to learn more.

This is really important information. There are so many different products available, it can be a very important step to talk to a professional who has looked through all the different options out there and can recommend from a smaller group some of the best.

Like with other products, there are riders, clauses and options that can be adjusted based on your needs! Every product was created for a reason (even if some seem to be created to make the creators money), and its essential to find such things that fit your needs.

I am happy to see you put yourself out there on the blockchain, to provide a certain amount of information for free is a public service, and has the potential to help people from all around the world with their financial education!

Blessings, and Steem on!

Hi ecoinstant!

Thank you for the support; it is a passion of mine to share some valuable information that can benefit and add value to peoples lives. Thanks for reaching out.

I look forward to future installments! Currently we are thinking that the index funds will perform worse in the short term than fix-rates because the market may be near a peak. Do you have any opinion on that?

Hi ecoinstant!

Thank you for your support, it is my passion to share valuable information that can help benefit families and individuals.

Congratulations @calastinone! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Surely annuities are a good investment.

It is likened to buying shares in a company.

That is the best business where even if one is not working they will keep sustained.

I understand where one listens to a friend before he invests, but he should never be held back for a myth.

Musemeza,

you sound very intelligent to listen to a friend and also seek out professional advice to verify the myths from the truth! That is the only way researching and seeking out wisdom is the best way to stay wise!

@calastinone I honestly had no idea that annuities were that in-depth. This was very good information and now I know more about them and can discuss this with my family more when we are talking about wills and setting up accounts for my nieces and nephews. Thank you for the information!

Your welcome I’m glad I can be of some help, the financial landscape is a difficult path as we aren’t taught these important financial resources in school. I would like to leave you with a quote and I’m glad I could be of some help,

“NO ONE IS USELESS IN THIS WORLD WHO LIGHTENS THE BURDEN OF ANOTHER.” -unknown

That is a wonderful quote. Thank you very much for your response! :)