The Best Daily Financial Market Highlights - August 18th, 2022

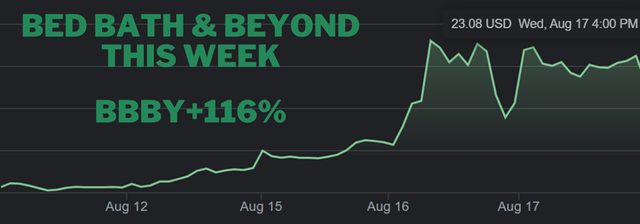

💎Happy Thursday, Steemers! Bed Bath & Beyond (BBBY) continued its rally yesterday - it jumped another 11% and is up nearly +400% this month!

What else is in today’s Financial Market Highlights?

- Amazon is raising fees.

- Target misses wide left.

- Another crypto CEO takes a hike.

STOCKS

- DOW: 33,980 (-0.50%)

- S&P: 4,274 (-0.72%)

- NASDAQ: 12,938 (-1.25%)

Stock numbers as of market close on August 17th

Just a Bit Outside

It was a rough day for Target (TGT -2.77%) after it missed by a long shot.

Earnings per share: $0.39 vs. $0.72 expected.

Revenue: $26.04 billion vs. $26.04 billion expected.

The most alarming news was the retailer’s profit plunge; quarterly profit fell nearly 90% from a year ago! Target missed the mark even after lowering guidance twice earlier this year.

Another shot: Target is a mainstay in the retail world, so this isn’t the end. Executives assured investors that a rebound is likely as it gets back on track for the rest of the year.

Last year’s numbers were bloated from extra money consumers had in their pockets and this year’s numbers have been hurt by inflation and rising prices.

At a Lowe Point

Lowe’s (LOW +0.54%) shared a similar story to Target, but it wasn’t as bad.

The home improvement retailer beat on earnings but missed on revenue.

- Sales were hurt by lower demand for seasonal products like patio furniture and grills. Demand for "pandemic” items like freezers and refrigerators also dropped.

Lowe’s saw an increase in sales to professionals such as contractors and electricians.

To Infinity and (Bed Bath) Beyond!

Shares of Bed Bath & Beyond are surging on an apparent short squeeze.

- At one point in yesterday's trading session, the stock was up 30%.

Deja Vu: Remember the GameStop saga? This is similar. Redditors are going all in on BBBY in order to squeeze out the hedge funds - diamond hands only.

INFLATION

- GOLD: $1,764 (-0.61%)

- AVG GAS: $3.94

- 2022 CPI: 8.5%

Inflation numbers as of August 17th

Amazon (AMZN) Raises the Roof

Don’t be happy, it’s not a good thing.

Amazon announced a series of raises to seller fulfillment fees.

What does that mean? Third-party sellers who use Fulfillment by Amazon will have to pay 35 cents per item sold in the U.S. or Canada. Fulfillment by Amazon (FBA) is a way for smaller businesses to use Amazon’s services for packaging and shipping.

The increases will take place from October 15th through January 14th - aka the holiday season. It’s the first time in Amazon's history that it raised fees for the holidays.

- “Our selling partners are incredibly important to us, and this is not a decision we made lightly,” Amazon said in the email.

Retail Sales = Flat

Inflation cooled slightly in July with gas prices leading the fall. Lower fuel costs allowed consumers to spend their money elsewhere.

July provided some respite from inflation pressures, and the decline in fuel costs particularly allowed consumers to spend elsewhere.

- Retail and food sales (excluding gasoline) rose +0.7% from a month ago.

CRYPTO

- BTC: $24,061 (-2.30%)

- ETH: $1,847 (-1.82%)

- SOL: $41.02 (-4.98%)

Crypto numbers as of 5:00 pm EST on August 17th

Job Cuts and Stepdowns

Genesis is another crypto brokerage that has succumbed to the crypto winter.

Yesterday, Genesis announced two major updates:

Its CEO Michael Moro is stepping down.

It is eliminating 20% of its workforce.

Genesis is one of the largest and best-known lenders in digital assets.

Unfortunately, the crypto market’s value has plunged 50% this year to about $1.1 trillion.

Like others before it, Genesis said the changes are necessary to “affirm their commitment to success” - crypto executives are starting to sound like a broken record.

GLOBAL SCOOP

- VIX: (+1.68%)

- WHEAT: (-0.53%)

- CORN: (+0.74%)

Global Scoop numbers as of market close on August 17th

Norway’s Poor First Half

The largest sovereign wealth fund in the world (Norway) lost $174 billion in the first half of the year.

What is a sovereign wealth fund? It is a country or state-owned investment fund that invests in financial assets like stocks, bonds, real estate, precious metals, etc.

Why the drop? Stock markets had a rough six months. The $1.3 trillion fund returned a negative 14.4% during the period.

Shifting Gears

Apple is in talks to move the production of various products to Vietnam.

What products? Apple Watches, HomePods, and MacBooks.

Why the shift? Apple has dealt with supply chain disruptions because of Covid-lockdowns in China, so it has been looking to expand production elsewhere.

- Apple has already started making AirPods in Vietnam.

REAL ESTATE

- 15-year: 4.92%

- 30-year: 6.12%

Mortgage rates via Quicken Loans as of 5:00 pm EST.

Big Summer Blowout

The Bay Area is on the clearance rack. Price reductions in the region surged 200% this year while sales dropped by 38%.

- Only 57% of homes in the area sold above the asking price this month, down from 73% back in April.

Hot and cold: Last summer, the Bay Area’s housing market was red hot with its high demand and low-interest rates, but rates have since doubled over the past year.

Losing Interest

Mortgage demand fell to a 22-year low last week.

Total mortgage demand dropped 2%, while applications for a mortgage dipped 1%.

Applications for a mortgage are now 18% lower than last summer.

Why? High-interest rates have slowly been scaring more and more buyers away. Looming fears of an economic downturn have also prevented an uptick in demand.

More gains to Crypto Culture🔥. Reshared🔁

This is a one-time notice from SCHOOL OF MINNOWS, a free value added service on steem.

Getting started on steem can be super hard on these social platforms 😪 but luckily there is some communities that help support the little guy 😊, you might like school of minnows, we join forces with lots of other small accounts to help each other grow!

Finally a good curation trail that helps its users achieve rapid growth, its fun on a bun! check it out. https://plu.sh/altlan/