(Finance) Your governments (in)ability to repay/insure savings lost due to bankruptcy - my analysis

Preface

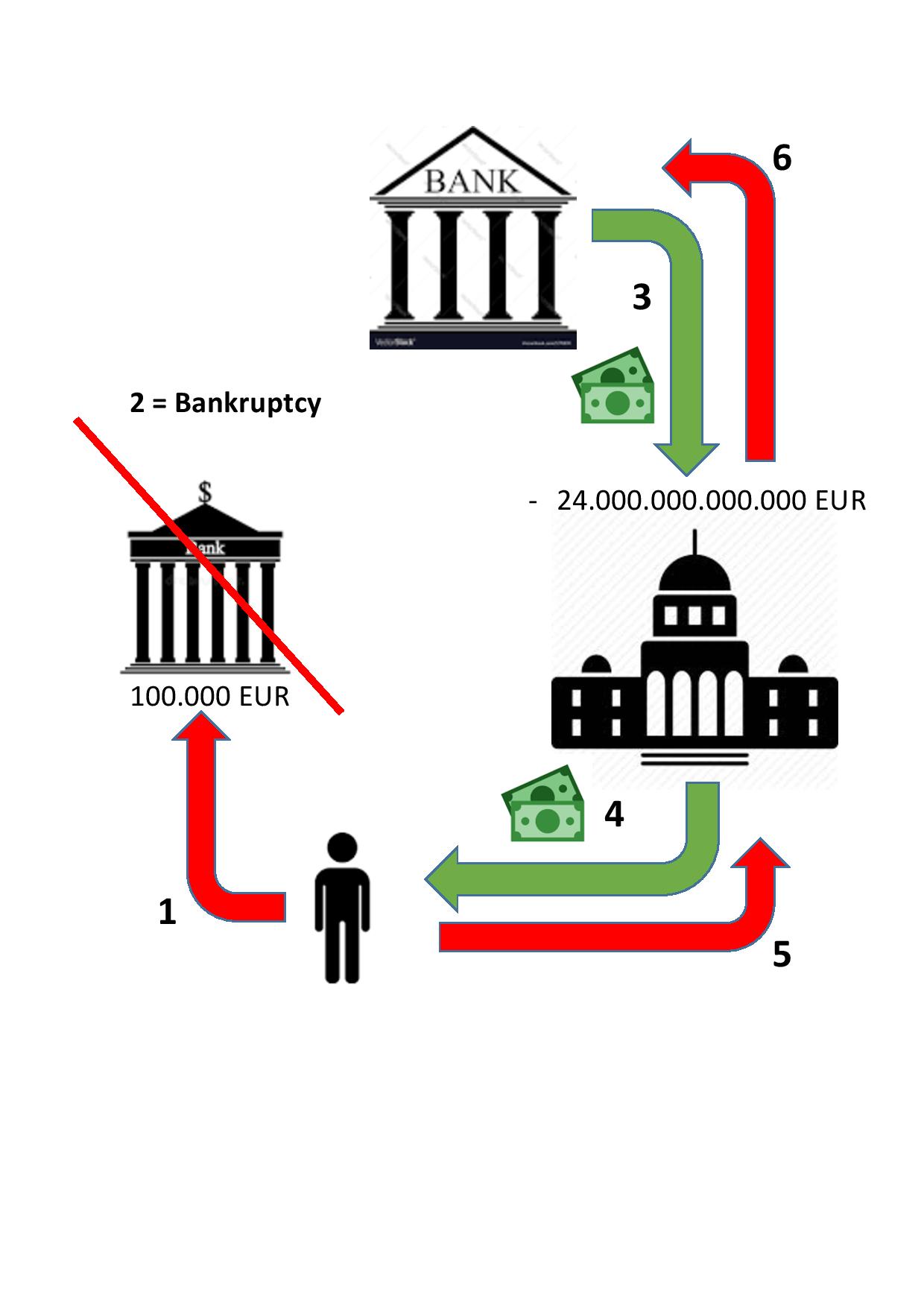

In many countries, -including my own- the government warrants a portion of your savings at the bank in case the funds are lost. The Belgian government assures me that when my bank goes bankrupt, it will give me back my savings.

The highest amount I will get back as a Belgian citizen is 100.000 EUR. For many people this is common knowledge and when you go to your local bank you will be informed about this.

The argument is that there is barely any downside (some costs) depositing your money with them because in case of bankruptcy the state insures your savings. As long as a bank isn't bankrupt you will be able to withdraw all of your money.

Then you have the comfort of operating within the legal framework, having a debitcard, protection against thievery, etc.

The Belgian state has a debt of over 444.000.000.000 EUR (444 billion) or 41.000 EUR per citizen. The U.S. has 24.000.000.000.000 $ (24 thousand billion) in debt, or 77.000 $ per citizen.

Hypothesis

The funds needed to reimburse your savings is a loan that the citizen is answerable to.

Reasoning

What do you find when you follow the realistic cashflows of this mechanism? Is it logical that an entity with billions in debt just repays lost savings? Especially when this entity derives it's income from taxation, from it's citizens.

The government doesn't have any other choice then to borrow the money required to repay it's citizens from a (central) bank. Because it has massive debt itself, and therefore no money at all. As with every loan, interest, will have to be repayed to compensate the bank for undertaking risk.

The collapse of the Greek economy is a good example of what happens when the system unravels and a state is declared bankrupt.

The ECB and European Union demanded extra measures from the Greeks (including laws, societal rules, a pay-back plan) to insure the now bankrupted state would eventually repay, and charged much higher interests as a result.

Given the nature of governments as financial actors who derive their income from taxation, the burden therefore seems to indirectly fall onto the general public - and whichever part of that public pays the most taxes in comparison to the rest. Because it is the citizen or taxpayer who is obligated to provide his state with income. This income is then used for the whole variety of government spending, including the repayments of loans that governments are obligated to repay.

My opinion

I would sincerely argue that this system is protecting the general public. Other people might end up having to repay the state's loan to repay lost savings. Or the next generation of taxpayers may end up paying for it.

But the point is that the money one receives, is in fact borrowed by the state. The state will in turn look onto the taxpayer to repay the amount borrowed and the interests.

I personally think it is more logical to see the repayed savings not as a gift from the state, but as a loan. If the treasury of the state wouldn't have debt but a positive figure on it's balance-sheet. Then this wouldn't apply. Sadly, that is far from the case.

So, are the savings actually secured? I think they're not. I think the only thing that is secured, is the possibility of governments being able to get a loan to repay you.

State's are considered to be worthy borrowers due to the fact it can increase taxation when it deems is necessary, turning it incredibly solvent. But, eventually, it's the citizen who pays off this loan.

Ofcourse, the broader question is, how much deeper into debt can governments really go before the whole system collapses? The numbers have become incomprehensible.

The latest financial crisis erupted once it became apparent that people could no longer pay off their debts. Since 2007 government-debt has dramatically increased.

The United State's debt was 9.008 billion dollars in 2007. Today it is 24.000 billion.

What do you think off this reasoning? If you found this article interesting please upvote and definatly let me hear what you think!

Excellent post.. You are an expert in writing. I wiil always visit your blog n following yu

Congratulations @goodreason! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP