Borrow…If You Dare/On The Dangers of Leverage and the Importance of the Investment Journey

I was recently at lunch with Jim O’Shaughnessy, the famed investor, Tweetstormer, and bestselling author of What Works on Wall Street, when he proposed the following investment question:

Imagine you have a newspaper from 1 year into the future. On the front page of the paper are the top 10 performing stocks from the prior year. In addition, a large bank has stated that they will provide you with as much margin as you want with no interest charges. The question is: Assuming you start with $10,000, how much would you borrow to invest in these top 10 stocks?

Think about how YOU would answer this question before you read my response below.

Before Jim had finished his question my mind was already racing. I thought I saw the trick he was trying to play and I quickly replied:

Oh I get it. Most people probably say, “Borrow as much as possible.” But I know that if I borrow as much as I want, I will move the market and be the reason why these stocks become the top performers. I will cause the future to happen. It will be a self-fulfilling prophecy. Worst yet, a year from now when I go to sell out my large positions, I probably won’t be able to do it without making the price crash and losing all my gains.

Therefore, I’d borrow just enough to get a gain without having a significant impact on the market. So only a few million dollars.

I thought my answer was pretty witty and I awaited my congratulatory response from Jim. He replied:

Nick, that is a great answer and better than 80% of the investors I have proposed the question to, but it’s still wrong.

What? How could this be? I was betting on sure winners and I knew I could exit my positions. Where had my logic failed me? A puzzled look came across my face when Jim continued:

Your problem is the margin. With $10,000 to start, if you borrowed millions, you would lose all of your equity. In fact, having a leverage ratio more than 4:1 ($30,000 borrowed) would have wiped you out in most years. It’s not a matter of if, but a matter of when.

As soon as he said it, I knew he was right. I had forgotten one of the simplest ideas in finance: the path matters. The problem is that while we know that you will get an a high return by the end of the year, if you hit a bad patch of too many negative return days in a row (which is normal), the leverage will wipe you out completely. In other words, the journey is more important than the destination.

I decided to test Jim’s thought experiment using a simulation. Note that in my simulation I am far more liberal in my assumptions, namely, that there is 0% margin requirement and that you get the average return of the top 10 stocks each day. These are both materially different than the real world, where you would have margin requirements and margin calls, but still illustrate the larger point.

So here is how the simulation works:

Get the daily returns for the top 10 performing stocks for 2014, 2015, 2016, and 2017 (~40 stocks in total).

Create a portfolio where you equally weight the returns across the 10 stocks on each day.

Resample the days randomly over the course of 252 trading days (this represents 1 simulation). For example, in the first day of my simulation I might use the average return for the top 10 stocks from March 4, 2014. Then the next day I could use the return from September 5, 2016, and so on for 252 days.

Run the prior step 1,000 times (representing 1,000 simulations) for different leverage levels (2:1, 4:1, etc.)

Count the number of simulations where your equity ($10,000) gets wiped out. For the record, your equity is gone when your account value drops $10,000 below its starting amount. So, at 4:1 leverage, your starting account value is $40,000. If the account value ever drops below $30,000, game over.

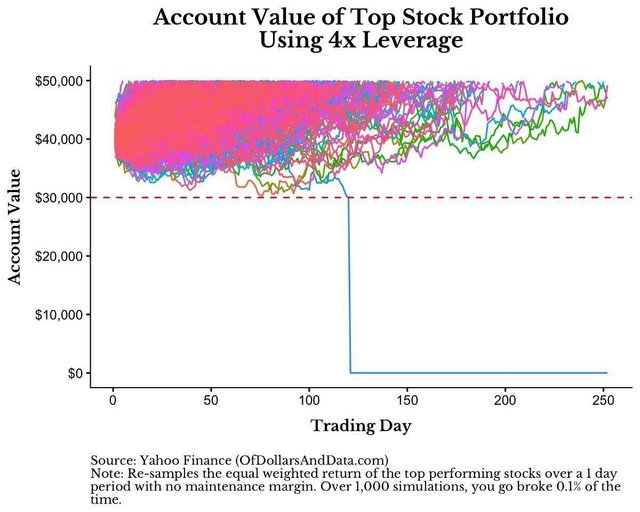

Below is an example of 1,000 simulations of a 4:1 leverage ratio ($30,000 borrowed and $10,000 in equity):

Note that the red dotted line is the point where you have no more equity at stake (so I force your account value to $0). There is only 1 simulation where this occurs above. The same plot for 10:1 leverage is here:

As you can see, more leverage leads to more cases where you go broke. If we were to look at the percentage of simulations where you go broke by leverage level, it would look like this:

Unsurprisingly, more leverage increases the probability that you go broke. Why? Even small declines in your portfolio wipe out your equity with larger amounts of leverage. For reference, over the course of the year (on average) your portfolio will go up hundreds of percentage points like the top 10 stocks did, but any string of bad days can wipe you out if you borrow too much.

The point of all of this is that even when we know the future with certainty, borrowing money isn’t a surefire solution to win big. Given we will never know the future with any degree of certainty, leverage is one of the most dangerous things you can do as a retail investor, so I do not recommend it. If Warren Buffett only levered 1.6:1 on average throughout his career, and he is arguably the greatest investor of all time, what chance do you stand of using leverage properly?

Don’t Forget the Destination

I know that most of this advice isn’t practical for you. You, like me, will probably never use leverage when investing and that is fine. However, this thought experiment contains a deep lesson: your investment journey will effect you far more than your investment destination. Just because you know the market should get 7% on average each year doesn’t mean you won’t live through sharp declines and decades of no real returns. These kinds of events are rare, but they happen and they can affect how you perceive markets.

Consider the case of Michael Burry who correctly predicted and profited from the 2008 housing crisis. Though he made his investors lots of money in the end, these same investors experienced excruciating losses in the short term while they waited for the housing market to collapse. As a result, none of Burry’s investors said thank you when the dust finally settled. The experience wasn’t worth the destination for them.

So don’t forget the destination while you are on your investment journey. There will be good times and there will be bad times, but don’t lose faith when there is blood in the streets. Stay the course, just keep buying, and thank you for reading!

➤ You can follow Of Dollars And Data via Email (1 weekly newsletter), Facebook, Twitter, or Medium.

This is post 73. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data

Disclaimer

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. The postings on this site are my own and do not necessarily reflect the views of my employer. Please read my “About” page for more information.

OfDollarsAndData.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com and affiliated sites.

FinanceInvestingMoneyPersonal FinanceLeverage