Diversifying Your Employer Stock

"Diversify. In stocks and bonds, as in much else, there is safety in numbers"

Sir John Templeton

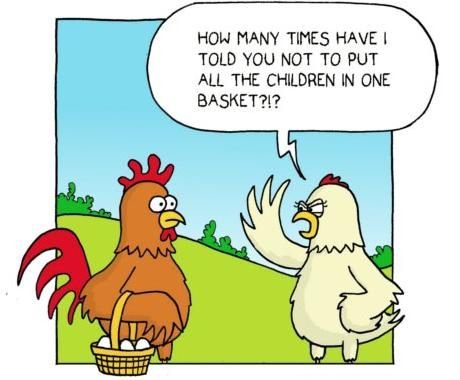

All of us know the old adage that you shouldn’t ‘put all of your eggs in one basket’. While we may know and understand this saying, how often are we really putting it into practice when it comes to our own investments, more specifically our employer stock..?

Employer stock are those shares or options in the company that we are employed by. For example, if I worked for XYZ Ltd and owned stock in XYZ Ltd, this would be considered my employer stock.

Recently, I was visiting my clients in Macau, otherwise known as the City of Dreams, perhaps due to the fact that those who are basing their retirement planning on winning at the casinos in Macau are truly ‘dreaming’. One common feature of many employers in Macau is the generous employee share schemes that are on offer and bonus options that form part of many remuneration plans. It is not uncommon for up to 25% of an employee’s remuneration to be paid in company stock, which results in those employees who have been with their employer for many years having significant exposure to the financial performance of one individual company. This can be particularly exciting while the company is performing well, as typically your bonuses are rising along with your employer’s share price, but how much risk are people really taking on without realising it..?

Let’s consider the worst case scenario…

Your employer faces some headwinds, which results in them having to make some cuts to the workforce to reduce their overheads. Sadly, this results in you losing your job and your income source is now gone until you can replace this with a new job. Unfortunately, the bad news doesn’t stop there. The disappointing company results also results in the company’s share price taking a significant hit and the value of your shares dives as well. With the appropriate strategies in place, we can at least lessen the impact of the bad news here. While you may think that this won’t happen to you, there are too many cases nowadays of companies that were deemed ‘too big to fail’ proving that they were anything but.

If the risks are so high, should you actually buy any company stock at all..?

There are many discounted share purchase plans that are on offer to employees for expats in Macau, Singapore and all over the globe, that can be a particularly attractive strategy. For example, if your employer’s stock is trading at $20.00 per share and you can buy it for $15.00 per share, that’s a an instant 33.33% return on your investment, which means that you’re actually increasing your wealth without needing to save as much. Remember though, it’s important to gradually diversify your holdings by selling the company stock over time and investing into a portfolio that is aligned with your risk profile and financial goals.

Before you jump head-first into your employer’s share purchase plan, be sure to review carefully any vesting provisions that are placed on the stock. This can limit how quickly you’re able to sell the shares and can place your personal finances at risk if a significant portion of your overall wealth is tied up in one stock, particularly if you can’t reduce the holding for a fixed period of time.

Another common occurrence for many employees is to be granted employee options, which are often tied to bonus payments. Options can be a more complicated strategy, particularly if you’re not familiar with how they’re priced or how they can be liquidated. You can find out more about the basics of options and the various strategies that can be adopted here. It’s important to consider whether it is more sensible and profitable for you to sell the options directly (where the options are exchange traded), or to exercise them (which means to purchase the shares at the option’s strike price) and sell the shares to diversify your holdings.

What if you’re in an executive management position at the company..?

It’s also important to consider any other implications if you’re in an executive management position of the company. You may have trading blackout periods where you’re not allowed to buy or sell the stock, you may have to publicly report any changes to your holdings and you may be in position of material non-public information without realising it. If you are in a senior management role, we would suggest speaking with your HR or compliance department before you make any changes to your share holdings. Remember, if changes to your positions are publicly reported, then the analysts may be closely watching any moves you decide to make.

The other key consideration when it comes to holding a growing stake in your employer’s stock is if you are a founder / co-founder or key investor in the company. You may be building your stake to ensure that you’re involved in the decision making, which can be particularly valuable if you are bringing significant value that can improve the company’s overall position.

Now that you understand the key considerations when it comes to employer stock, what should you be considering as an employee..?

The first key step here is to review your overall level of diversification, which simply means outlining how your overall wealth is invested. If you haven’t already done so, I’d suggest spending some time at your computer or with a notepad and designing your own personal balance sheet to get a true sense of how you’re invested. This will also allow you to clearly see how much of your overall wealth is actually tied up in company stock.

There is no ‘one-size-fits-all’ approach to how much is enough in an employer’s stock, but as a general rule of thumb, if it is above 20% of your overall investments, you may want to seriously consider your strategy. Once you know how much of your net wealth is tied up in your employer’s stock, start to make a plan for how you’re going to diversify these holdings. This could mean investing in other stocks in the same country, investing in stock markets globally, purchasing an investment property, money market investments, bonds or otherwise. A ‘buy and sell’ strategy can be an excellent way to boost your overall income if your company is offering a discounted share purchase plan. Of course, we recommend that you speak to your qualified financial planner and/or tax professional to consider if this strategy is appropriate for you.

To Your Financial Success!