The not-so get rich quick scheme. Trading the Market, from $5000 to $1M

Why even try when every expert says it can't be done ?

I have learned a lot in the past few years and I want to share it with you.

I will attempt to make $1,000,000,000 in 5 years, starting from around $5000.

I have a small brokerage account, and if you're like me your 401k won't take you very far.

I make good money in my 9 to 5 job, but several major set-backs, a good size family and poor money management habits have left me with little to nothing in the way of retirement. I have a 30 year mortgage on a 300K house and I have $5000 in savings. I have no debt. I don't have a 401k, I used what I had in the last one to make a down payment on my house.

For most people, one million is a round figure and a symbol if financial independence.

If I think I'm pretty smart, with an engineering background, so why can't I figure out how to myself financially independent ?

After all, I budget my expenses, I shop at Wal-Mart, I don't eat out much or buy fancy clothes. I'm sure Dave Ramsey would scold me for some of the stupid tax I've paid. I had a $1000 emergency fund and one of my cars always had its name on it. But I don't gamble, buy big cars or expensive vacations.

I used to read J.D. Roth's blog GetRichSlowly, because it has lots of good advice on how to save here and there, and mostly on how to think differently to achieve financial freedom.

The problem I see with these approaches is that they take time, lots of time, and lots of hard choices, day-in and day out. It feels like a money treadmill. Compounded, the amount of discipline I would need to show between now and my retirement age, would have to be enormous, to make up for the mistakes, hardships, indulgence and negligence of my past.

Most financial counselors would agree I need to get with the program, save more, plan more and invest more if I want to get out of the whole. They're basically right. At the same time they're all wrong.

Here's why they're right:

- Get with the program, Save more, Plan more and Invest more is what you need to do in your twenties, when your income is much above what you need (to save more), and when you could reign- in what you want (by getting with the program), so you can put away enough because that money can compound long enough to really add up (plan more) to a point where you can relax and watch it grow (invest more).

- Doing the work of planning focuses you on the future and reigning-in your expenses in order to save teaches you how to prioritize and discern between your wants and your needs. Finally investing might teach you how the system works.

- Dave's advice to get out of debt using the debt snowball is great. It compounds your ability to get more saved and paid off. It teaches you to put more of your sacrifice to work toward getting out of the whole. The other reason, is that debt should be your priority, because it compounds faster than what you're likely to get back from your investments.

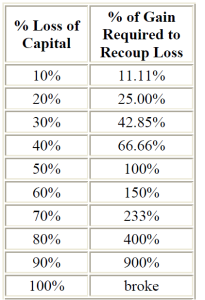

- Look at the table below. Because a penny-saved is a penny earned, not saving money for 20 years is very much like starting your life with a million dollars, spending most of it and then trying to grow what's left of it back to where you started. If you lost 50% of it, it would require you to double what's left of your investment to get back to that million dollar.

Good post and im definitely following your journey. I too have recently become interested in trading forex to help my finances. 5K to 1M in 5Y definitely sounds attainable and if your looking for a friend along the way let me know.