Stocks to consider: Activision Blizzard (ATVI)

I realize that the main purpose for many people on this forum is to promote the value of cryptocurrency. I hold some myself and am currently mining with an Antminer. However, before bitcoin was created, and even now, placed their money into companies through purchasing options, bonds, and stocks as an investment.

Thus, I'd like to share some of my top favorite stocks the next few days. Hopefully, everyone can see alternate versions of investments, and I will be sharing if I own the stock or not, myself.

First up, Activision Blizzard (ATVI)

This stock has been in my portfolio for years and as full disclosure I have a position at the current time.

Pros:

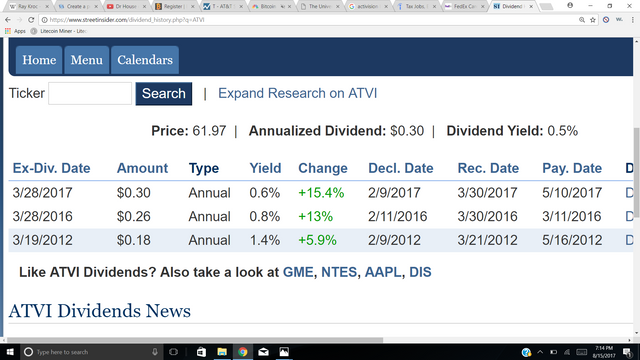

First, It's begun to give a reliable and constant dividend, as the image below shows dividends becoming constant in 2016 and 2017. While it isn't guaranteed, usually such payouts mean a constant dividend moving forward can be expected (the market punishes stocks who do not follow such tendencies).

(source: https://www.streetinsider.com/dividend_history.php?q=ATVI)

And the price is up 71% overall for the year.

(Source: https://www.streetinsider.com/stock_lookup.php?q=ATVI)

Several strong titles ensure a steady cash flow:

1.) Overwatch

2.) Call of Duty

3.) World of Warcraft (WoW)

4.) Skylanders series

5.) Starcraft

6.) Destiny

7.) Hearthstone

8.) Diablo

These are among some of the best selling games of all time, but do not include all of their games. WoW titles guarantee a monthly income with its user base in the millions. Call of Duty games have had sales in the amount of $1 Billion for the past few years after each release. games such as Starcraft and Overwatch are MLG games. The company has a strong product that is seen in both the casual and competitive gaming world.

Cons: P/E ratio is a tad high at 42.

By definition, the P/E ratio is the price of the security/ current earnings. As such, a typically "safe" P/E ratio has been seen as 20-25x earnings. However, with the most recent stock market bull run, many companies are seeing P/E ratios that are much higher. Take Amazon for example, it has a P/E ratio nearly 200.

This could be due to an increase in consumer sentiment about the market as a whole. It could be due to increased confidence in specific companies. Personally, I'm in the first group. Stocks are, as a whole, largely overvalued. However, in an era of inflated P/E's a 42 may be a slight cause for a concern, but its still a fair P/E.

Everyone on here gets to make their own financial advice. The overall purpose of supporting Steemit, is to increase the popularity of the brand and in turn, the income we all hope to create on here. However, a safely balanced portfolio always gauruntees that in the case of a meltdown, you won't be left holding an empty bag.

Thus, I'd consider adding ATVI to your own portfolio.

Have any stocks that you'd like to consider?

feel free to post a comment below, and maybe I'll make my next piece on it!

Want to see more in-depth technical analysis?

Just say the word, and I'll be happy to tweak my next post to show some!

Thank you for your time and have a great day!

I'd like your take on a penny stock, symbol DGIF. I own a little, thinking of getting more. Highly speculative but they are in the process of merging with a company that provides data storage/archiving at greatly reduced cost and space with contracts with several military bases. I think once they complete their funding and merger this stock will take off. Right now it is thinly traded. What do you think?

I'll be honest. Hold what you have if you think that there's a chance. This is essentially like buying a lottery ticket. Maybe there's a chance that they will hit it big! But, everything that I saw has me believe otherwise.

First, the news releases. Nothing has been released concerning the company besides some information from 6 months ago. I couldn't find any information about such a merger in my quick research that I performed, other than the mergers and acquisitions that took place in February of this year.

Seen here (http://www.releasewire.com/press-releases/update-for-digital-info-security-2017-766841.htm).

A lack of transparency over such things can imply issues with said merger. It also doesn't explain why the CFO stepped down since February (https://relationshipscience.com/peter-van-dorn-p3766595). A lot of other members of the board have stepped down as well. That opens up for a lot more questions. Did they get fired or did they jump off a sinking ship?

Next, the company has extremely small volume. Less than 2,000 shares traded per day. In addition, the company accounced a 1 for 40 reverse split. This was to increase it's value of it's stock per the last release that was previously linked. Said stock has since not increased in value since that time.

Third, Website doesn't work. A technology driven company not having a website is a major red flag for most people. The forum post following the stock, seen here (https://investorshub.advfn.com/Digital-Info-Security-Co-DGIF-8120/) has the website posted there. Said website is under construction.

Lastly, the buying and selling of the stock isn't constant. The company is bought and sold on maybe 1 day per week. Take a look at the following 5 day chart.

http://www.marketwatch.com/investing/stock/dgif/charts

the stock was only sold on 1 day of the past 5. That's troubling.

In the end, I don't really need to do financial analysis. One, because it's hard to provide actual analysis without access to financials (they help provide hard data). Secondly, because right now the company just doesn't seem like it is doing well right now. In fact, it appears to me it's on it's last legs. I would use caution before investing anymore of your hard earned money into this.

If you have a hole burning in your pocket, feel free to follow me. Tomorrow I'll be doing a report on a company I plan on buying this week. No guarantees that it will make money, but I think it's a good value stock to consider.

Please feel free to post any more questions you have.

Check out their website at http://www.digital7.biz/